What LeadDesk Oy's (HEL:LEADD) 26% Share Price Gain Is Not Telling You

LeadDesk Oy (HEL:LEADD) shareholders would be excited to see that the share price has had a great month, posting a 26% gain and recovering from prior weakness. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 13% in the last twelve months.

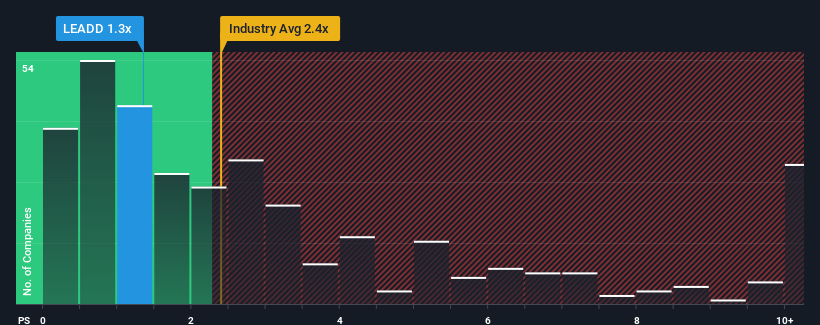

Even after such a large jump in price, you could still be forgiven for feeling indifferent about LeadDesk Oy's P/S ratio of 1.3x, since the median price-to-sales (or "P/S") ratio for the Software industry in Finland is also close to 1.6x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for LeadDesk Oy

What Does LeadDesk Oy's Recent Performance Look Like?

With revenue growth that's inferior to most other companies of late, LeadDesk Oy has been relatively sluggish. It might be that many expect the uninspiring revenue performance to strengthen positively, which has kept the P/S ratio from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

Keen to find out how analysts think LeadDesk Oy's future stacks up against the industry? In that case, our free report is a great place to start.Is There Some Revenue Growth Forecasted For LeadDesk Oy?

The only time you'd be comfortable seeing a P/S like LeadDesk Oy's is when the company's growth is tracking the industry closely.

If we review the last year of revenue growth, the company posted a worthy increase of 9.4%. This was backed up an excellent period prior to see revenue up by 131% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenues over that time.

Shifting to the future, estimates from the only analyst covering the company suggest revenue should grow by 7.1% per year over the next three years. That's shaping up to be materially lower than the 15% each year growth forecast for the broader industry.

With this information, we find it interesting that LeadDesk Oy is trading at a fairly similar P/S compared to the industry. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. Maintaining these prices will be difficult to achieve as this level of revenue growth is likely to weigh down the shares eventually.

What Does LeadDesk Oy's P/S Mean For Investors?

Its shares have lifted substantially and now LeadDesk Oy's P/S is back within range of the industry median. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our look at the analysts forecasts of LeadDesk Oy's revenue prospects has shown that its inferior revenue outlook isn't negatively impacting its P/S as much as we would have predicted. At present, we aren't confident in the P/S as the predicted future revenues aren't likely to support a more positive sentiment for long. A positive change is needed in order to justify the current price-to-sales ratio.

We don't want to rain on the parade too much, but we did also find 1 warning sign for LeadDesk Oy that you need to be mindful of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About HLSE:LEADD

LeadDesk Oyj

Provides cloud-based contact center solutions for sales outreach and customer service in Finland.

Acceptable track record with low risk.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success