We Think Shareholders May Consider Being More Generous With Gofore Oyj's (HEL:GOFORE) CEO Compensation Package

Key Insights

- Gofore Oyj will host its Annual General Meeting on 4th of April

- Salary of €190.0k is part of CEO Mikael Nylund's total remuneration

- The overall pay is 57% below the industry average

- Over the past three years, Gofore Oyj's EPS grew by 33% and over the past three years, the total shareholder return was 0.8%

Shareholders will be pleased by the robust performance of Gofore Oyj (HEL:GOFORE) recently and this will be kept in mind in the upcoming AGM on 4th of April. The focus will probably be on the future strategic initiatives that the board and management will put in place to improve the business rather than executive remuneration when they cast their votes on company resolutions. We have prepared some analysis below and we show why we think CEO compensation looks decent with even the possibility for a raise.

See our latest analysis for Gofore Oyj

How Does Total Compensation For Mikael Nylund Compare With Other Companies In The Industry?

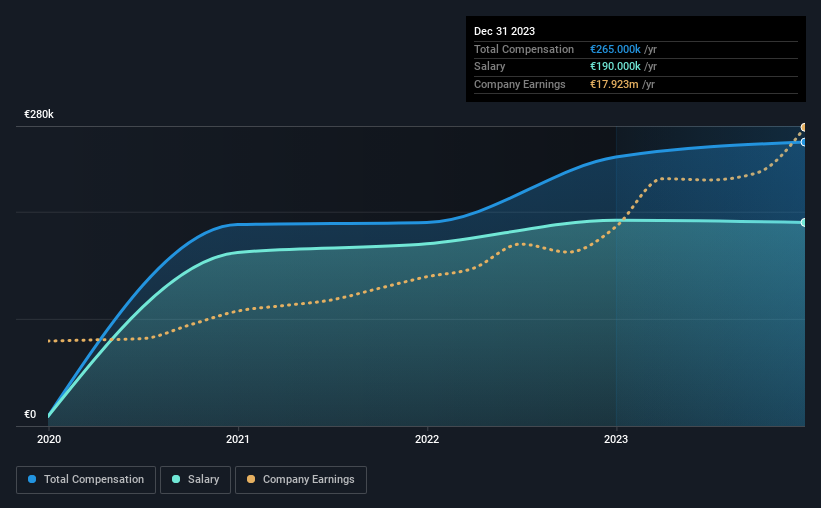

Our data indicates that Gofore Oyj has a market capitalization of €333m, and total annual CEO compensation was reported as €265k for the year to December 2023. That's just a smallish increase of 5.6% on last year. Notably, the salary which is €190.0k, represents most of the total compensation being paid.

For comparison, other companies in the Finnish IT industry with market capitalizations ranging between €185m and €742m had a median total CEO compensation of €622k. In other words, Gofore Oyj pays its CEO lower than the industry median. Moreover, Mikael Nylund also holds €4.9m worth of Gofore Oyj stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | €190k | €192k | 72% |

| Other | €75k | €59k | 28% |

| Total Compensation | €265k | €251k | 100% |

On an industry level, roughly 71% of total compensation represents salary and 29% is other remuneration. Our data reveals that Gofore Oyj allocates salary more or less in line with the wider market. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

Gofore Oyj's Growth

Gofore Oyj's earnings per share (EPS) grew 33% per year over the last three years. Its revenue is up 26% over the last year.

Shareholders would be glad to know that the company has improved itself over the last few years. Most shareholders would be pleased to see strong revenue growth combined with EPS growth. This combo suggests a fast growing business. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has Gofore Oyj Been A Good Investment?

With a total shareholder return of 0.8% over three years, Gofore Oyj has done okay by shareholders, but there's always room for improvement. Accordingly, a proposal to increase CEO remuneration without seeing an improvement in shareholder returns might not be met favorably by most shareholders.

In Summary...

Overall, the company hasn't done too poorly performance-wise, but we would like to see some improvement. If it continues on the same road, shareholders might feel even more confident about their investment, and have little to no objections concerning CEO pay. Rather, investors would more likely want to engage on discussions related to key strategic initiatives and future growth opportunities for the company and set their longer-term expectations.

Shareholders may want to check for free if Gofore Oyj insiders are buying or selling shares.

Important note: Gofore Oyj is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About HLSE:GOFORE

Gofore Oyj

Provides digital transformation consultancy services for private and public sectors in Finland and internationally.

Excellent balance sheet and good value.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success