- Finland

- /

- Communications

- /

- HLSE:NOKIA

Can Nokia’s 5G Expansion Justify Its 47% Rally in 2025?

Reviewed by Bailey Pemberton

- Ever wondered if Nokia Oyj is still a great pick or if the recent excitement means you should tread carefully? Let's look at what the numbers and market movements are really indicating about its value today.

- Despite a 4.5% dip over the last week, Nokia's stock has rallied an impressive 30.6% year-to-date and is up 46.8% over the past year. This suggests renewed growth potential and shifting market sentiment.

- Recent headlines about 5G network expansion deals and Nokia's role in emerging European telecom projects have attracted the attention of investors. This has sparked fresh debate about its long-term prospects. Increased industry partnerships and government support have driven optimism, but they have also introduced new risks to consider.

- Measured against our six key value checks, Nokia earns a 2 out of 6 on its valuation score. This suggests there may be some opportunities but also real pitfalls to watch. As we examine various valuation methods next, look out for an even more insightful approach we will share before the article wraps up.

Nokia Oyj scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Nokia Oyj Discounted Cash Flow (DCF) Analysis

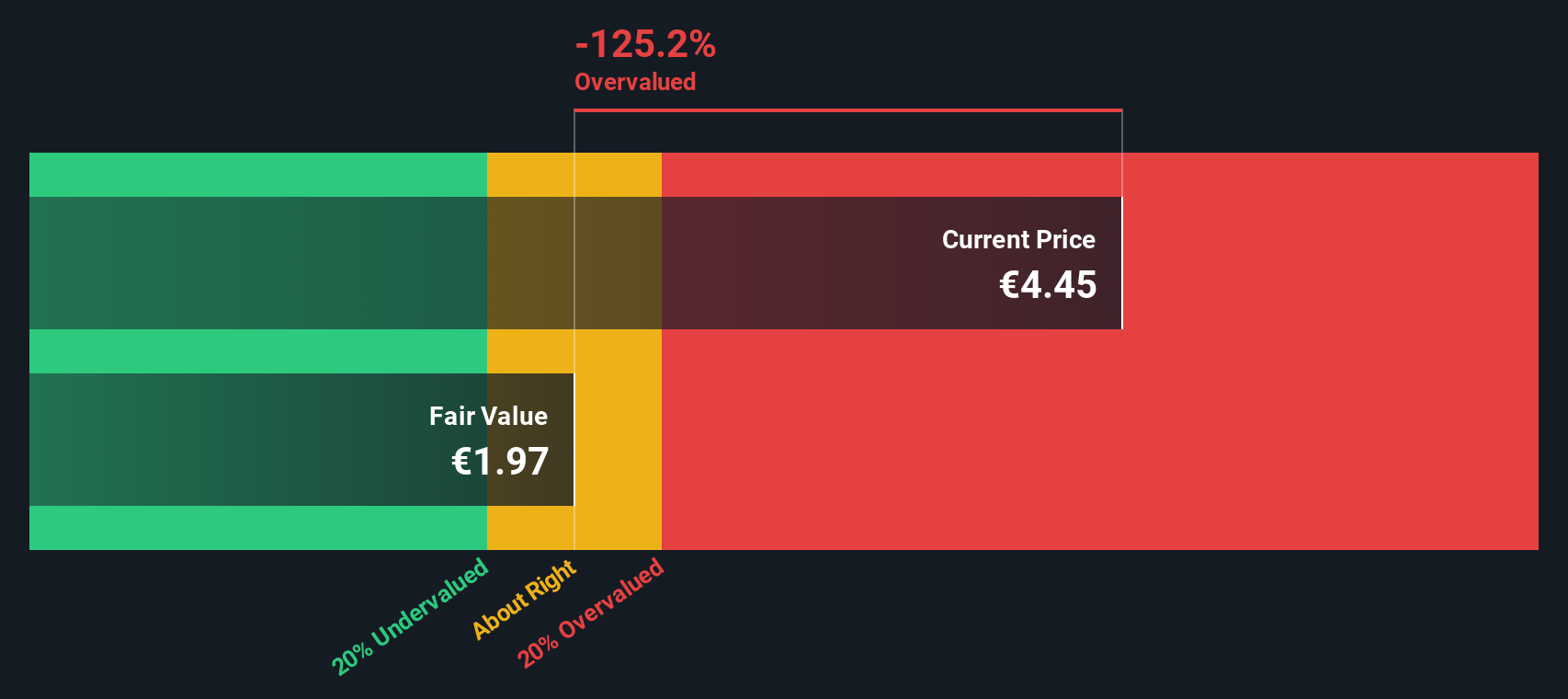

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting future free cash flows and then discounting them back to their present value. This approach helps investors see what Nokia Oyj might be worth based on how much actual cash the business is expected to generate.

Nokia's current Free Cash Flow stands at approximately €1.33 billion. Analyst estimates suggest that annual Free Cash Flow could be around €1.87 billion by 2026 and €2.24 billion by 2027, both in today's euros. Beyond analyst estimates, Simply Wall St extrapolates FCF further, with a projected Free Cash Flow of €823.3 million by 2029 and about €432.7 million by 2035. The gradual decline in long-term projections highlights the challenges and uncertainties facing Nokia’s future cash generation potential.

After tallying up all of these discounted cash flows, the model estimates Nokia’s intrinsic value at €2.06 per share. The current share price is trading 173.4% above this calculated value. This indicates that the market is substantially more optimistic about Nokia’s prospects than the DCF model suggests.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Nokia Oyj may be overvalued by 173.4%. Discover 905 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Nokia Oyj Price vs Earnings

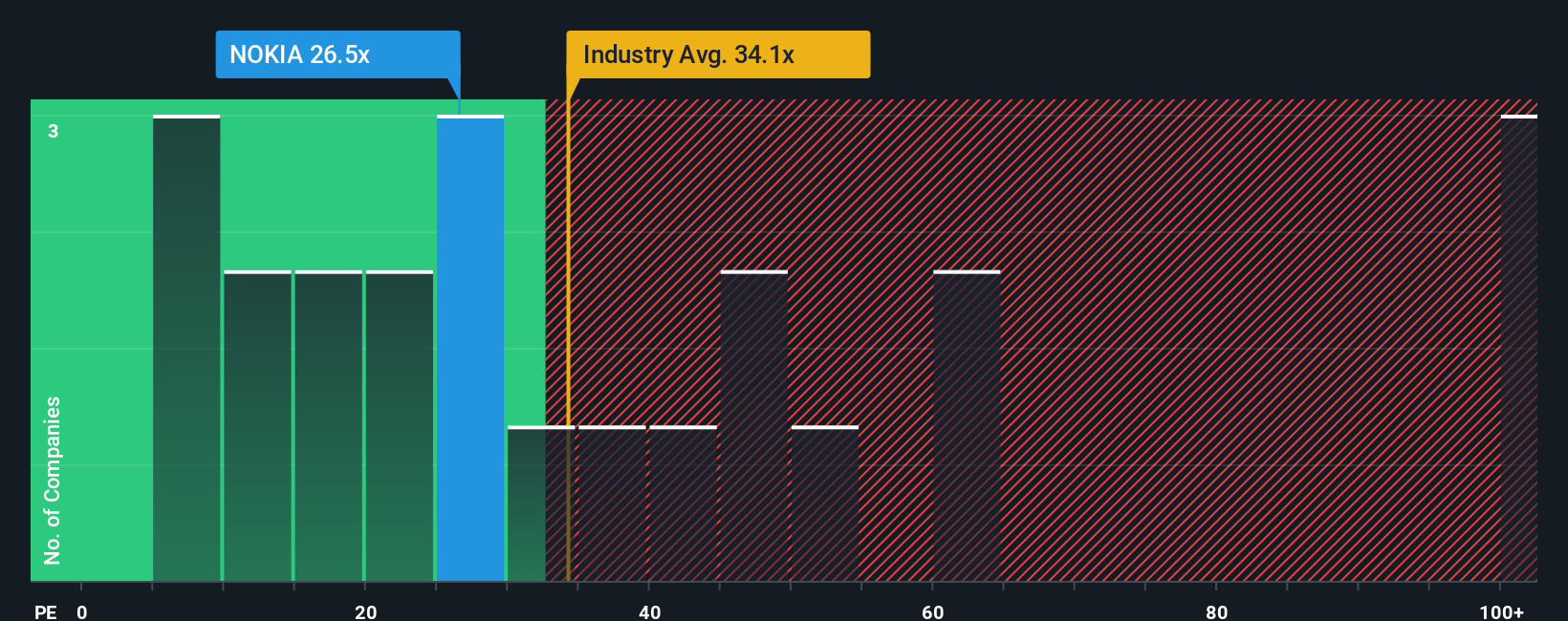

The Price-to-Earnings (PE) ratio is a widely used valuation metric for profitable companies like Nokia Oyj because it directly relates the company’s share price to its per-share earnings, offering a straightforward snapshot of how much investors are willing to pay for each euro of earnings.

Growth expectations and perceived risks play a big role in shaping what counts as a “normal” PE ratio. Companies with higher expected growth or lower risks typically command higher PE multiples, while those with subdued prospects or greater uncertainty tend to trade at lower ratios.

Nokia Oyj currently trades at a PE ratio of 36.1x. For context, the average PE among its industry peers is 69.5x, and the broader Communications industry itself sits at 35.1x. This places Nokia just above the industry average but a fair bit below its direct peers.

Simply Wall St’s proprietary “Fair Ratio” for Nokia is 35.7x. This number goes a step further than traditional comparisons by factoring in Nokia’s specific growth outlook, risks, profit margin, market capitalization, and industry. Because it is purpose-built for the company’s unique profile, the Fair Ratio provides a more personalized and reliable benchmark than a generic peer or industry average could offer.

Comparing the actual PE of 36.1x to the Fair Ratio of 35.7x, the difference is less than 0.10. This suggests that Nokia’s share price is aligned with what you would reasonably expect, given its fundamentals and outlook.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1416 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Nokia Oyj Narrative

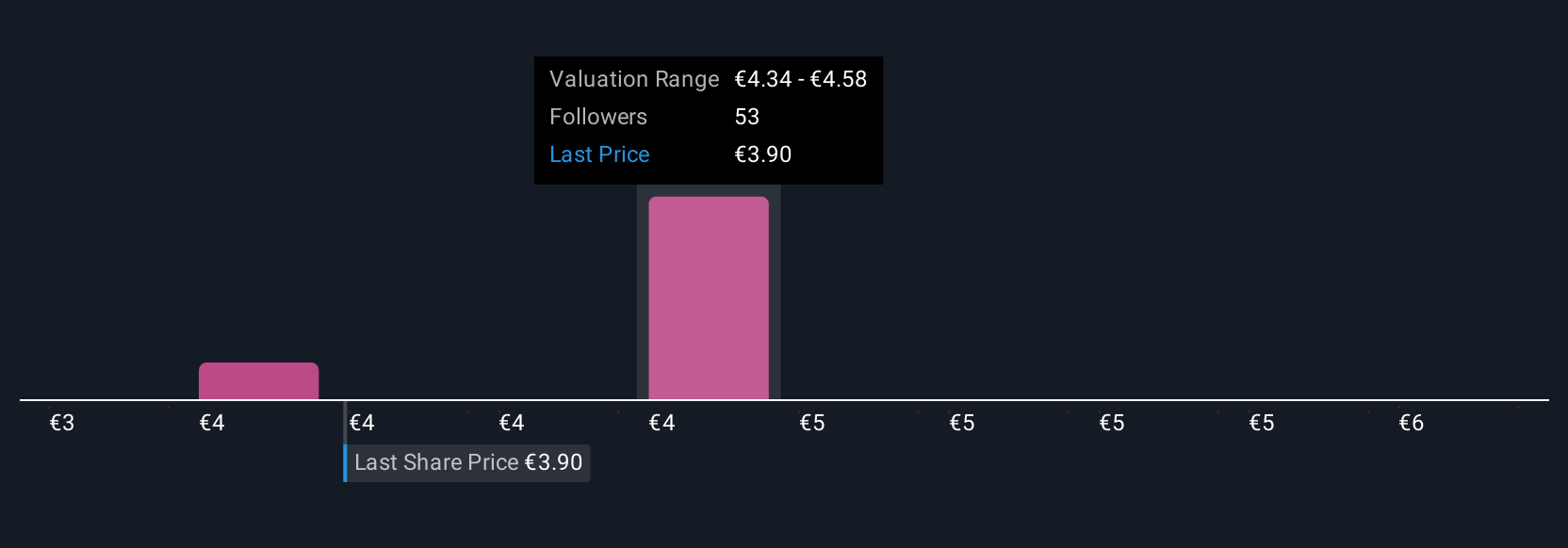

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your personalized investment story. It connects the facts you believe about a company (like its future revenues, earnings, and margins) to a financial forecast and then straight to a fair value. Narratives take what matters most to you, whether it's optimism about 5G, concerns about competition, or expectations for recurring revenue, and translate that outlook into a clear, actionable valuation.

Available on Simply Wall St's Community page, Narratives make sophisticated analysis accessible to everyone. Millions of investors use Narratives to decide when to buy or sell by comparing their calculated Fair Value to the current market price. Whenever news breaks, earnings are released, or estimates change, Narratives update automatically so your analysis always stays relevant.

For example, one investor might focus on robust network demand and set a higher fair value of €5.75 for Nokia Oyj, while another might worry about declining market share and use a more cautious value of €3.00. Narratives empower you to base every buy or sell decision on a story that is yours, grounded in real numbers and updated as the situation evolves.

Do you think there's more to the story for Nokia Oyj? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nokia Oyj might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:NOKIA

Nokia Oyj

Provides mobile, fixed, and cloud network solutions in North and Latin America, Greater China, India, rest of the Asia Pacific, Europe, the Middle East, and Africa.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives