- Finland

- /

- Retail Distributors

- /

- HLSE:WUF1V

I Ran A Stock Scan For Earnings Growth And Wulff-Yhtiöt Oyj (HEL:WUF1V) Passed With Ease

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. But as Warren Buffett has mused, 'If you've been playing poker for half an hour and you still don't know who the patsy is, you're the patsy.' When they buy such story stocks, investors are all too often the patsy.

In contrast to all that, I prefer to spend time on companies like Wulff-Yhtiöt Oyj (HEL:WUF1V), which has not only revenues, but also profits. Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

View our latest analysis for Wulff-Yhtiöt Oyj

How Quickly Is Wulff-Yhtiöt Oyj Increasing Earnings Per Share?

As one of my mentors once told me, share price follows earnings per share (EPS). That means EPS growth is considered a real positive by most successful long-term investors. Who among us would not applaud Wulff-Yhtiöt Oyj's stratospheric annual EPS growth of 58%, compound, over the last three years? Growth that fast may well be fleeting, but like a lotus blooming from a murky pond, it sparks joy for the wary stock pickers.

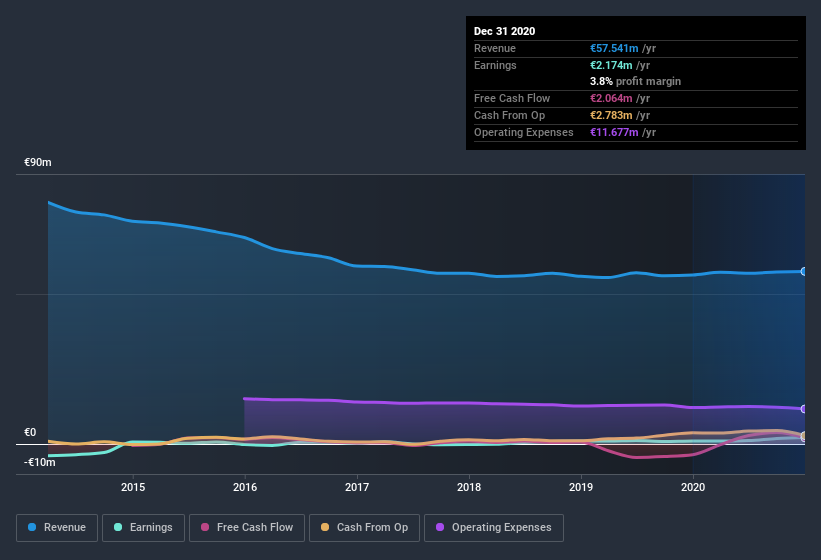

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Wulff-Yhtiöt Oyj shareholders can take confidence from the fact that EBIT margins are up from 3.1% to 6.1%, and revenue is growing. That's great to see, on both counts.

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

Wulff-Yhtiöt Oyj isn't a huge company, given its market capitalization of €21m. That makes it extra important to check on its balance sheet strength.

Are Wulff-Yhtiöt Oyj Insiders Aligned With All Shareholders?

Many consider high insider ownership to be a strong sign of alignment between the leaders of a company and the ordinary shareholders. So we're pleased to report that Wulff-Yhtiöt Oyj insiders own a meaningful share of the business. Indeed, with a collective holding of 57%, company insiders are in control and have plenty of capital behind the venture. To me this is a good sign because it suggests they will be incentivised to build value for shareholders over the long term. Of course, Wulff-Yhtiöt Oyj is a very small company, with a market cap of only €21m. That means insiders only have €12m worth of shares, despite the large proportional holding. That might not be a huge sum but it should be enough to keep insiders motivated!

It's good to see that insiders are invested in the company, but are remuneration levels reasonable? A brief analysis of the CEO compensation suggests they are. I discovered that the median total compensation for the CEOs of companies like Wulff-Yhtiöt Oyj with market caps under €168m is about €267k.

Wulff-Yhtiöt Oyj offered total compensation worth €145k to its CEO in the year to . That comes in below the average for similar sized companies, and seems pretty reasonable to me. While the level of CEO compensation isn't a huge factor in my view of the company, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of a culture of integrity, in a broader sense.

Is Wulff-Yhtiöt Oyj Worth Keeping An Eye On?

Wulff-Yhtiöt Oyj's earnings per share have taken off like a rocket aimed right at the moon. The sweetener is that insiders have a mountain of stock, and the CEO remuneration is quite reasonable. The strong EPS improvement suggests the businesses is humming along. Wulff-Yhtiöt Oyj certainly ticks a few of my boxes, so I think it's probably well worth further consideration. It is worth noting though that we have found 4 warning signs for Wulff-Yhtiöt Oyj (1 can't be ignored!) that you need to take into consideration.

Although Wulff-Yhtiöt Oyj certainly looks good to me, I would like it more if insiders were buying up shares. If you like to see insider buying, too, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

When trading Wulff-Yhtiöt Oyj or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Wulff-Yhtiöt Oyj might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About HLSE:WUF1V

Wulff-Yhtiöt Oyj

Provides workplace products, IT supplies, ergonomics, printing, international exhibition, and event services in Finland, Sweden, Norway, Denmark, Estonia, other European countries, and internationally.

Undervalued with excellent balance sheet.