Verkkokauppa.com Oyj (HEL:VERK) Surges 26% Yet Its Low P/S Is No Reason For Excitement

Verkkokauppa.com Oyj (HEL:VERK) shareholders would be excited to see that the share price has had a great month, posting a 26% gain and recovering from prior weakness. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 26% over that time.

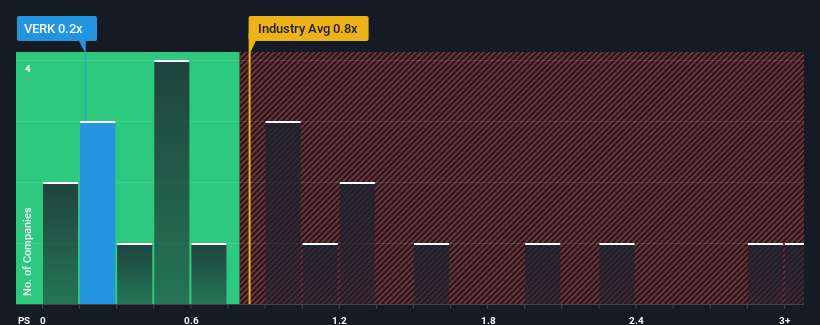

Although its price has surged higher, it would still be understandable if you think Verkkokauppa.com Oyj is a stock with good investment prospects with a price-to-sales ratios (or "P/S") of 0.2x, considering almost half the companies in Finland's Multiline Retail industry have P/S ratios above 0.8x. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Verkkokauppa.com Oyj

How Verkkokauppa.com Oyj Has Been Performing

Verkkokauppa.com Oyj could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on Verkkokauppa.com Oyj will help you uncover what's on the horizon.Do Revenue Forecasts Match The Low P/S Ratio?

Verkkokauppa.com Oyj's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Retrospectively, the last year delivered a frustrating 7.0% decrease to the company's top line. As a result, revenue from three years ago have also fallen 19% overall. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Looking ahead now, revenue is anticipated to climb by 4.1% per year during the coming three years according to the three analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 6.9% each year, which is noticeably more attractive.

With this in consideration, its clear as to why Verkkokauppa.com Oyj's P/S is falling short industry peers. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

What Does Verkkokauppa.com Oyj's P/S Mean For Investors?

Despite Verkkokauppa.com Oyj's share price climbing recently, its P/S still lags most other companies. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Verkkokauppa.com Oyj's analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Verkkokauppa.com Oyj, and understanding these should be part of your investment process.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About HLSE:VERK

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives