- Finland

- /

- Communications

- /

- HLSE:NOKIA

Nokia (HLSE:NOKIA): Evaluating Valuation as Shares Trade Sideways After Robust Rebound

Reviewed by Simply Wall St

Nokia Oyj (HLSE:NOKIA) shares saw subdued movement today, with the stock ticking slightly lower. Investors are digesting recent performance and evaluating whether the company’s trajectory justifies its current valuation or signals further gains ahead.

See our latest analysis for Nokia Oyj.

Nokia Oyj’s share price has rebounded robustly over the past quarter, up 41% in 90 days and 20% year-to-date, helped by improving total shareholder returns and optimism around the company’s current trajectory. Longer-term holders have also seen gains, with a total shareholder return of 35% over the past year and 72% in five years. This underscores building momentum as the market reassesses valuation and growth prospects.

If you’re interested in spotting exceptional momentum stories, now is the perfect time to widen your search and check out fast growing stocks with high insider ownership

With solid recent gains and room to analyst targets, the key question now is whether Nokia’s shares remain undervalued or if the market has already priced in all foreseeable growth opportunities, leaving limited upside for new buyers.

Most Popular Narrative: 1.7% Undervalued

The current narrative pegs Nokia Oyj’s fair value just above the last close price, highlighting the tug-of-war between improved profit outlook and tempered sales growth expectations. This nuanced consensus reveals that even as optimism has risen recently, not every growth driver is fully embraced by the market.

Scalable operational improvements, ongoing cost discipline, and rapid integration of recent acquisitions (for example, Infinera) are positioned to enhance operating leverage and expand net margins over time as revenue mix shifts towards higher-margin portfolios. Investments in innovation (such as cybersecurity, AI network solutions, and next-generation optical technology) plus expanding monetization of IP and patents should increase Nokia's high-margin revenue streams, supporting overall earnings growth.

Want to uncover the catalysts behind this razor-thin fair value gap? The secret weapon is not just growth; it is what analysts are predicting about future profit margins and the expected surge in recurring revenues. Guess what bold assumptions the narrative is making? Dive in to decode the real calculation behind this target price.

Result: Fair Value of $5.29 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent competitive challenges in Mobile Networks and macroeconomic pressures could quickly undermine recent optimism and shift analyst sentiment once again.

Find out about the key risks to this Nokia Oyj narrative.

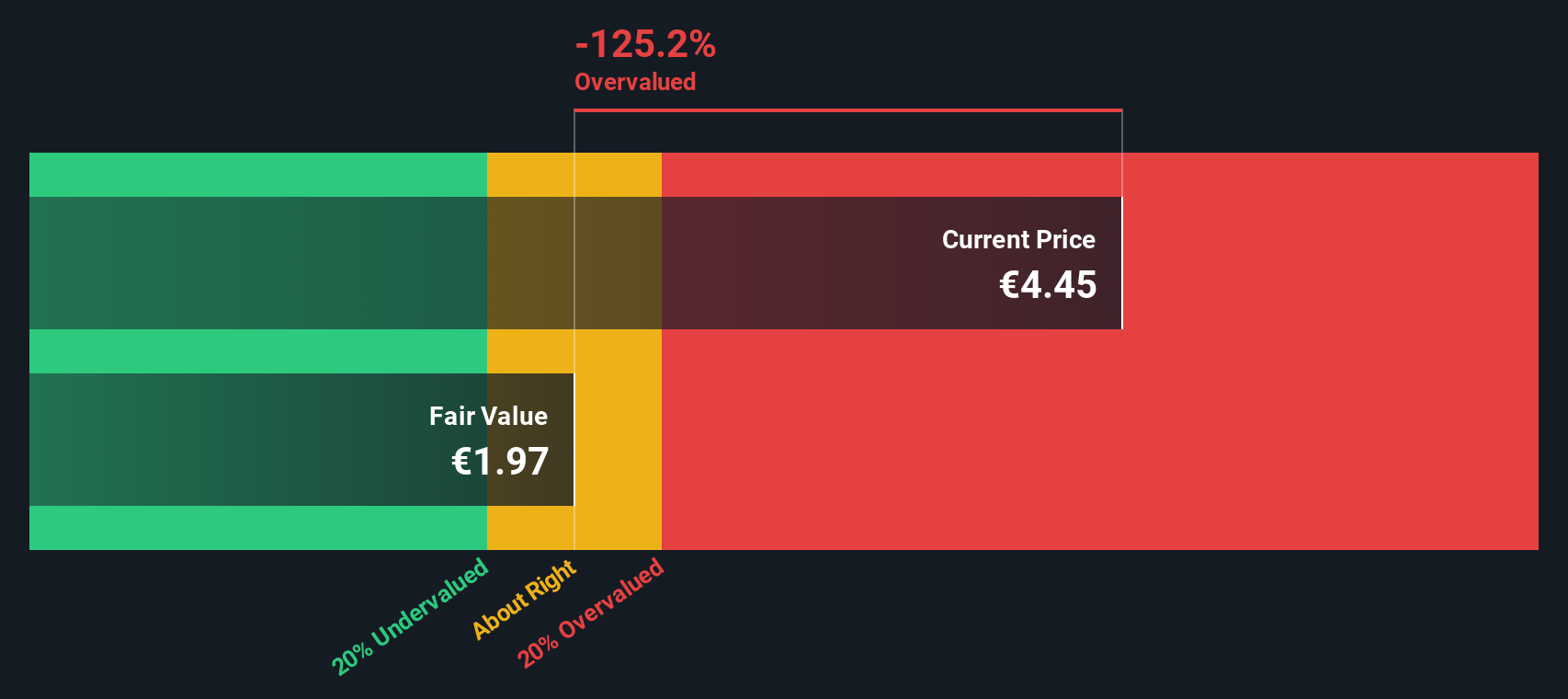

Another View: SWS DCF Model Adds Perspective

Looking through the lens of our DCF model, the valuation story takes an interesting turn. According to this method, Nokia is actually trading above its calculated fair value. This challenges the optimistic consensus price target and raises questions about whether current market prices reflect more hope than hard fundamentals. Could sentiment be running ahead of real earning power?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Nokia Oyj for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 919 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Nokia Oyj Narrative

If you have your own perspective or enjoy digging deeper into the numbers, you can quickly build a personalized view in just a few minutes. Do it your way

A great starting point for your Nokia Oyj research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t limit your strategy. Fresh opportunities can supercharge your portfolio when you look beyond the obvious. Here are three timely themes to put on your radar right now:

- Hunt for value and position yourself for long-term upside with these 919 undervalued stocks based on cash flows, spotlighting stocks the market may be underpricing.

- Boost your income potential by targeting these 16 dividend stocks with yields > 3% offering reliable yields above 3% and strong fundamentals.

- Ride the cutting edge of innovation by tapping into these 26 AI penny stocks changing the business landscape through artificial intelligence breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nokia Oyj might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:NOKIA

Nokia Oyj

Provides mobile, fixed, and cloud network solutions in North and Latin America, Greater China, India, rest of the Asia Pacific, Europe, the Middle East, and Africa.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives