European Penny Stocks Spotlight: RCS MediaGroup And 2 More To Consider

Reviewed by Simply Wall St

Amidst a mixed performance in European markets, with the pan-European STOXX Europe 600 Index snapping two weeks of losses, investors are keeping a close eye on economic uncertainties and central bank policies. In this context, penny stocks—often representing smaller or newer companies—are gaining attention for their potential to offer growth at lower price points. Despite being considered an outdated term, penny stocks can still present appealing opportunities when backed by strong financials and solid fundamentals.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Bredband2 i Skandinavien (OM:BRE2) | SEK2.06 | SEK1.97B | ✅ 4 ⚠️ 0 View Analysis > |

| Transferator (NGM:TRAN A) | SEK2.36 | SEK224.19M | ✅ 2 ⚠️ 3 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.72 | SEK278.94M | ✅ 4 ⚠️ 3 View Analysis > |

| Hifab Group (OM:HIFA B) | SEK3.92 | SEK238.49M | ✅ 2 ⚠️ 2 View Analysis > |

| Cellularline (BIT:CELL) | €2.55 | €53.7M | ✅ 4 ⚠️ 2 View Analysis > |

| I.M.D. International Medical Devices (BIT:IMD) | €1.46 | €25.29M | ✅ 4 ⚠️ 2 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.992 | €33.22M | ✅ 4 ⚠️ 3 View Analysis > |

| High (ENXTPA:HCO) | €3.12 | €61.28M | ✅ 2 ⚠️ 3 View Analysis > |

| Fondia Oyj (HLSE:FONDIA) | €4.98 | €18.61M | ✅ 2 ⚠️ 3 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.17 | €299.6M | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 434 stocks from our European Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

RCS MediaGroup (BIT:RCS)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: RCS MediaGroup S.p.A. offers multimedia publishing services across Italy and internationally, with a market capitalization of approximately €466.77 million.

Operations: RCS MediaGroup's revenue is primarily derived from Italy Newspapers (€371 million), Advertising and Sport (€286.1 million), Unidad Editorial (€220.6 million), Magazines Italy (€65.2 million), and Corporate and Other Activities (€80.8 million).

Market Cap: €466.77M

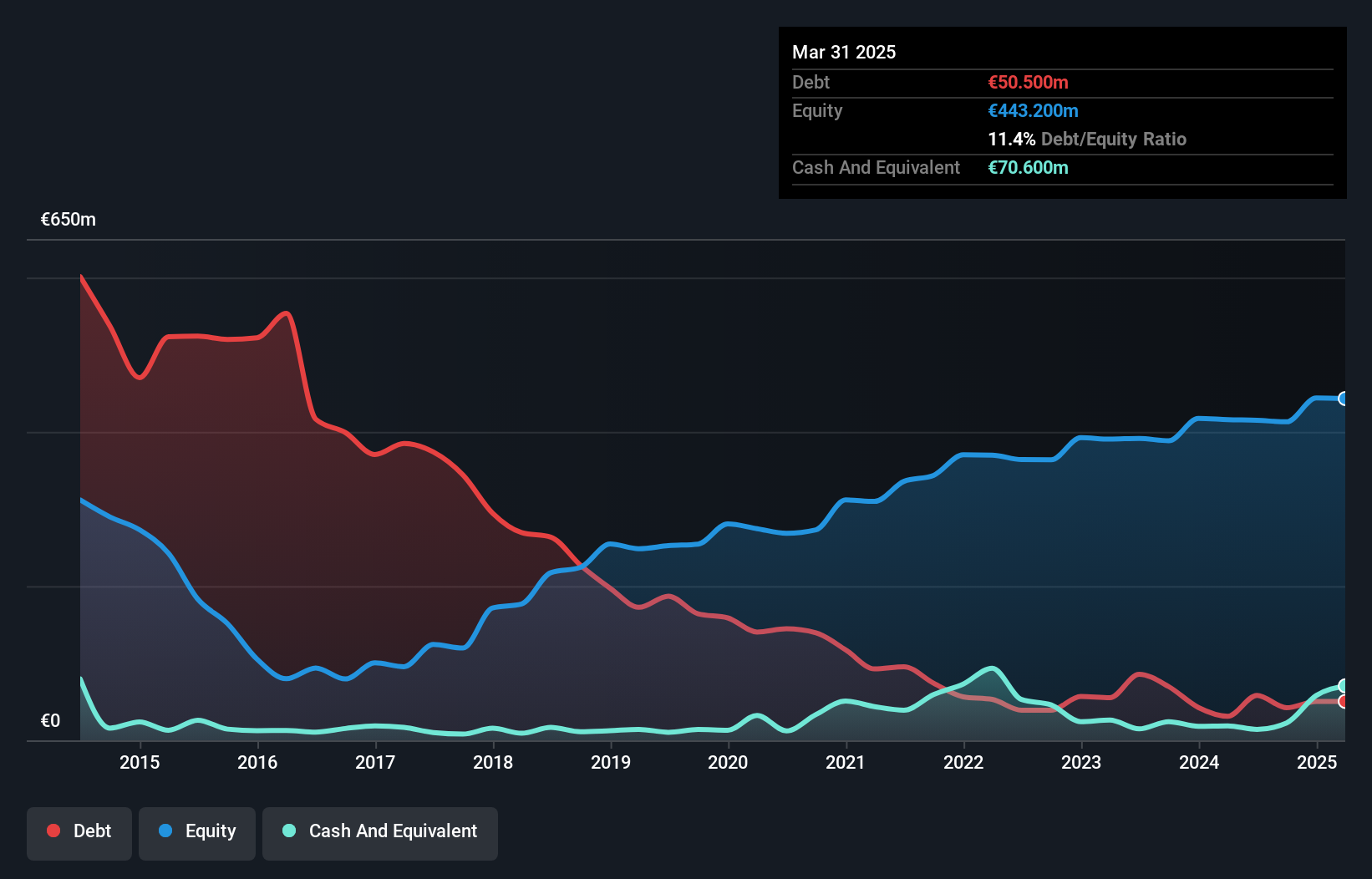

RCS MediaGroup, with a market cap of €466.77 million, presents a mixed picture for penny stock investors. The company has experienced stable earnings growth, with profits increasing by 2.5% annually over the past five years and recent annual earnings growth of 13.1%. Despite trading at a significant discount to its estimated fair value, RCS faces challenges such as slightly declining revenue and net income in the latest fiscal year. Its financial health is supported by satisfactory debt levels and well-covered interest payments, though short-term liabilities exceed short-term assets. The management team is seasoned, enhancing operational stability amidst market volatility.

- Dive into the specifics of RCS MediaGroup here with our thorough balance sheet health report.

- Understand RCS MediaGroup's track record by examining our performance history report.

Betolar Oyj (HLSE:BETOLAR)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Betolar Oyj is a materials technology company focused on providing solutions to reduce CO2 emissions in the construction industry, with a market cap of €23.72 million.

Operations: The company's revenue is primarily derived from its Construction Materials segment, amounting to €0.76 million.

Market Cap: €23.72M

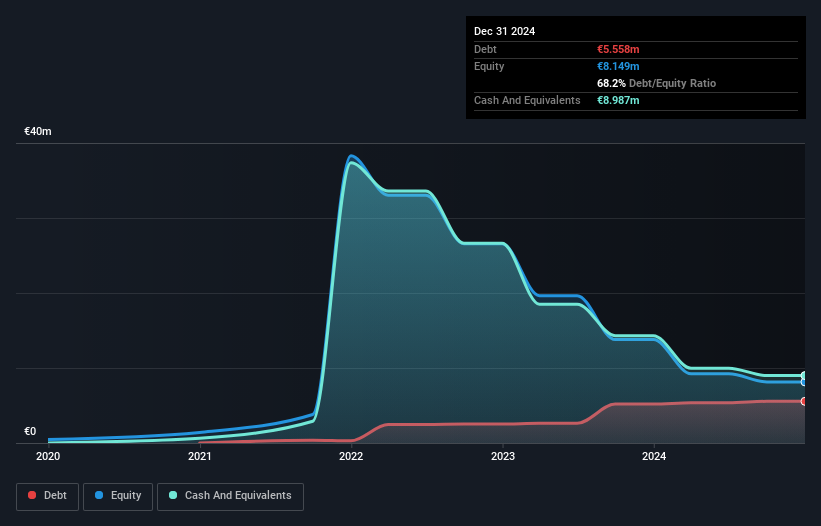

Betolar Oyj, with a market cap of €23.72 million, is a pre-revenue materials technology company focused on sustainable construction solutions. Despite its innovative Geoprime® solution for low-emission concrete, the company remains unprofitable and has seen losses increase by 25% annually over the past five years. Recent strategic alliances, such as with Consolis Parma for hollow-core slabs production, highlight potential growth avenues but are not expected to significantly impact revenue soon. Betolar's financial position shows more cash than debt and sufficient short-term assets to cover liabilities, though its share price remains highly volatile.

- Take a closer look at Betolar Oyj's potential here in our financial health report.

- Understand Betolar Oyj's earnings outlook by examining our growth report.

Impact Coatings (OM:IMPC)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Impact Coatings AB (publ) offers physical vapor deposition (PVD) surface treatment solutions for hydrogen and metallization applications across Sweden, Europe, North America, Asia, and globally, with a market cap of SEK341.20 million.

Operations: The company generates revenue from its Specialty Chemicals segment, amounting to SEK120.5 million.

Market Cap: SEK341.2M

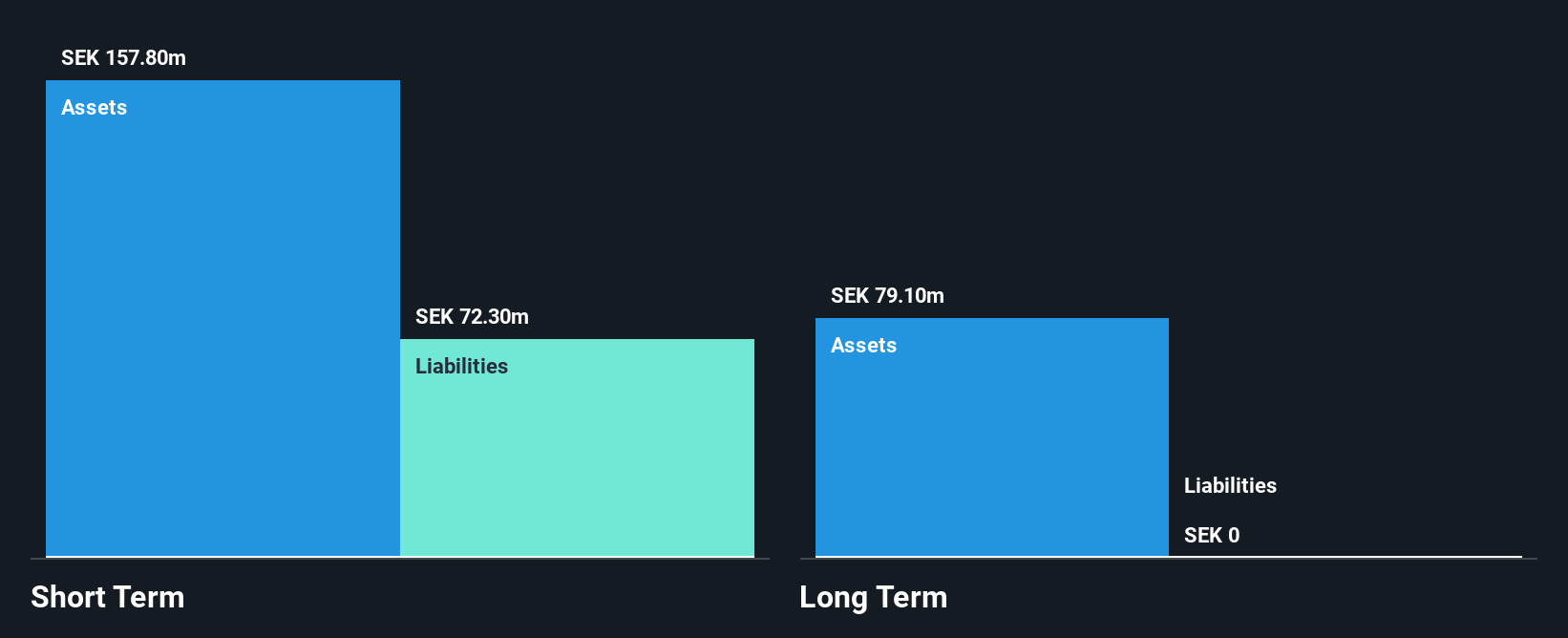

Impact Coatings AB, with a market cap of SEK341.20 million, is not pre-revenue but remains unprofitable, reporting a net loss of SEK29.6 million for 2024 despite revenue growth to SEK102.4 million. The company benefits from being debt-free and having short-term assets exceeding liabilities by a significant margin (SEK186.7M vs SEK86.5M). Recent collaborations with Feintool and SITEC position it as a preferred supplier in the hydrogen industry, potentially enhancing its market presence. However, challenges include an inexperienced management team and limited cash runway under one year if current cash flow trends persist.

- Get an in-depth perspective on Impact Coatings' performance by reading our balance sheet health report here.

- Evaluate Impact Coatings' prospects by accessing our earnings growth report.

Seize The Opportunity

- Dive into all 434 of the European Penny Stocks we have identified here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:RCS

RCS MediaGroup

Provides multimedia publishing services in Italy, Spain, and internationally.

Excellent balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives