3 European Stocks That May Be Priced Below Their Estimated Value

Reviewed by Simply Wall St

Amid renewed uncertainty about U.S. trade policy and escalating geopolitical tensions in the Middle East, European markets have faced a challenging environment, with the pan-European STOXX Europe 600 Index ending 1.57% lower recently. As investors navigate these turbulent waters, identifying stocks that may be priced below their estimated value can offer potential opportunities for those looking to capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| VIGO Photonics (WSE:VGO) | PLN518.00 | PLN1023.50 | 49.4% |

| TTS (Transport Trade Services) (BVB:TTS) | RON4.265 | RON8.43 | 49.4% |

| Sparebank 68° Nord (OB:SB68) | NOK183.40 | NOK365.74 | 49.9% |

| Qt Group Oyj (HLSE:QTCOM) | €55.65 | €107.98 | 48.5% |

| Montana Aerospace (SWX:AERO) | CHF19.58 | CHF38.95 | 49.7% |

| Lectra (ENXTPA:LSS) | €23.65 | €46.54 | 49.2% |

| Exsitec Holding (OM:EXS) | SEK132.00 | SEK256.86 | 48.6% |

| Etteplan Oyj (HLSE:ETTE) | €10.60 | €20.47 | 48.2% |

| dormakaba Holding (SWX:DOKA) | CHF716.00 | CHF1400.46 | 48.9% |

| BigBen Interactive (ENXTPA:BIG) | €1.06 | €2.11 | 49.7% |

Let's explore several standout options from the results in the screener.

Admicom Oyj (HLSE:ADMCM)

Overview: Admicom Oyj provides cloud-based software and business process automation solutions in Finland, with a market cap of €253.86 million.

Operations: The company generates revenue of €36.24 million from its software and programming segment.

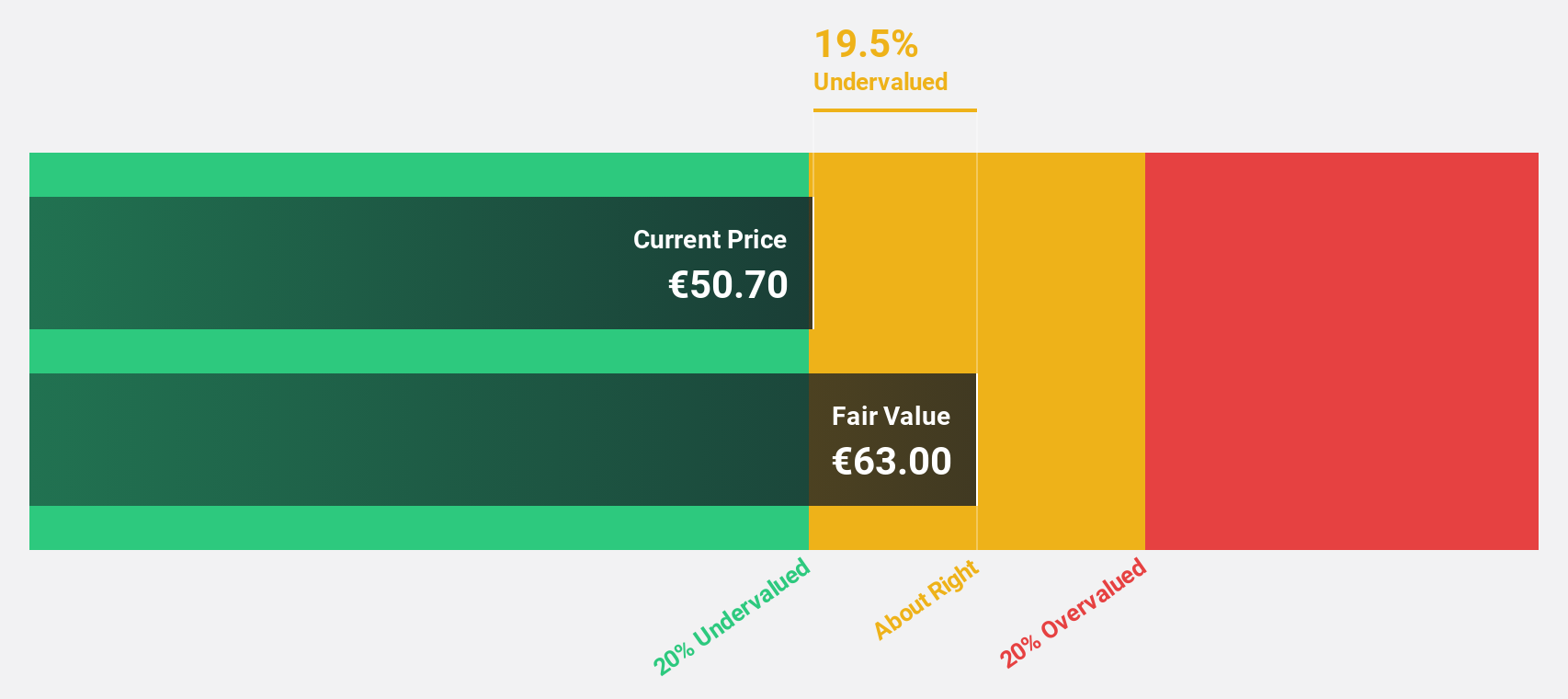

Estimated Discount To Fair Value: 19.6%

Admicom Oyj is trading at €50.6, below its estimated fair value of €62.95, indicating it may be undervalued based on cash flows. Despite a recent dip in net income to €0.676 million for Q1 2025, the company forecasts significant earnings growth of 21.5% annually over the next three years, outpacing the Finnish market's average growth rate. However, revenue growth remains modest with expectations between 6% and 11% for this year.

- Our growth report here indicates Admicom Oyj may be poised for an improving outlook.

- Click here to discover the nuances of Admicom Oyj with our detailed financial health report.

Gofore Oyj (HLSE:GOFORE)

Overview: Gofore Oyj offers digital transformation consultancy services to both private and public sectors in Finland and internationally, with a market cap of €295.24 million.

Operations: The company's revenue primarily comes from its computer services segment, which generated €183.72 million.

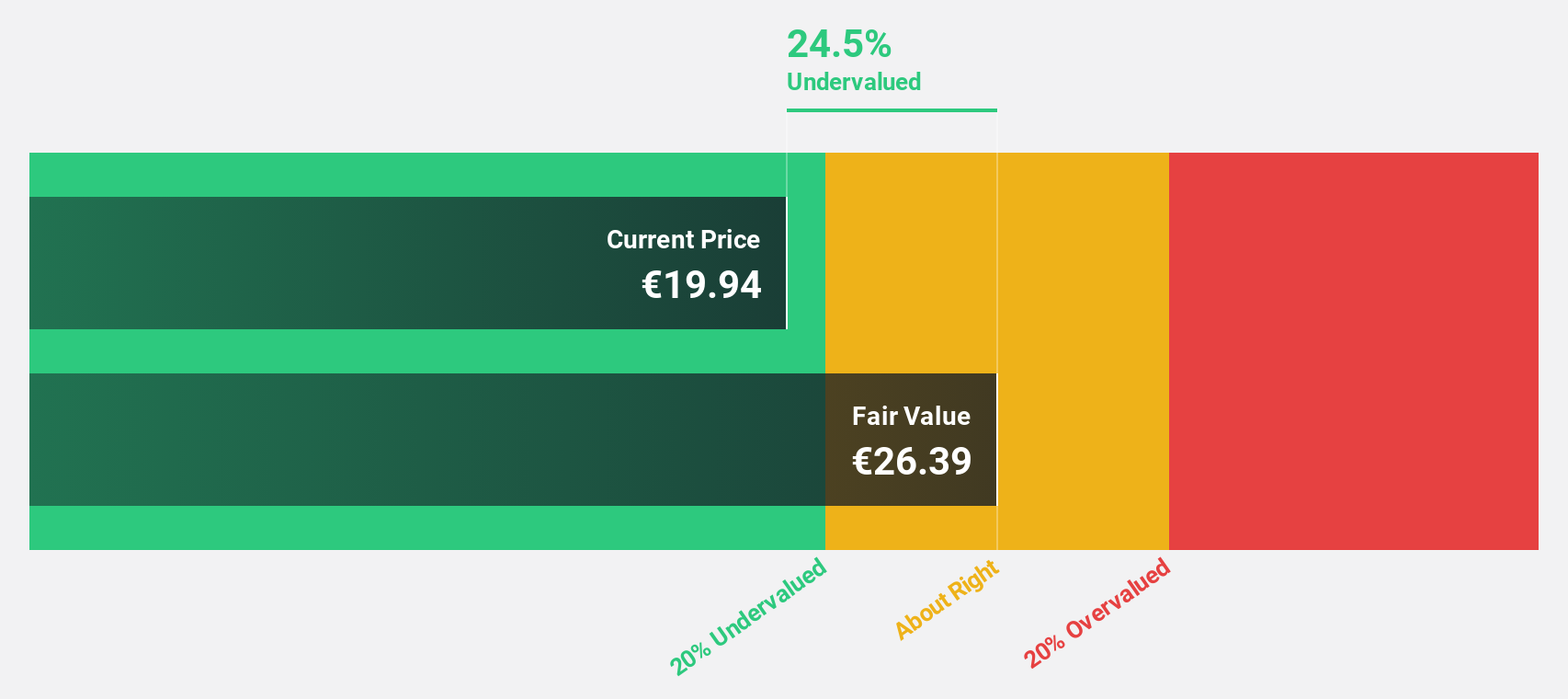

Estimated Discount To Fair Value: 28.9%

Gofore Oyj, trading at €18.76, is undervalued based on cash flows with a fair value estimate of €26.39. Despite recent declines in quarterly net income to €1.8 million and sales to €46.43 million, earnings are expected to grow significantly at 23.1% annually, surpassing the Finnish market's growth rate of 13.4%. The company secured a major framework agreement with DVV valued at up to €250 million, enhancing its revenue potential amidst high share price volatility recently observed.

- Our expertly prepared growth report on Gofore Oyj implies its future financial outlook may be stronger than recent results.

- Take a closer look at Gofore Oyj's balance sheet health here in our report.

Synektik Spólka Akcyjna (WSE:SNT)

Overview: Synektik Spólka Akcyjna offers products, services, and IT solutions for surgery, diagnostic imaging, and nuclear medicine applications in Poland with a market cap of PLN1.83 billion.

Operations: Synektik Spólka Akcyjna generates revenue through its offerings in surgery, diagnostic imaging, and nuclear medicine applications within Poland.

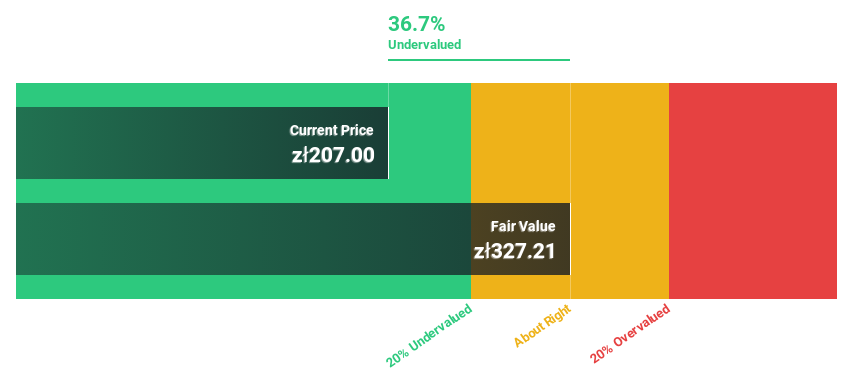

Estimated Discount To Fair Value: 32%

Synektik Spólka Akcyjna, trading at PLN 214.6, is undervalued based on cash flows with a fair value estimate of PLN 315.41. Despite a decline in revenue to PLN 327.82 million for the half year ended March 31, 2025, net income rose slightly to PLN 47.56 million. Earnings are forecasted to grow annually by 18.18%, outpacing the Polish market's growth rate of 14.6%. The company's return on equity is projected to be very high at 48.2% in three years.

- According our earnings growth report, there's an indication that Synektik Spólka Akcyjna might be ready to expand.

- Unlock comprehensive insights into our analysis of Synektik Spólka Akcyjna stock in this financial health report.

Turning Ideas Into Actions

- Delve into our full catalog of 174 Undervalued European Stocks Based On Cash Flows here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:GOFORE

Gofore Oyj

Provides digital transformation consultancy services for private and public sectors in Finland and internationally.

Flawless balance sheet and good value.

Market Insights

Community Narratives