Stock Analysis

Here's Why I Think Solteq Oyj (HEL:SOLTEQ) Might Deserve Your Attention Today

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. And in their study titled Who Falls Prey to the Wolf of Wall Street?' Leuz et. al. found that it is 'quite common' for investors to lose money by buying into 'pump and dump' schemes.

In contrast to all that, I prefer to spend time on companies like Solteq Oyj (HEL:SOLTEQ), which has not only revenues, but also profits. Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

View our latest analysis for Solteq Oyj

How Fast Is Solteq Oyj Growing Its Earnings Per Share?

Over the last three years, Solteq Oyj has grown earnings per share (EPS) like young bamboo after rain; fast, and from a low base. So I don't think the percent growth rate is particularly meaningful. As a result, I'll zoom in on growth over the last year, instead. Like a firecracker arcing through the night sky, Solteq Oyj's EPS shot from €0.059 to €0.17, over the last year. You don't see 192% year-on-year growth like that, very often.

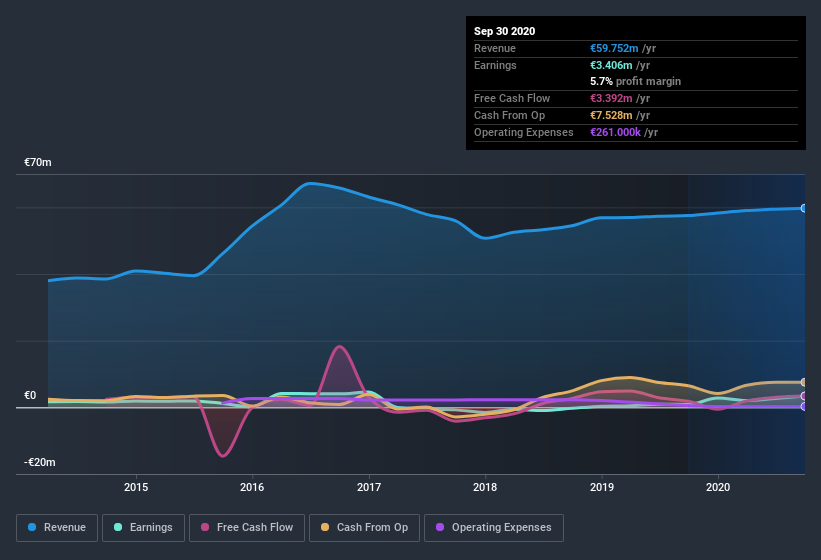

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). While we note Solteq Oyj's EBIT margins were flat over the last year, revenue grew by a solid 3.9% to €60m. That's progress.

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. To that end, right now and today, you can check our visualization of consensus analyst forecasts for future Solteq Oyj EPS 100% free.

Are Solteq Oyj Insiders Aligned With All Shareholders?

I like company leaders to have some skin in the game, so to speak, because it increases alignment of incentives between the people running the business, and its true owners. So it is good to see that Solteq Oyj insiders have a significant amount of capital invested in the stock. Indeed, they hold €12m worth of its stock. That's a lot of money, and no small incentive to work hard. That amounts to 19% of the company, demonstrating a degree of high-level alignment with shareholders.

Should You Add Solteq Oyj To Your Watchlist?

Solteq Oyj's earnings per share have taken off like a rocket aimed right at the moon. That sort of growth is nothing short of eye-catching, and the large investment held by insiders certainly brightens my view of the company. The hope is, of course, that the strong growth marks a fundamental improvement in the business economics. So to my mind Solteq Oyj is worth putting on your watchlist; after all, shareholders do well when the market underestimates fast growing companies. Even so, be aware that Solteq Oyj is showing 4 warning signs in our investment analysis , and 1 of those is a bit unpleasant...

You can invest in any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you’re looking to trade Solteq Oyj, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're helping make it simple.

Find out whether Solteq Oyj is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About HLSE:SOLTEQ

Solteq Oyj

Provides information technology services and software solutions specializing in the digitalization of business and industry-specific software in Finland, Sweden, Norway, Denmark, Poland, and the United Kingdom.

Undervalued with reasonable growth potential.