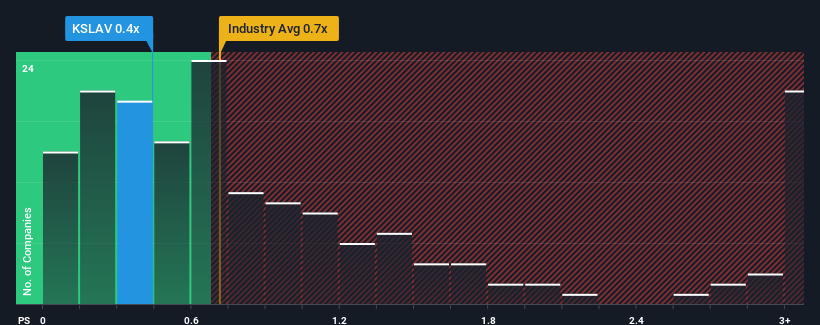

There wouldn't be many who think Keskisuomalainen Oyj's (HEL:KSLAV) price-to-sales (or "P/S") ratio of 0.4x is worth a mention when the median P/S for the Media industry in Finland is similar at about 0.9x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for Keskisuomalainen Oyj

How Has Keskisuomalainen Oyj Performed Recently?

For instance, Keskisuomalainen Oyj's receding revenue in recent times would have to be some food for thought. Perhaps investors believe the recent revenue performance is enough to keep in line with the industry, which is keeping the P/S from dropping off. If you like the company, you'd at least be hoping this is the case so that you could potentially pick up some stock while it's not quite in favour.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Keskisuomalainen Oyj's earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The P/S?

Keskisuomalainen Oyj's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 1.1%. As a result, revenue from three years ago have also fallen 1.0% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

It turns out the industry is also predicted to shrink 0.07% in the next 12 months, mirroring the company's downward momentum based on recent medium-term annualised revenue results.

In light of this, it's understandable that Keskisuomalainen Oyj's P/S sits in line with the majority of other companies. Nonetheless, there's no guarantee the P/S has found a floor yet with recent revenue going backwards, despite the industry heading down in unison. Maintaining these prices will be difficult to achieve as a continuation of recent revenue trends is likely to weigh down the shares eventually.

What Does Keskisuomalainen Oyj's P/S Mean For Investors?

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Keskisuomalainen Oyj revealed its three-year contraction in revenue is resulting in a P/S that matches the industry, given the industry is also set to shrink at a similar rate. It would appear as though shareholders are comfortable with the current P/S ratio, as they seem to have confidence that future revenue will not result in any unfavourable surprises. However, we're slightly cautious about the company's ability to stay its recent medium-term course and resist further pain to its business from the broader industry turmoil. For now though, it's hard to see the share price moving strongly in either direction unless there's a material change to operating conditions.

Before you settle on your opinion, we've discovered 2 warning signs for Keskisuomalainen Oyj that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Keskisuomalainen Oyj might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About HLSE:KSL

Keskisuomalainen Oyj

Engages in publishing, printing, and distributing newspapers and electronic communications in Finland.

Undervalued second-rate dividend payer.

Market Insights

Community Narratives