- Finland

- /

- Communications

- /

- HLSE:NOKIA

Is Nokia (HLSE:NOKIA) Overvalued After Rapid 41% Share Price Surge? A Fresh Look at Valuation

Reviewed by Simply Wall St

See our latest analysis for Nokia Oyj.

After a standout 40.6% one-month share price return, Nokia Oyj is grabbing attention again as momentum ramps up. The company is building on both steady fundamentals and renewed investor interest. The company’s 1-year total shareholder return sits at 43.1%, with a 5-year total return of 111.2%, highlighting a powerful longer-term performance recovery.

If Nokia’s turnaround has you looking for your next opportunity, now is the perfect moment to widen your view and discover fast growing stocks with high insider ownership.

With shares climbing so quickly, the key question is whether Nokia Oyj’s recent gains leave room for further upside or if the market has already priced in its improving business. Is there still a buying opportunity left on the table?

Most Popular Narrative: 12% Overvalued

At €5.93, Nokia Oyj’s share price stands well above the €5.29 fair value from the most widely-followed narrative. This gap puts market optimism and analyst calculations in sharp contrast ahead of key milestones.

Scalable operational improvements, ongoing cost discipline, and rapid integration of recent acquisitions, such as Infinera, are positioned to enhance operating leverage and expand net margins over time as revenue mix shifts towards higher-margin portfolios. Investments in innovation, such as cybersecurity, AI network solutions, and next-gen optical technology, plus expanding monetization of IP and patents, should increase Nokia's high-margin revenue streams and support overall earnings growth.

Want to see what’s driving this valuation? The secret lies in bold growth forecasts, ambitious margin goals, and some surprising future earnings assumptions. Find out which financial leaps fuel this price target and how they shape Nokia Oyj’s outlook. Dive in to analyze the catalysts powering this unusually high valuation.

Result: Fair Value of €5.29 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent currency volatility and flat revenue in the Mobile Networks segment could challenge Nokia’s profit outlook and put current optimism to the test.

Find out about the key risks to this Nokia Oyj narrative.

Another View: What Do Price Ratios Say?

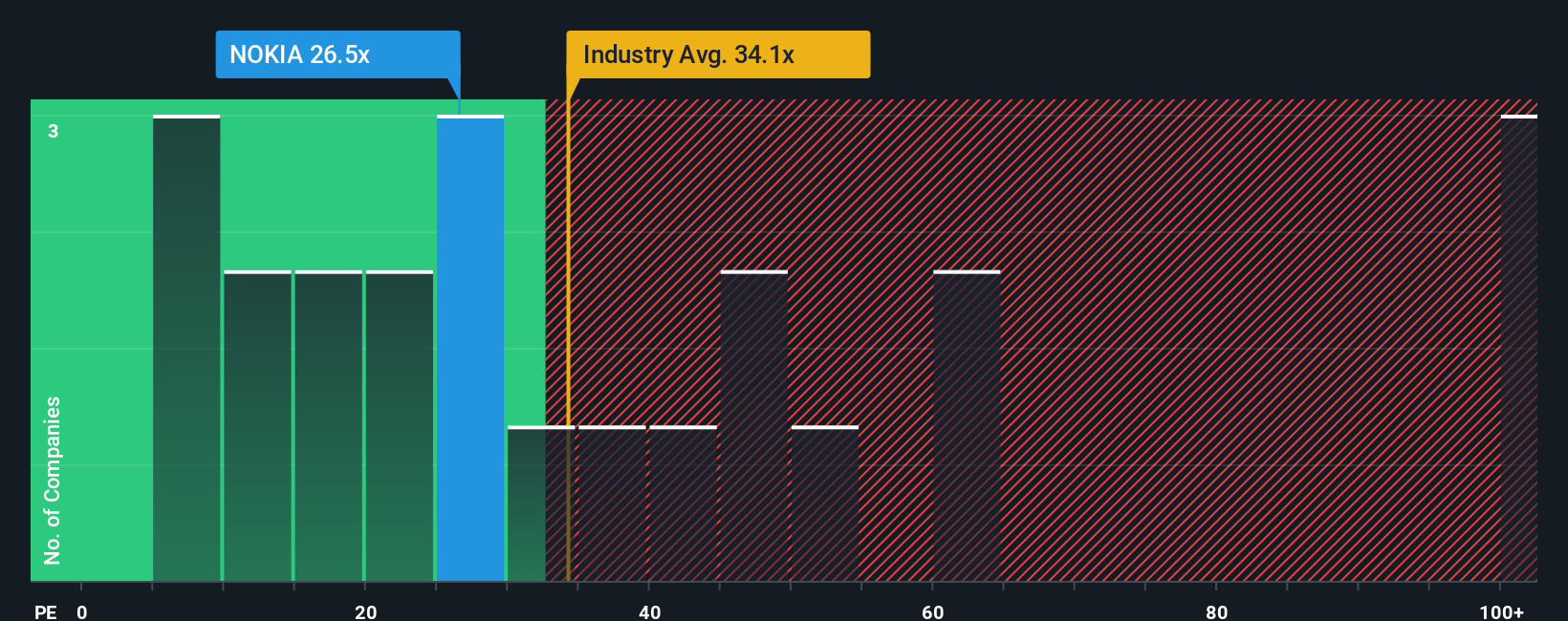

Looking at market valuation ratios offers a different perspective on Nokia Oyj. The company trades at a price-to-earnings ratio of 37.9x, just below the European Communications industry average of 38.1x and far lower than the peer average of 73.5x. However, this is still above the estimated fair ratio of 35.1x. This suggests the market might see more upside than fundamentals support and also opens room for valuation risk. Could investors be betting on Nokia’s turnaround, or are they overlooking caution signals?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Nokia Oyj Narrative

Whether you see things differently or want to dig deeper into the numbers, you can shape your own view of Nokia Oyj in just minutes, your way with Do it your way.

A great starting point for your Nokia Oyj research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Act now to spot smart opportunities that others might overlook with our top investment routes. You will not want to miss these trends taking off.

- Uncover untapped value by targeting these 845 undervalued stocks based on cash flows where strong cash flows reveal companies that could be flying under the radar.

- Maximize yield and boost your portfolio returns by investigating these 20 dividend stocks with yields > 3% offering attractive payouts above 3%.

- Jump on the AI growth boom with these 26 AI penny stocks that are innovating across industries and reshaping the investing landscape.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nokia Oyj might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:NOKIA

Nokia Oyj

Provides mobile, fixed, and cloud network solutions in North and Latin America, Greater China, India, rest of the Asia Pacific, Europe, the Middle East, and Africa.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives