Verkkokauppa.com (HLSE:VERK) Profitability Returns, Challenging Bearish Narratives on Margins

Reviewed by Simply Wall St

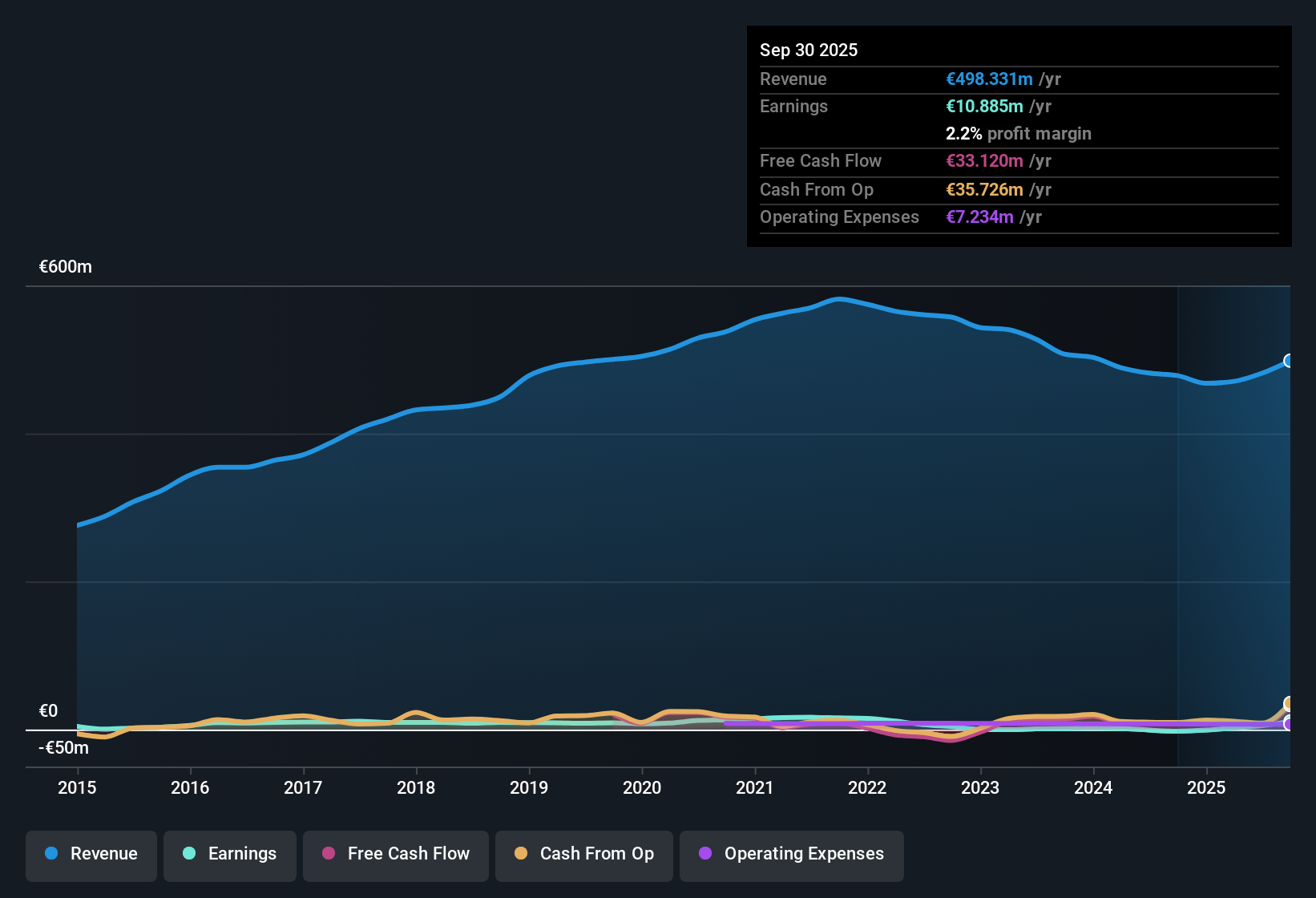

Verkkokauppa.com Oyj (HLSE:VERK) returned to profitability over the past year, following a period when earnings declined by 58.1% per year for five years. Looking ahead, forecasts call for earnings to grow at 2.4% per year and revenue to rise 4.8% per year. Improved margins are expected to support higher-quality earnings. While the stock trades below its estimated fair value of €5.3 per share, investors will notice it currently carries a high price-to-earnings multiple at 33.9x compared to a peer average of 18.3x. Recent insider selling and share price volatility also add a layer of caution, but consistent profit and revenue growth remain as rewards on the table.

See our full analysis for Verkkokauppa.com Oyj.Next, we will see how these headline figures hold up against the crowd-sourced narratives, as there may be some surprises when the numbers collide with market sentiment.

Curious how numbers become stories that shape markets? Explore Community Narratives

Margins Recovered After Five Years of Declines

- After earnings fell by an average of 58.1% annually for five years, Verkkokauppa.com has now restored profitability with improved margins. Future guidance calls for 2.4% annual earnings growth alongside 4.8% revenue growth.

- The prevailing market view sees the return to profitability and higher margins as a positive sign for operational resilience, but cautions that execution risks remain:

- While improved cost controls are a tailwind, competitive intensity in Finnish e-commerce means margin expansion may not be linear.

- Sustained profit growth will likely require successful product innovation or further efficiency gains to outpace sector headwinds.

Price Tag Well Above Peers Even as DCF Implies Upside

- With a price-to-earnings multiple of 33.9x, Verkkokauppa.com’s valuation significantly exceeds the peer average of 18.3x and the global sector average of 22.1x. The company still trades below its DCF fair value of €5.30, with a current share price of €3.92.

- The prevailing market view highlights strong debate over whether steady profit growth justifies the premium:

- Bulls point to the discount versus DCF fair value as a sign of meaningful upside. Bears question if sector outperformance warrants a price nearly double that of rivals.

- The conflicting valuation story puts pressure on the company to deliver outsized growth compared to competitors to maintain its current rating.

Insider Selling Shadows a Profitable Turnaround

- Substantial insider selling in the latest quarter and recent share price volatility could signal wariness from within the company, even as profits return.

- The prevailing market view notes that, despite clear operational momentum, insider actions and an unsteady share price add to investor caution:

- Share price stability has not been observed over the last three months, which contrasts with the business’s newfound profitability.

- Such insider activity tends to weigh on sentiment and makes many investors less likely to see the latest earnings as a definitive turning point.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Verkkokauppa.com Oyj's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Verkkokauppa.com’s high valuation, recent insider selling, and volatile share price raise uncertainty around the sustainability of its recent profitability.

If caution about overpaying for uncertain growth resonates, use our these 876 undervalued stocks based on cash flows to uncover companies trading at more compelling valuations based on their future cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:VERK

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives