We Discuss Why The CEO Of Digia Oyj (HEL:DIGIA) Is Due For A Pay Rise

Key Insights

- Digia Oyj will host its Annual General Meeting on 23rd of March

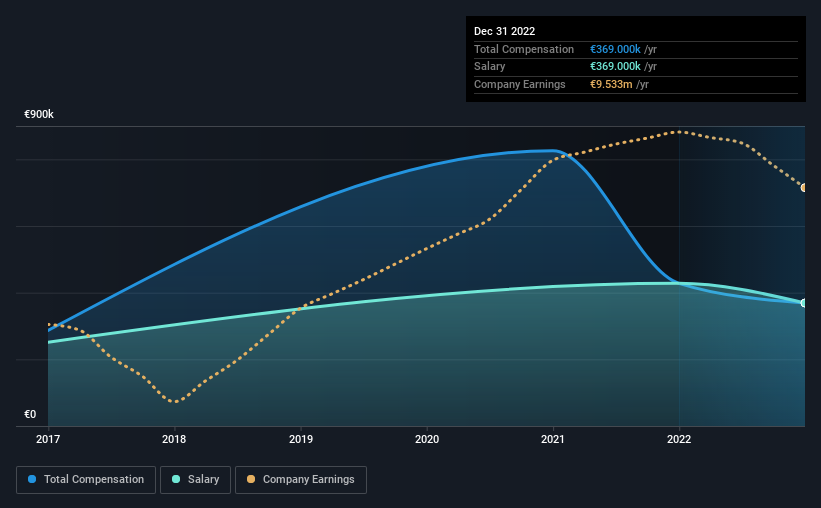

- Total pay for CEO Timo Levoranta includes €369.0k salary

- The total compensation is 30% less than the average for the industry

- Digia Oyj's EPS grew by 10% over the past three years while total shareholder return over the past three years was 76%

The solid performance at Digia Oyj (HEL:DIGIA) has been impressive and shareholders will probably be pleased to know that CEO Timo Levoranta has delivered. This would be kept in mind at the upcoming AGM on 23rd of March which will be a chance for them to hear the board review the financial results, discuss future company strategy and vote on resolutions such as executive remuneration and other matters. We think the CEO has done a pretty decent job and probably deserves a well-earned pay rise.

See our latest analysis for Digia Oyj

Comparing Digia Oyj's CEO Compensation With The Industry

According to our data, Digia Oyj has a market capitalization of €155m, and paid its CEO total annual compensation worth €369k over the year to December 2022. We note that's a decrease of 14% compared to last year. It is worth noting that the CEO compensation consists entirely of the salary, worth €369k.

For comparison, other companies in the Finnish IT industry with market capitalizations ranging between €94m and €377m had a median total CEO compensation of €531k. This suggests that Timo Levoranta is paid below the industry median. What's more, Timo Levoranta holds €616k worth of shares in the company in their own name.

| Component | 2022 | 2021 | Proportion (2022) |

| Salary | €369k | €428k | 100% |

| Other | - | - | - |

| Total Compensation | €369k | €428k | 100% |

Talking in terms of the industry, salary represented approximately 65% of total compensation out of all the companies we analyzed, while other remuneration made up 35% of the pie. At the company level, Digia Oyj pays Timo Levoranta solely through a salary, preferring to go down a conventional route. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

Digia Oyj's Growth

Digia Oyj has seen its earnings per share (EPS) increase by 10% a year over the past three years. Its revenue is up 9.5% over the last year.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. It's good to see a bit of revenue growth, as this suggests the business is able to grow sustainably. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has Digia Oyj Been A Good Investment?

We think that the total shareholder return of 76%, over three years, would leave most Digia Oyj shareholders smiling. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

In Summary...

Digia Oyj pays CEO compensation exclusively through a salary, with non-salary compensation completely ignored. The company's solid performance might have made most shareholders happy, possibly making CEO remuneration the least of the matters to be discussed in the AGM. Instead, investors might be more interested in discussions that would help manage their longer-term growth expectations such as company business strategies and future growth potential.

CEO compensation is a crucial aspect to keep your eyes on but investors also need to keep their eyes open for other issues related to business performance. We've identified 1 warning sign for Digia Oyj that investors should be aware of in a dynamic business environment.

Switching gears from Digia Oyj, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About HLSE:DIGIA

Digia Oyj

Operates as a software and service company in Finland, Sweden, and internationally.

Undervalued with solid track record and pays a dividend.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success