Market Cool On Digitalist Group Plc's (HEL:DIGIGR) Revenues Pushing Shares 28% Lower

To the annoyance of some shareholders, Digitalist Group Plc (HEL:DIGIGR) shares are down a considerable 28% in the last month, which continues a horrid run for the company. The good news is that in the last year, the stock has shone bright like a diamond, gaining 185%.

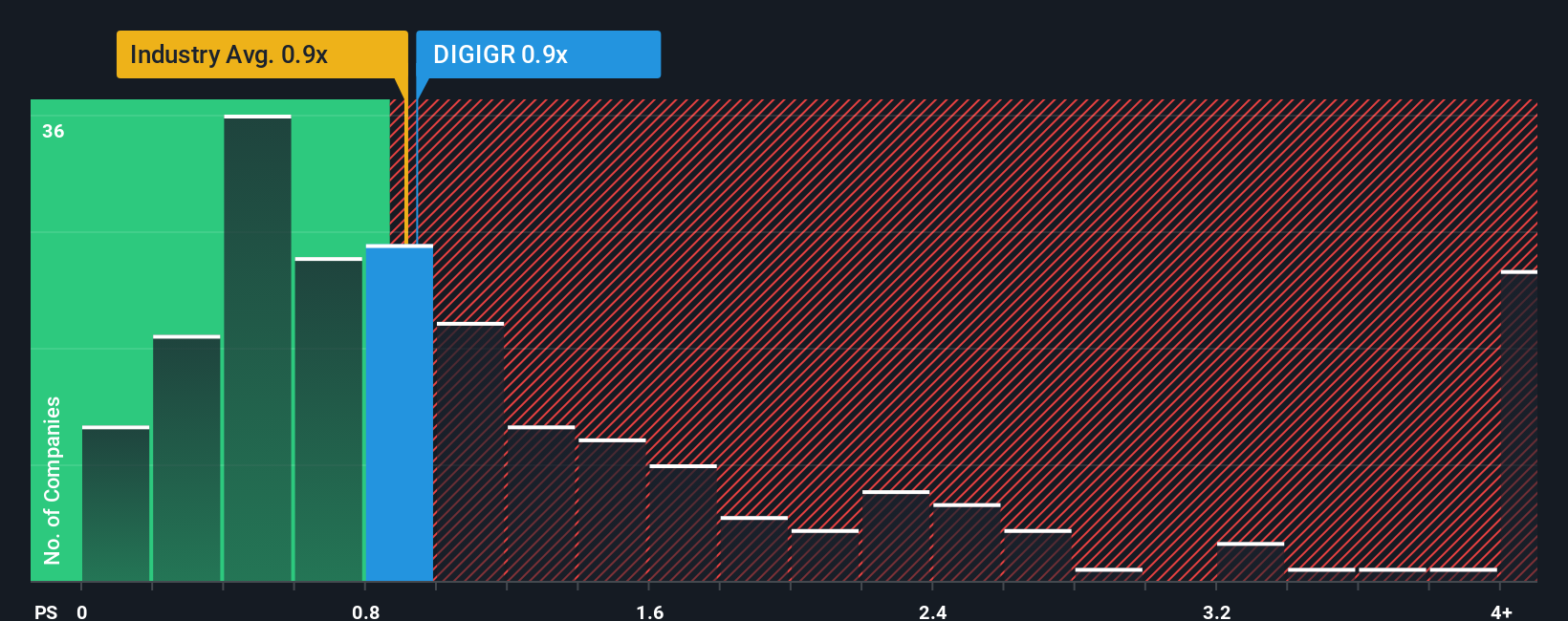

In spite of the heavy fall in price, it's still not a stretch to say that Digitalist Group's price-to-sales (or "P/S") ratio of 0.9x right now seems quite "middle-of-the-road" compared to the IT industry in Finland, where the median P/S ratio is around 0.7x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for Digitalist Group

How Digitalist Group Has Been Performing

For example, consider that Digitalist Group's financial performance has been poor lately as its revenue has been in decline. Perhaps investors believe the recent revenue performance is enough to keep in line with the industry, which is keeping the P/S from dropping off. If not, then existing shareholders may be a little nervous about the viability of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Digitalist Group's earnings, revenue and cash flow.Is There Some Revenue Growth Forecasted For Digitalist Group?

In order to justify its P/S ratio, Digitalist Group would need to produce growth that's similar to the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 3.2%. As a result, revenue from three years ago have also fallen 13% overall. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for a contraction of 24% shows the industry is even less attractive on an annualised basis.

With this in consideration, we find it intriguing but explainable that Digitalist Group's P/S matches closely with its industry peers. Even if the company's recent growth rates continue outperforming the industry, shrinking revenues are unlikely to lead to a stable P/S long-term. It's conceivable that the P/S falls to lower levels if the company doesn't improve its top-line growth, which would be difficult to do with the current industry outlook.

The Bottom Line On Digitalist Group's P/S

Following Digitalist Group's share price tumble, its P/S is just clinging on to the industry median P/S. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Even though revenue is has been declining, we've seen that Digitalist Group's P/S remains higher than the industry, partially attributable to the fact that the industry's revenue outlook is set to decline even further. There could be some unobserved threats to revenue preventing the P/S ratio from matching this more attractive performance. Perhaps there is some hesitation about the company's ability to deviate from the industry's dismal performance and maintain a relatively smaller revenue decline. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

Before you take the next step, you should know about the 4 warning signs for Digitalist Group (3 don't sit too well with us!) that we have uncovered.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About HLSE:DIGIGR

Digitalist Group

A technology company, provides consultancy services related to digital solutions in Finland and Sweden.

Slight risk and slightly overvalued.

Similar Companies

Market Insights

Community Narratives