- China

- /

- Life Sciences

- /

- SHSE:688046

3 Promising Value Stocks Estimated To Be Up To 44.3% Below Intrinsic Value

Reviewed by Simply Wall St

In a week marked by busy earnings reports and mixed economic signals, global markets experienced volatility with major indexes mostly finishing lower. As growth stocks lagged behind value shares, investors are increasingly turning their attention to undervalued stocks that may represent compelling opportunities in the current market environment. Identifying promising value stocks involves assessing those trading below their intrinsic value, especially in times when cautious earnings reports and economic uncertainties dominate headlines.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| First National (NasdaqCM:FXNC) | US$22.50 | US$44.83 | 49.8% |

| Harmony Gold Mining (JSE:HAR) | ZAR180.36 | ZAR359.54 | 49.8% |

| Lindab International (OM:LIAB) | SEK226.80 | SEK450.91 | 49.7% |

| West Bancorporation (NasdaqGS:WTBA) | US$23.49 | US$46.79 | 49.8% |

| Ligand Pharmaceuticals (NasdaqGM:LGND) | US$129.90 | US$258.67 | 49.8% |

| Redcentric (AIM:RCN) | £1.1775 | £2.35 | 50% |

| DoubleVerify Holdings (NYSE:DV) | US$19.72 | US$39.40 | 49.9% |

| Laboratorio Reig Jofre (BME:RJF) | €2.89 | €5.74 | 49.6% |

| Alnylam Pharmaceuticals (NasdaqGS:ALNY) | US$272.22 | US$544.40 | 50% |

| Fine Foods & Pharmaceuticals N.T.M (BIT:FF) | €8.24 | €16.38 | 49.7% |

Let's take a closer look at a couple of our picks from the screened companies.

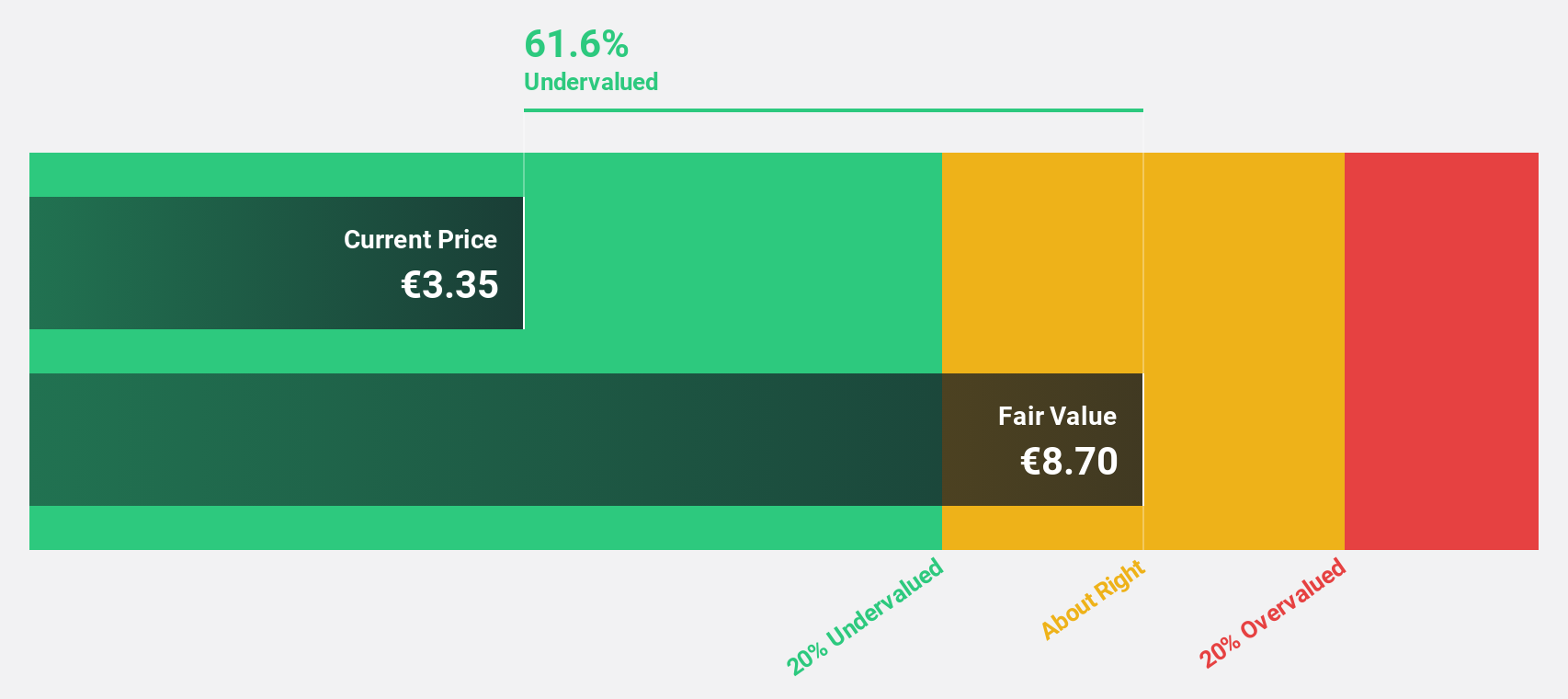

Outokumpu Oyj (HLSE:OUT1V)

Overview: Outokumpu Oyj is a company that produces and sells various stainless steel products across Finland, other European countries, North America, the Asia-Pacific, and internationally, with a market cap of €1.46 billion.

Operations: The company's revenue segments include €1.72 billion from the Americas, €491 million from Ferrochrome, and €4.21 billion from Europe (excluding Ferrochrome).

Estimated Discount To Fair Value: 42%

Outokumpu Oyj is trading at €3.46, significantly below its estimated fair value of €5.96, indicating potential undervaluation based on cash flows. Despite recent executive changes and a challenging earnings history with a net loss for the nine months ending September 2024, the company is expected to become profitable in the next three years with forecasted earnings growth of 95.83% annually. However, its dividend yield of 7.53% isn't well covered by earnings or free cash flow.

- Our growth report here indicates Outokumpu Oyj may be poised for an improving outlook.

- Get an in-depth perspective on Outokumpu Oyj's balance sheet by reading our health report here.

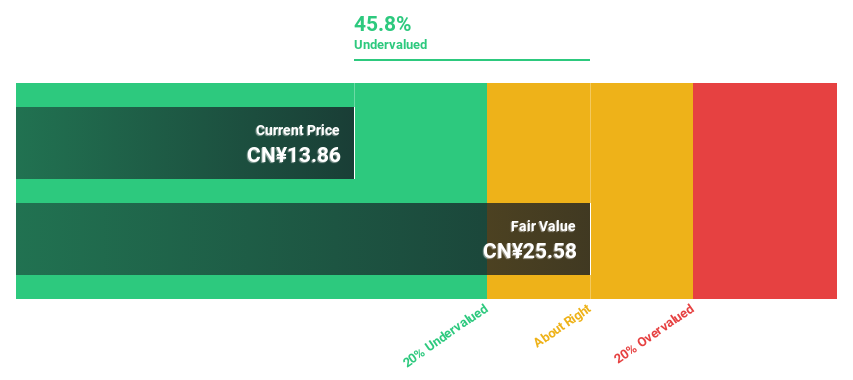

GemPharmatech (SHSE:688046)

Overview: GemPharmatech Co., Ltd. is a contract research organization offering genetically engineered mouse models and preclinical research services globally, with a market cap of approximately CN¥5.83 billion.

Operations: GemPharmatech generates revenue through its provision of genetically engineered mouse models and preclinical research services to the global scientific community.

Estimated Discount To Fair Value: 44.3%

GemPharmatech is trading at CN¥14.28, significantly below its estimated fair value of CN¥25.64, suggesting undervaluation based on cash flows. Despite a volatile share price and a decline in net income for the nine months ending September 2024, the company is implementing a buyback program worth up to CNY 40 million to enhance employee incentives. Forecasts indicate robust annual earnings growth of over 20%, with revenue expected to outpace market growth at 21.7% annually.

- Our earnings growth report unveils the potential for significant increases in GemPharmatech's future results.

- Delve into the full analysis health report here for a deeper understanding of GemPharmatech.

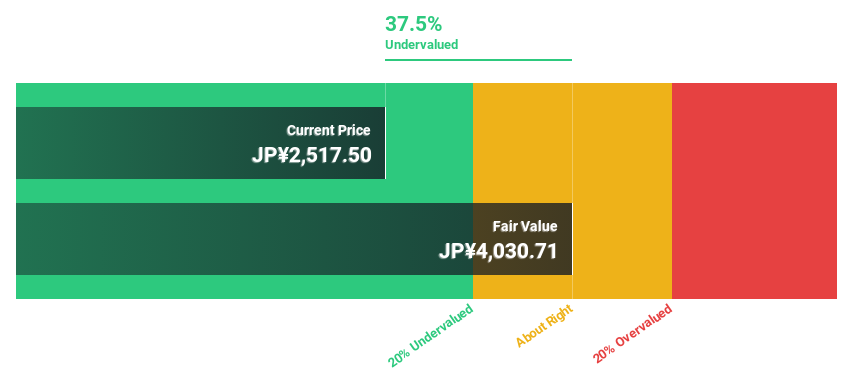

THK (TSE:6481)

Overview: THK Co., Ltd. manufactures and sells mechanical components globally, with a market cap of ¥324.43 billion.

Operations: The company's revenue segments are as follows: Japan contributes ¥162.26 billion, the Americas ¥94.66 billion, Europe ¥71.28 billion, China ¥60.45 billion, and other regions ¥20.52 billion.

Estimated Discount To Fair Value: 34%

THK Co., Ltd. is trading at ¥2,646, well below its estimated fair value of ¥4,006.89, highlighting potential undervaluation based on cash flows. Despite a forecasted low return on equity of 7.1% in three years and slower revenue growth at 5.9% per year compared to industry benchmarks, earnings are expected to grow significantly by 20.89% annually, surpassing the Japanese market's growth rate of 8.9%. Recent executive changes may influence strategic execution positively or negatively.

- In light of our recent growth report, it seems possible that THK's financial performance will exceed current levels.

- Click here and access our complete balance sheet health report to understand the dynamics of THK.

Where To Now?

- Unlock our comprehensive list of 922 Undervalued Stocks Based On Cash Flows by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688046

GemPharmatech

A contract research organization, provides genetically engineered mouse models and preclinical research services to the scientific community worldwide.

Flawless balance sheet with high growth potential.