High Growth Tech Stocks In Europe ParTec And Two Promising Contenders

Reviewed by Simply Wall St

Amid renewed uncertainty about U.S. trade policy and escalating geopolitical tensions in the Middle East, the pan-European STOXX Europe 600 Index ended 1.57% lower, with major stock indexes such as Germany’s DAX and Italy’s FTSE MIB also experiencing declines. In this context of market volatility, identifying high-growth tech stocks in Europe requires careful consideration of their innovation potential and resilience to broader economic pressures; ParTec is one such company that stands out alongside two other promising contenders in this dynamic sector.

Top 10 High Growth Tech Companies In Europe

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Intellego Technologies | 30.80% | 45.66% | ★★★★★★ |

| Archos | 21.07% | 36.58% | ★★★★★★ |

| KebNi | 21.51% | 66.96% | ★★★★★★ |

| Pharma Mar | 29.61% | 44.92% | ★★★★★★ |

| Bonesupport Holding | 29.14% | 56.14% | ★★★★★★ |

| argenx | 21.84% | 26.93% | ★★★★★★ |

| Xbrane Biopharma | 24.95% | 56.77% | ★★★★★★ |

| Skolon | 31.51% | 99.52% | ★★★★★★ |

| Diamyd Medical | 86.29% | 93.04% | ★★★★★★ |

| Elliptic Laboratories | 36.33% | 78.99% | ★★★★★★ |

Here we highlight a subset of our preferred stocks from the screener.

ParTec (DB:JY0)

Simply Wall St Growth Rating: ★★★★★☆

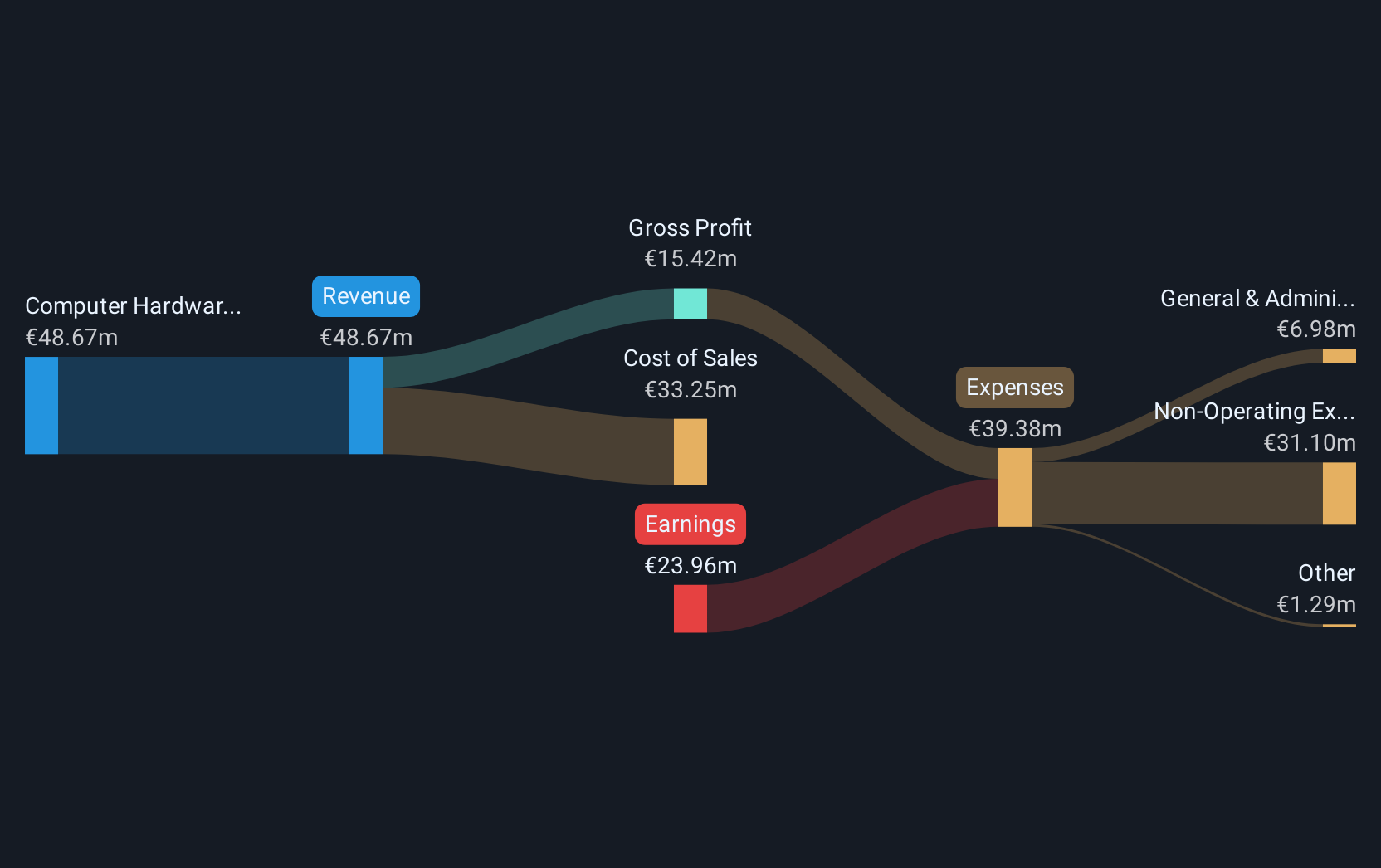

Overview: ParTec AG specializes in developing, manufacturing, and supplying supercomputer and quantum computer solutions, with a market capitalization of €288 million.

Operations: ParTec AG generates revenue primarily from its Computer Hardware segment, amounting to €48.67 million.

ParTec's strategic focus on integrating cutting-edge technologies like AI and quantum computing into its offerings is positioning it as a significant player in Europe's tech landscape. Recent partnerships, such as with ORCA Computing to enhance quantum-accelerated HPC and AI solutions, underscore its commitment to innovation—critical in an industry where technological advancements rapidly redefine market dynamics. Notably, ParTec’s involvement in building one of the world’s largest supercomputers reflects its capability to handle large-scale, complex projects. Financially, the company is set for robust growth with revenue expected to surge by 32.5% annually and earnings projected to grow at 41.7% per year. These figures suggest that ParTec is not only expanding its technological footprint but also aligning its growth trajectory well above the broader German market's average.

- Get an in-depth perspective on ParTec's performance by reading our health report here.

Gain insights into ParTec's historical performance by reviewing our past performance report.

Gofore Oyj (HLSE:GOFORE)

Simply Wall St Growth Rating: ★★★★☆☆

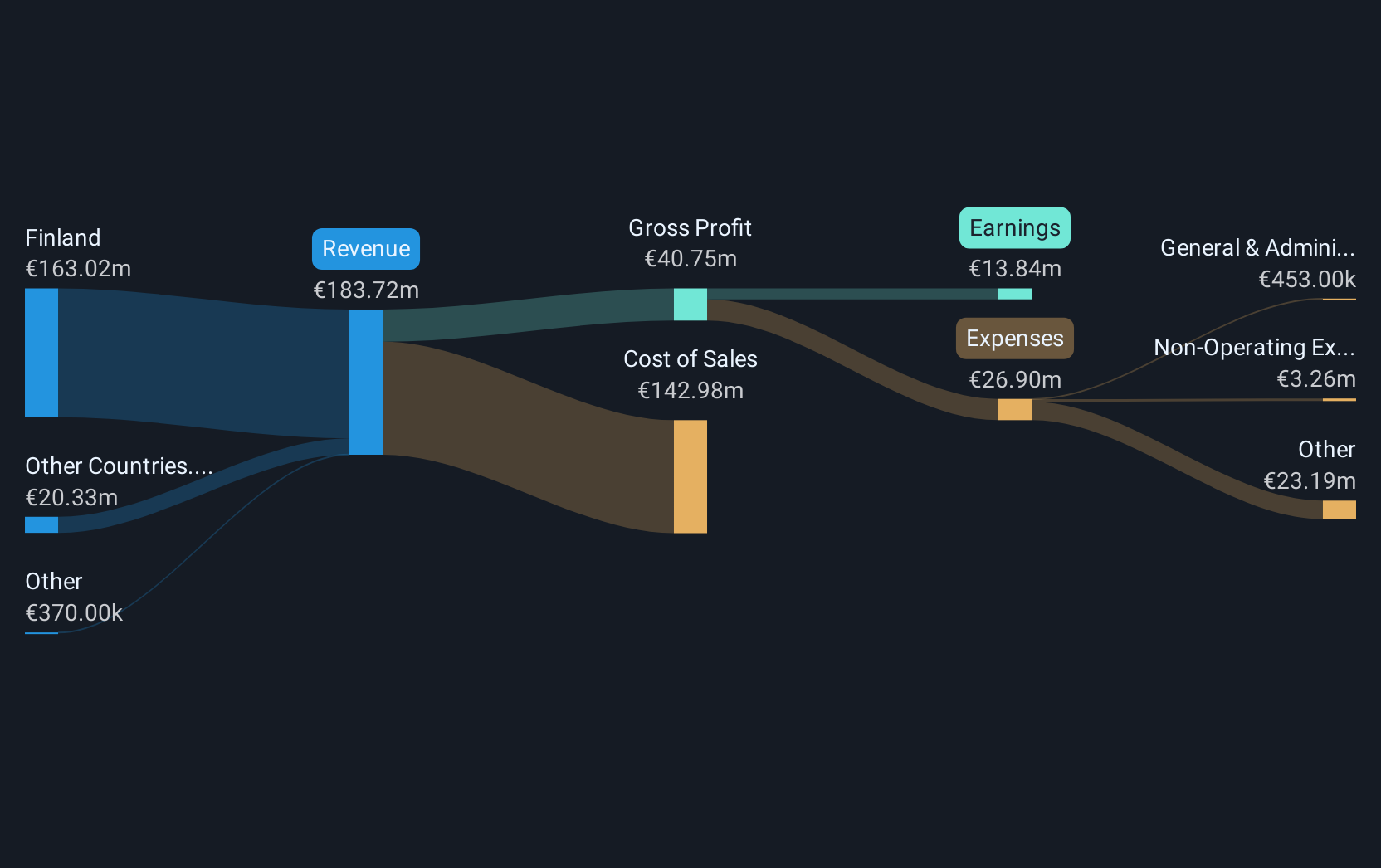

Overview: Gofore Oyj is a company that offers digital transformation consultancy services to both private and public sectors, with a market capitalization of €295.24 million.

Operations: The company generates revenue primarily from computer services, amounting to €183.72 million.

Gofore Oyj's recent selection by the Digital and Population Data Services Agency underlines its robust positioning within Europe's tech sector, especially in providing expert IT services. Despite a challenging fiscal quarter with net sales dropping to €46.43 million from €49.24 million year-over-year and net income falling to €1.8 million, Gofore maintains a promising growth trajectory with expected revenue and earnings growth of 7.8% and 23.1% per year, respectively—outpacing the broader Finnish market averages of 3.6% for revenue and 13.4% for earnings growth annually.

- Dive into the specifics of Gofore Oyj here with our thorough health report.

Gain insights into Gofore Oyj's past trends and performance with our Past report.

Napatech (OB:NAPA)

Simply Wall St Growth Rating: ★★★★★★

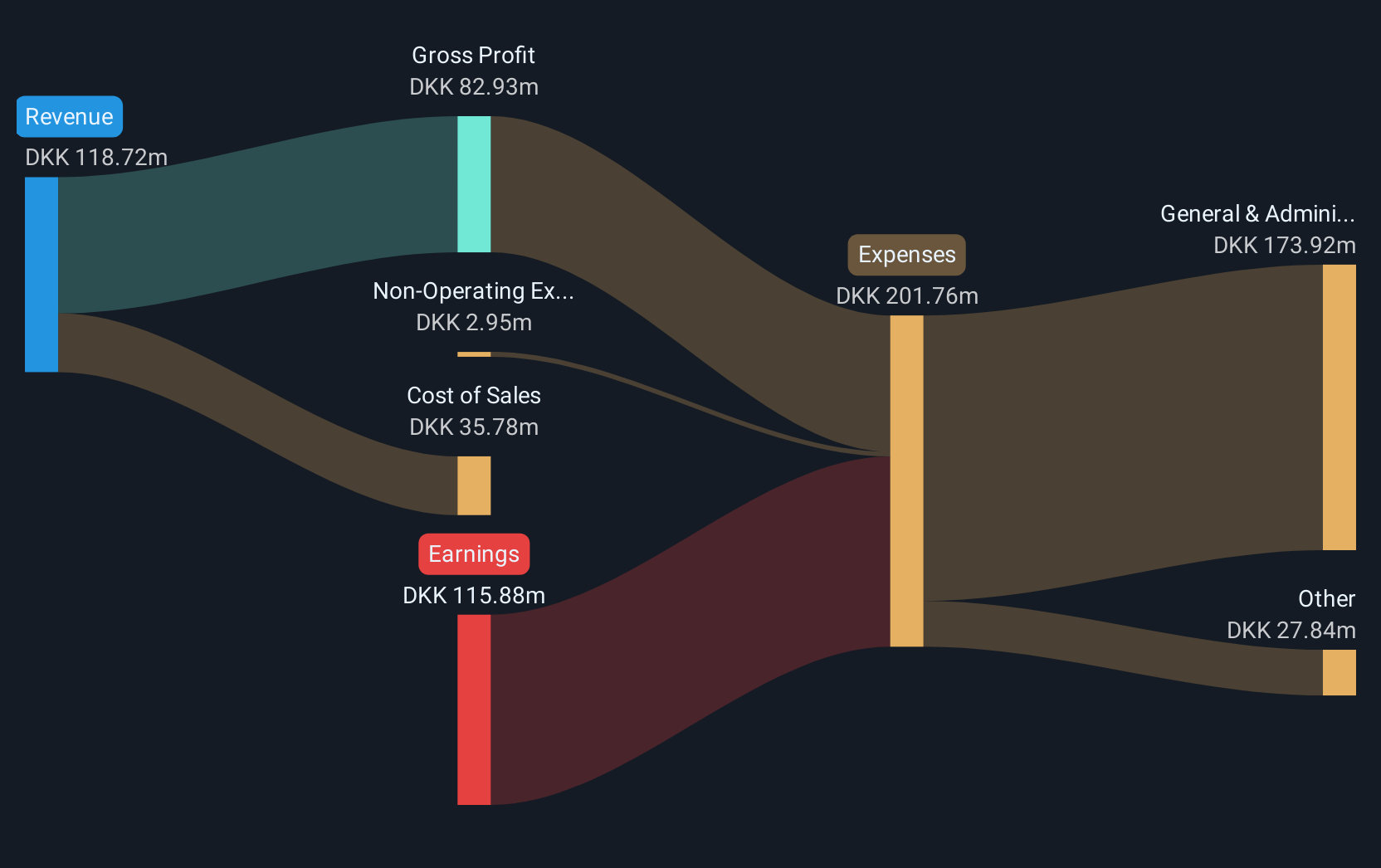

Overview: Napatech A/S specializes in providing programmable smart network interface cards and infrastructure processing units for cloud, enterprise, and telecom datacenter networks across the Americas and internationally, with a market capitalization of NOK2.56 billion.

Operations: Napatech A/S generates revenue through the sale of programmable smart network interface cards and infrastructure processing units, serving cloud, enterprise, and telecom datacenter networks globally. The company operates with a market capitalization of NOK2.56 billion.

Napatech's recent strategic maneuvers, including a significant follow-on equity offering and partnerships for AI infrastructure solutions, underscore its commitment to capitalizing on the burgeoning demand for data security and AI-driven network enhancements. With a 61.1% forecasted annual revenue growth outpacing the Norwegian market's 2.5%, coupled with an anticipated earnings surge of 102.7% annually, the firm is positioning itself as a pivotal player in tech innovation. Notably, its collaboration with d-Matrix and Xelera not only enhances its product offerings but also solidifies its role in advancing AI infrastructure critical for high-frequency trading environments, promising robust future prospects in a rapidly evolving industry landscape.

- Click here and access our complete health analysis report to understand the dynamics of Napatech.

Evaluate Napatech's historical performance by accessing our past performance report.

Next Steps

- Take a closer look at our European High Growth Tech and AI Stocks list of 225 companies by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:GOFORE

Gofore Oyj

Provides digital transformation consultancy services for private and public sectors in Finland and internationally.

Excellent balance sheet with reasonable growth potential.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion