SSH Communications Security Oyj (HEL:SSH1V) Has Debt But No Earnings; Should You Worry?

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We can see that SSH Communications Security Oyj (HEL:SSH1V) does use debt in its business. But the real question is whether this debt is making the company risky.

When Is Debt A Problem?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

See our latest analysis for SSH Communications Security Oyj

What Is SSH Communications Security Oyj's Net Debt?

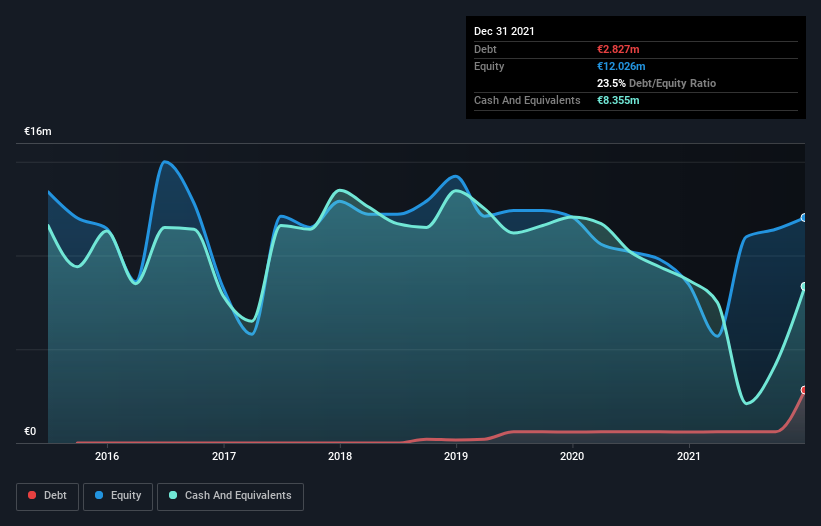

As you can see below, at the end of December 2021, SSH Communications Security Oyj had €2.83m of debt, up from €582.0k a year ago. Click the image for more detail. But on the other hand it also has €8.36m in cash, leading to a €5.53m net cash position.

A Look At SSH Communications Security Oyj's Liabilities

The latest balance sheet data shows that SSH Communications Security Oyj had liabilities of €14.7m due within a year, and liabilities of €9.25m falling due after that. On the other hand, it had cash of €8.36m and €4.57m worth of receivables due within a year. So it has liabilities totalling €11.0m more than its cash and near-term receivables, combined.

Given SSH Communications Security Oyj has a market capitalization of €96.9m, it's hard to believe these liabilities pose much threat. Having said that, it's clear that we should continue to monitor its balance sheet, lest it change for the worse. Despite its noteworthy liabilities, SSH Communications Security Oyj boasts net cash, so it's fair to say it does not have a heavy debt load! There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine SSH Communications Security Oyj's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

In the last year SSH Communications Security Oyj wasn't profitable at an EBIT level, but managed to grow its revenue by 42%, to €16m. With any luck the company will be able to grow its way to profitability.

So How Risky Is SSH Communications Security Oyj?

Although SSH Communications Security Oyj had an earnings before interest and tax (EBIT) loss over the last twelve months, it generated positive free cash flow of €811k. So taking that on face value, and considering the net cash situation, we don't think that the stock is too risky in the near term. One positive is that SSH Communications Security Oyj is growing revenue apace, which makes it easier to sell a growth story and raise capital if need be. But that doesn't change our opinion that the stock is risky. For riskier companies like SSH Communications Security Oyj I always like to keep an eye on the long term profit and revenue trends. Fortunately, you can click to see our interactive graph of its profit, revenue, and operating cashflow.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About HLSE:SSH1V

SSH Communications Security Oyj

Operates as a cybersecurity company for humans, systems, and networks in the Americas, the Asia Pacific, Europe, the Middle East, and Africa.

Reasonable growth potential with adequate balance sheet.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026