- Finland

- /

- Communications

- /

- HLSE:NOKIA

Evaluating Nokia Shares After 48% Rally on Private 5G and Network Expansion News

Reviewed by Bailey Pemberton

- Ever wondered if Nokia Oyj is really as undervalued or overlooked as some investors suspect? Let’s break down whether this Finnish tech giant is offering real value or just the illusion of a bargain.

- The stock has been making waves lately, jumping 12.8% in the last week and up an eye-catching 48.3% over the past month. This has sparked fresh debates on its growth potential and shifting risk profile.

- Much of this recent surge has coincided with renewed industry optimism and headlines about Nokia’s new partnerships in network infrastructure and expansion into private 5G deals. These moves have clearly caught the market’s attention, as investors weigh how recent momentum could shape the company’s long-term value.

- But here’s where it gets interesting. By our checks, Nokia scores a 2 out of 6 on our valuation assessment, meaning it looks undervalued on just a couple of classic metrics. We’ll examine those traditional approaches next, before exploring a smarter and more holistic way to judge true value at the end of this article.

Nokia Oyj scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Nokia Oyj Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's true worth by projecting its future cash flows and discounting them back to today's value, reflecting how much those potential returns are worth in present terms. This is a popular approach for assessing how much long-term future profits are actually worth right now.

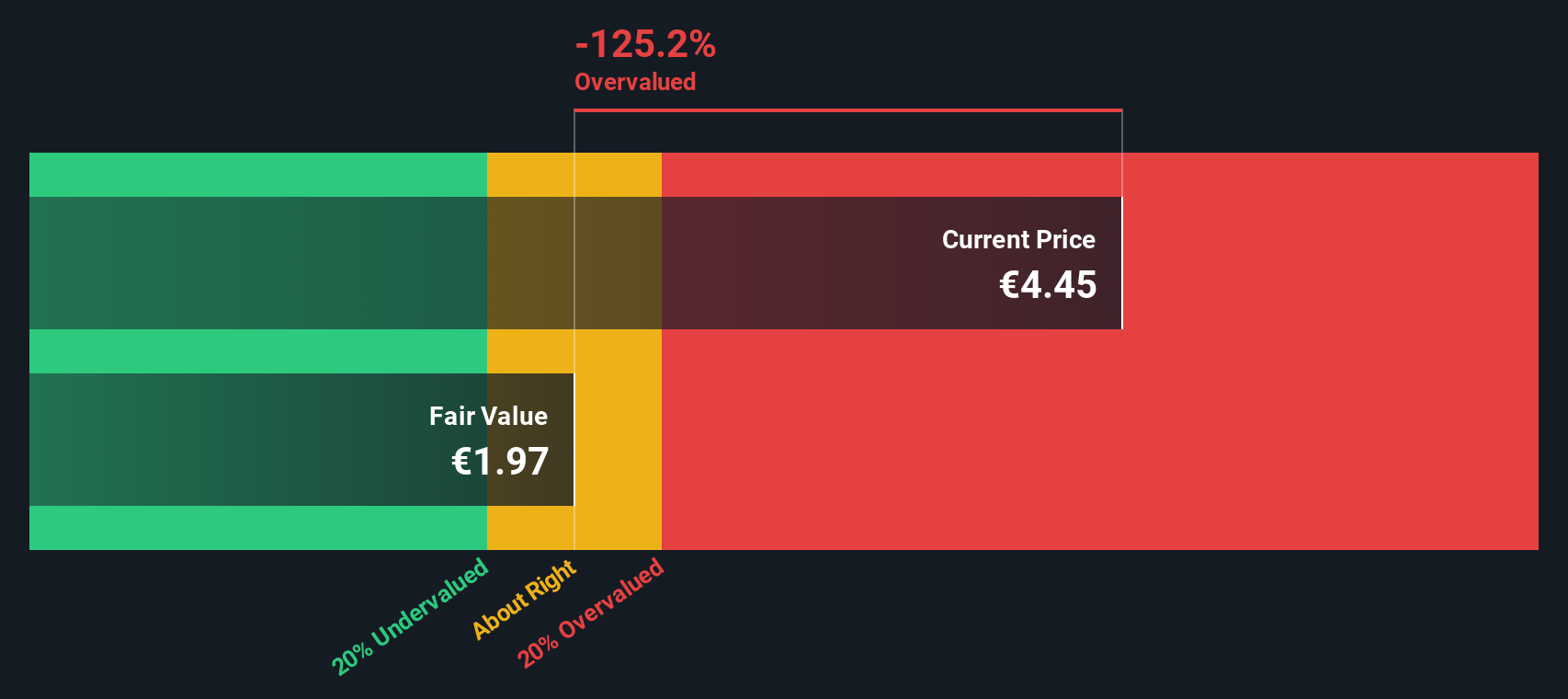

Nokia Oyj's current Free Cash Flow stands at approximately €1.33 billion. Analyst estimates cover the next five years, after which Simply Wall St extrapolates further cash flow projections. For 2029, cash flow is forecast to be around €823 million, and by 2035, it is expected to decrease further to about €428 million per year. These figures signal a projected decline over time, with future cash flows increasingly reliant on broad market assumptions beyond those initial analyst estimates.

Based on these projections, the DCF model calculates an intrinsic value for Nokia’s shares of just €2.00. Compared to the current share price, this implies the stock is trading at a staggering 207.6% premium, which the model suggests is significantly overvalued.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Nokia Oyj may be overvalued by 207.6%. Discover 842 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Nokia Oyj Price vs Earnings

The Price-to-Earnings (PE) ratio is widely used to value profitable companies like Nokia Oyj, as it gives investors a quick sense of how much they are paying for each euro of current earnings. This metric is especially popular because it puts the company’s valuation in context with its actual profit generation, making it easier to compare across different companies within the same sector.

A “normal” or “fair” PE ratio depends on several factors. Strong expected earnings growth and lower risk typically justify a higher multiple, while more modest growth prospects or higher risk would mean a lower figure is appropriate. So, it is important to assess not just the company in isolation, but how the market is likely to price these prospects in the context of the industry and peers.

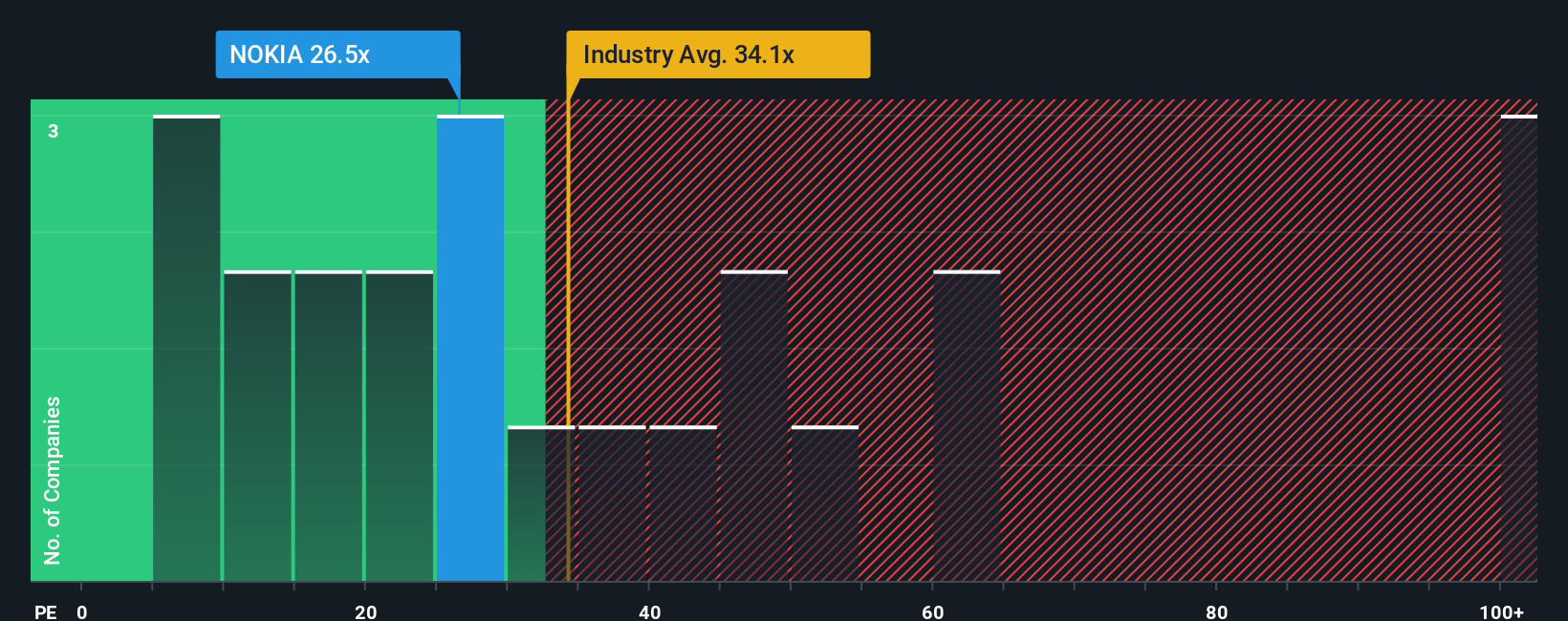

Currently, Nokia Oyj is trading at a PE ratio of 39.3x, while the industry average stands at 35.1x, and its peer average is even higher at 76.3x. On the surface, this places Nokia’s valuation somewhat above the sector norm but below many of its closest competitors. To account for specific differences, such as Nokia’s earnings growth, profit margins, scale, and risk profile, Simply Wall St uses a proprietary “Fair Ratio,” which distills these characteristics into a single benchmark. For Nokia, the Fair Ratio comes in at 35.2x.

Relying solely on peer or industry averages can be misleading because these benchmarks do not always reflect unique company-level traits. The Fair Ratio, in contrast, is tailored to Nokia’s actual fundamentals and risk factors, offering a more objective basis for valuation.

Comparing Nokia’s current PE of 39.3x with the Fair Ratio of 35.2x suggests the shares are trading at a premium to what would be expected based on its fundamentals.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1411 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Nokia Oyj Narrative

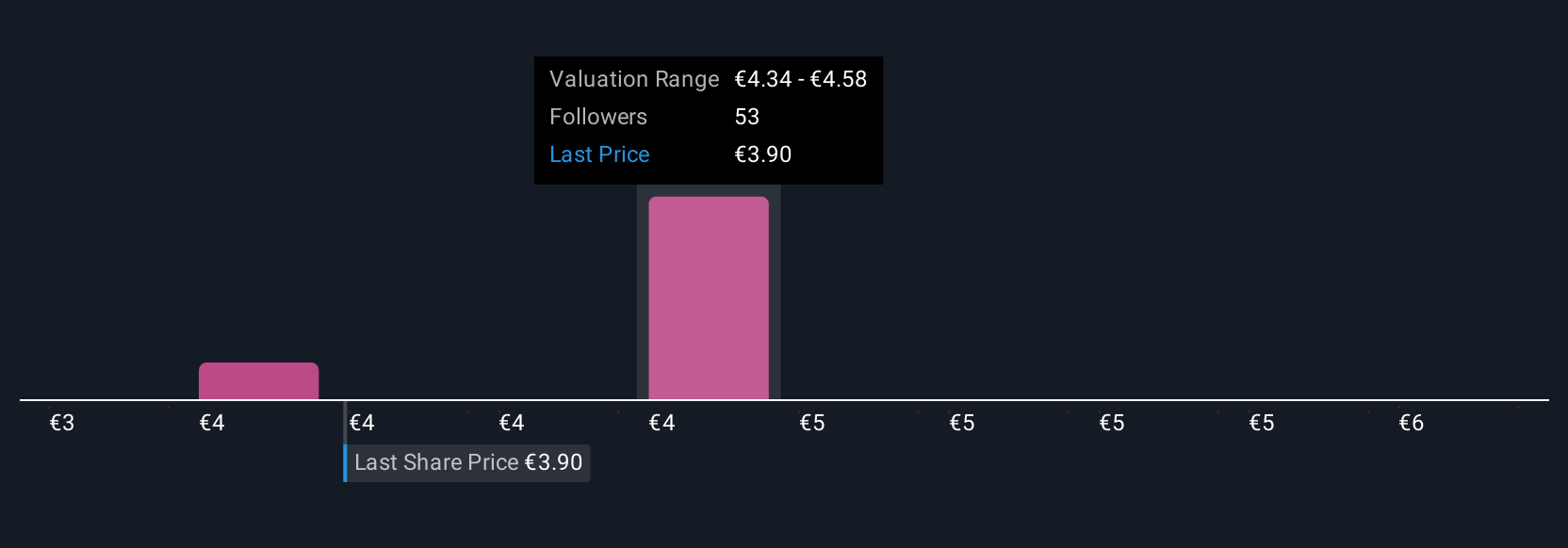

Earlier we mentioned that there's an even better way to understand valuation. Let's introduce you to Narratives. A Narrative is your own story about Nokia Oyj, where you lay out not just the numbers, but your perspective on why those numbers will play out the way you expect. Narratives connect your view of the company’s prospects with a financial forecast and then link that directly to a fair value for the shares.

Narratives on Simply Wall St’s Community page make this approach easy and accessible, empowering millions of investors to combine what they know about the business with their assumptions about revenue, earnings, and margins. This means you can see at a glance how your outlook compares to others, and how your fair value lines up against the current share price to make more informed buy or sell decisions.

These Narratives are dynamic. Whenever new news or earnings data comes in, the forecasts and valuations update, keeping your investment thesis relevant. For example, some Nokia Oyj investors believe aggressive innovation and expansion justify a fair value of €5.75 per share, while others see ongoing competitive pressures and assign a value as low as €3.0. Narratives give you the framework to express your own view, adjust as the facts change, and invest with greater clarity and confidence.

Do you think there's more to the story for Nokia Oyj? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nokia Oyj might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:NOKIA

Nokia Oyj

Provides mobile, fixed, and cloud network solutions in North and Latin America, Greater China, India, rest of the Asia Pacific, Europe, the Middle East, and Africa.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives