- Finland

- /

- Paper and Forestry Products

- /

- HLSE:STERV

Exploring Stora Enso (HLSE:STERV) Valuation After Recent Share Price Momentum

Reviewed by Simply Wall St

Stora Enso Oyj (HLSE:STERV) shares have moved modestly this month. This has encouraged investors to dig deeper into the underlying drivers behind the stock’s recent performance and to consider what longer-term trends might be at play.

See our latest analysis for Stora Enso Oyj.

After a strong bounce over the past week, Stora Enso Oyj's momentum has helped offset a weaker showing seen earlier this year. While the 1-year total shareholder return remains negative, short-term share price gains may signal shifting investor sentiment and renewed interest in the company’s growth story.

If you’re considering what else might be gaining traction right now, this is an ideal moment to broaden your radar and discover fast growing stocks with high insider ownership

With Stora Enso Oyj trading below both analyst targets and estimated intrinsic value, the question is whether there is undervaluation for investors to seize, or if the market is already anticipating a turnaround in growth.

Most Popular Narrative: 12% Undervalued

Stora Enso Oyj’s most widely followed narrative points to a fair value that stands distinctly above the last closing price of €9.81. This puts the spotlight on why many see hidden value in the company’s positioning and future potential. The debate intensifies as bulls and bears weigh cost-cutting momentum, asset optimization, and strategic shifts versus industry uncertainty and near-term macro headwinds.

“Operational streamlining, asset optimization, and efficiency initiatives are expected to enhance profitability, unlock asset value, and support long-term growth.”

Want to unlock the story behind this valuation? There is a bold projection buried here: profitability is expected to swing sharply, powered by new margins and a dramatically changing earnings profile. Which aggressive assumptions drive the consensus target, and could the market be missing the forest for the trees? Delve into the full narrative to find out the quantitative bets that analysts believe set Stora Enso apart.

Result: Fair Value of €11.17 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing industry overcapacity and persistently high input costs could limit profit recovery. This may potentially challenge the optimistic outlook for Stora Enso Oyj.

Find out about the key risks to this Stora Enso Oyj narrative.

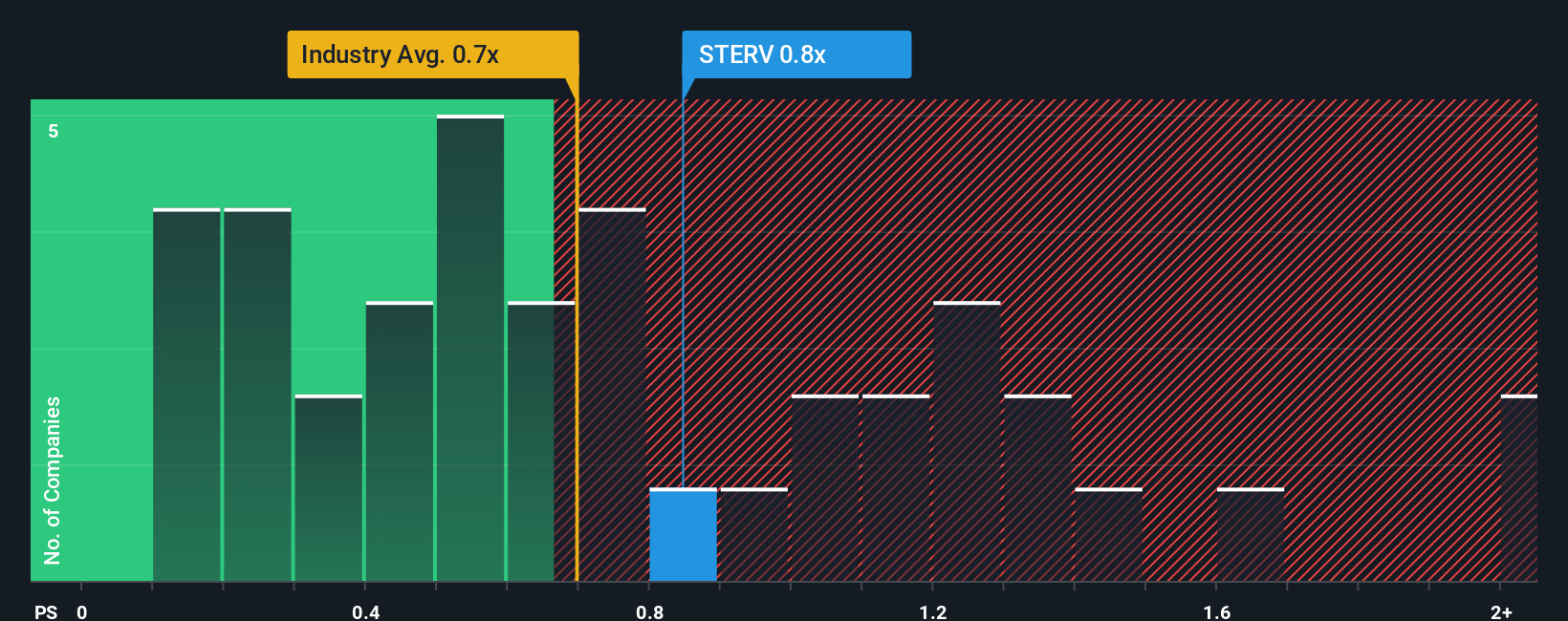

Another View: Multiples Send a Cautious Signal

Taking a different angle, Stora Enso Oyj’s price-to-sales ratio sits at 0.8x, which is higher than the European Forestry industry average of 0.6x but below its fair ratio of 2.1x. This means the stock is priced slightly above its peers, yet well below where the market could re-rate it. Does this imply hidden value or lingering doubt?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Stora Enso Oyj Narrative

If you see the story differently or want to dig deeper on your own terms, you can craft your personal Stora Enso Oyj narrative in just minutes: Do it your way

A great starting point for your Stora Enso Oyj research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors look ahead, taking advantage of timely opportunities beyond the obvious. Expand your reach with some of the most compelling stock screens hand-picked for strong potential and unique advantages.

- Supercharge your income potential by targeting high yields with these 17 dividend stocks with yields > 3% offering attractive returns above 3%.

- Ride the momentum of AI-driven change with these 27 AI penny stocks uncovering companies at the forefront of artificial intelligence innovation.

- Tap into market mispricings right now by snapping up bargains with these 877 undervalued stocks based on cash flows focused on stocks trading below their intrinsic value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:STERV

Stora Enso Oyj

Provides renewable solutions for the packaging, biomaterials, wooden constructions, and paper industries in Finland and internationally.

Good value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives