Ilkka Oyj (HLSE:ILKKA2) Earnings Rebound Challenges Persistent Bearish Narrative on Profit Trends

Reviewed by Simply Wall St

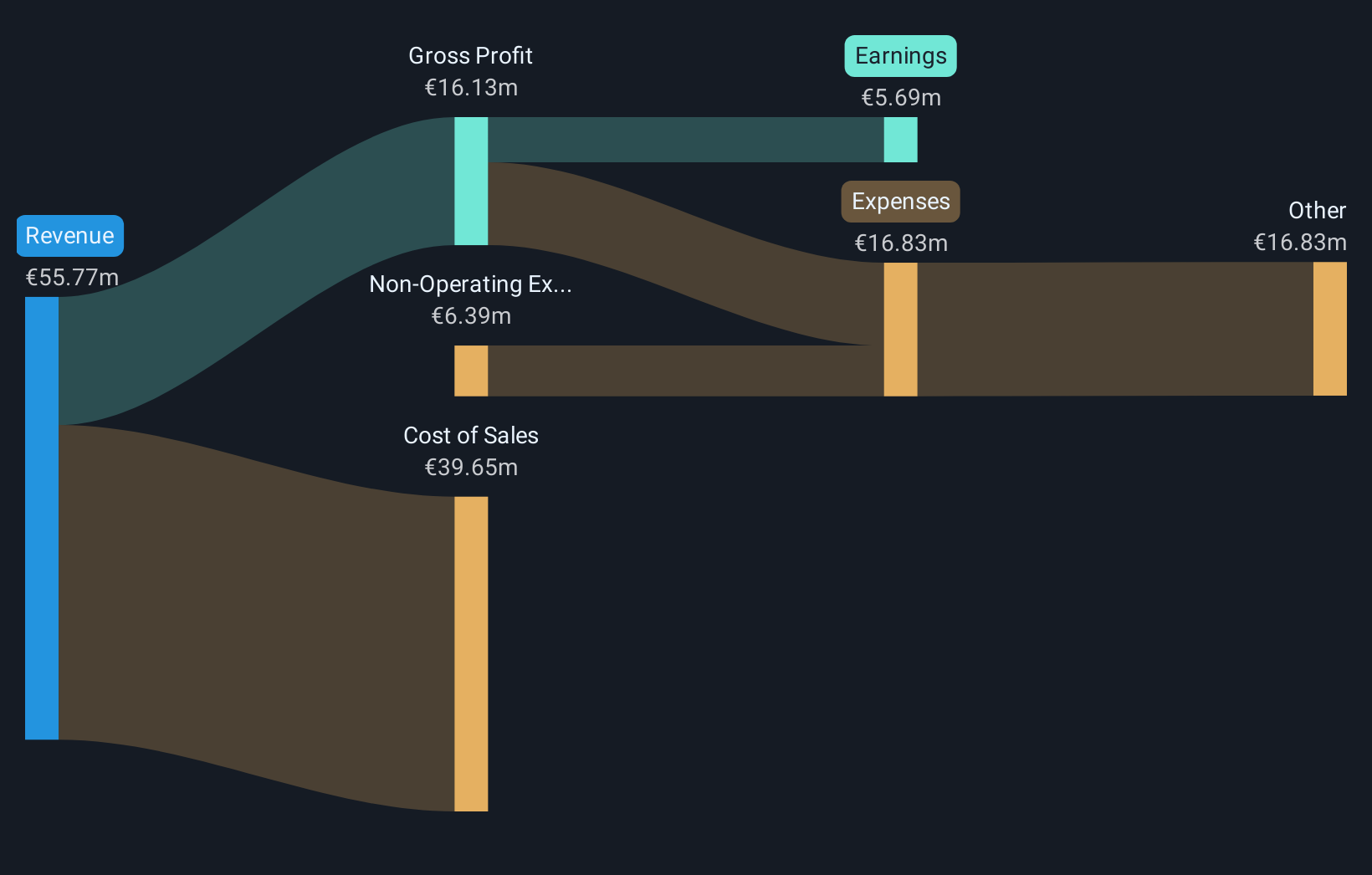

Ilkka Oyj (HLSE:ILKKA2) turned around a five-year trend of steep earnings declines by delivering 5.8% earnings growth this year; previously, the company averaged a 30.7% annual earnings drop. However, revenue is projected to fall by 2.3% annually over the next three years, with earnings expected to decrease 6.5% each year. Net profit margins narrowed to 10.2% from last year’s 12.8%, pointing to some pressure on overall profitability even as relative valuation keeps investor interest balanced.

See our full analysis for Ilkka Oyj.Next up, we will set these headline results against the market narratives to see which storylines hold up and which may need to be re-examined.

Curious how numbers become stories that shape markets? Explore Community Narratives

Margins Squeezed Despite Recent Profit Bump

- Net profit margins shrank to 10.2% from last year’s 12.8%, narrowing by 2.6 percentage points even as annual earnings growth briefly turned positive.

- With margins under pressure, prevailing market analysis highlights a mixed outlook. Recent profitability has improved notably from an average annual decline of 30.7% over five years, yet consensus among market watchers is that structural pressures in the sector remain unresolved:

- The brief earnings turnaround is tempered by forecasted annual declines in both revenue (down 2.3% per year) and earnings (down 6.5% per year), casting doubt on longer-term stability.

- The margin contraction is interpreted as a sign that the company’s turnaround may lack durability unless operating leverage or cost management improves ahead of further revenue drops.

Valuation: Discounted to Peers, Premium to Sector

- Ilkka trades at a price-to-earnings ratio of 18.7x, which is well below the peer average of 44.9x but above the European media industry’s 15.1x, placing its valuation in a middle ground.

- Prevailing market observers point out that while Ilkka’s P/E discount to peers appears attractive, the premium over its wider industry signals specific company risk that investors must factor in:

- Bulls may see the peer discount as a value opportunity, but the DCF fair value of 4.11 is below the current share price of 4.20, arguing that the stock is not obviously undervalued by cash flow standards.

- Valuation tension reflects diverging narratives, with some emphasizing relative value and others wary of sector headwinds and future earnings declines.

Dividend Sustainability Eyed as Revenue Set to Decline

- With revenue projected to fall 2.3% annually for the next three years and earnings to decrease by 6.5% each year, sustainability of Ilkka’s dividend is a growing concern amidst tightening margins.

- Market interpretation draws a direct link between the negative forecast trends and income investors’ caution. Prevailing analyses warn that despite Ilkka’s reputation for steady dividends, ongoing declines in the top and bottom lines could compromise future payouts if underlying profitability does not stabilize:

- A shrinking profit margin erodes dividend coverage, heightening the risk of payout reductions if forecasts materialize.

- This risk is echoed in the hesitation among value-focused holders, who now weigh future income against worsening fundamentals more critically.

See what the community is saying about Ilkka Oyj

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Ilkka Oyj's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

With margins shrinking, forecasts of declining revenue and earnings, and increasing questions on dividend sustainability, Ilkka faces real challenges to future stability.

If steady income is your priority, uncover better opportunities for reliable yield among these 1970 dividend stocks with yields > 3% with stronger business fundamentals supporting their payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:ILKKA2

Ilkka Oyj

Operates in publishing and printing businesses in Finland and internationally.

Adequate balance sheet with low risk.

Market Insights

Community Narratives