- Finland

- /

- Household Products

- /

- HLSE:SUY1V

Suominen Oyj (HLSE:SUY1V) Losses Worsen 60% Annually, Profitability Hopes Challenge Cautious Narrative

Reviewed by Simply Wall St

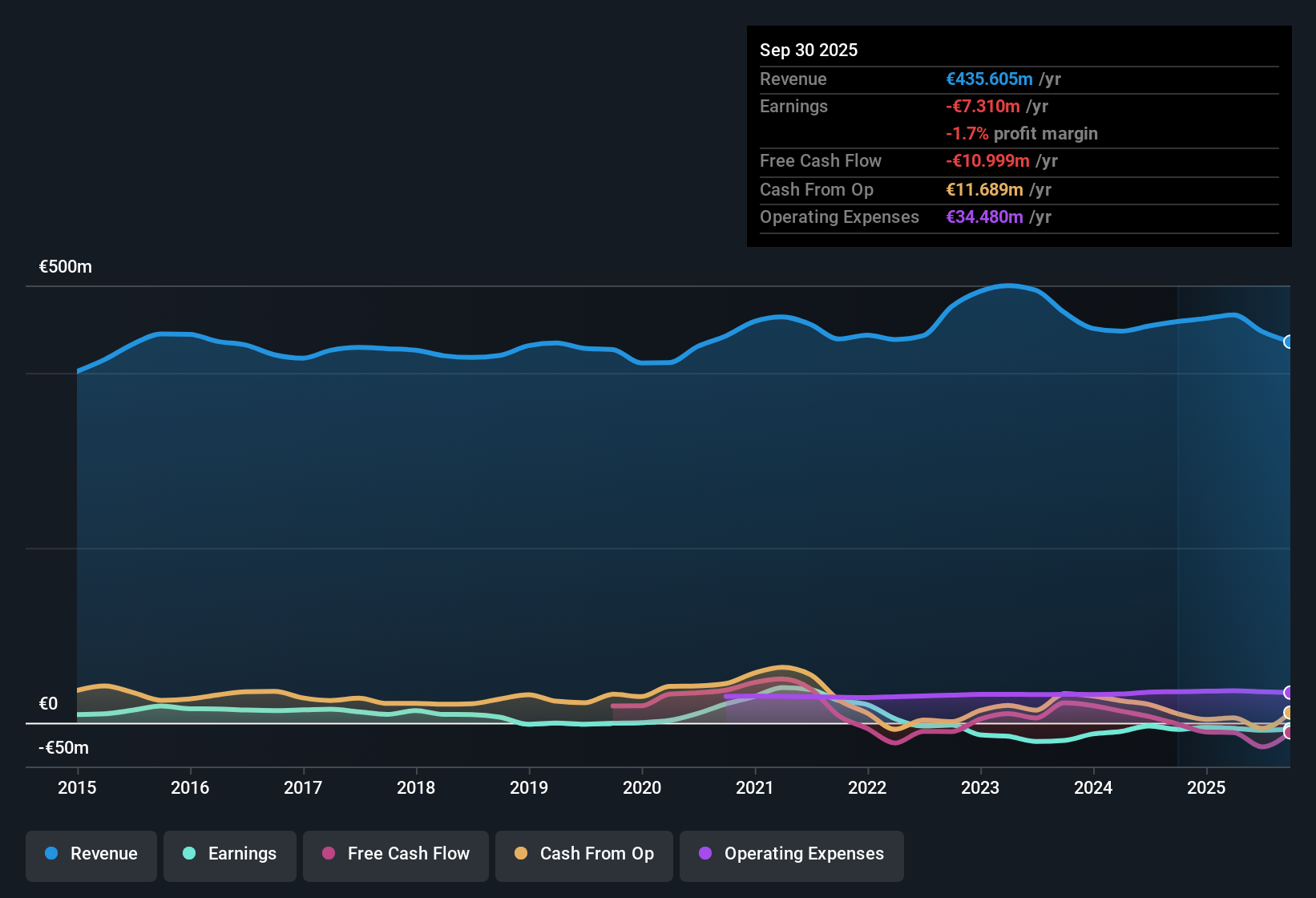

Suominen Oyj (HLSE:SUY1V) remains unprofitable, with losses having grown at a rapid 60.2% per year over the past five years. While revenue is currently forecast to increase 3.1% annually, trailing the Finnish market’s 4% annual pace, the company is expected to turn profitable within the next three years. Earnings are projected to accelerate at a hefty 105.73% each year going forward. The unique mix of historical losses, modest revenue growth, and a major shift toward profitability is front and center for investors watching the latest results.

See our full analysis for Suominen Oyj.Next, we will put these headline figures side by side with the latest Simply Wall St narratives to see where expectations match reality and where the numbers tell a different story.

Curious how numbers become stories that shape markets? Explore Community Narratives

Trading at a Deep Discount to Peers

- Suominen's shares are priced at just 0.2 times Price-To-Sales, sharply undercutting both the global household products industry average of 1.3 times and immediate peer group at 1.4 times.

- Although the stock appears cheap against the sector, the analysis highlights that the market is discounting near-term risks including a weaker financial position and recent instability in the share price.

- This discount could attract value-oriented investors, but only if the company starts to deliver on its profit and growth forecasts.

- Other firms in the sector typically enjoy higher multiples. This suggests that sustained operational issues are weighing on Suominen's valuation relative to industry norms.

DCF Fair Value Points to Major Upside

- The most recent DCF fair value for Suominen is €9.66, well above the current market price of €1.74, indicating a potential valuation gap.

- The narrative underscores the tension between statistical upside and ongoing losses, questioning whether profitability can materialize quickly enough to justify the wide spread versus fair value.

- Despite historical losses, the expectation of turning profitable in the next three years aligns with the optimism implied by the DCF estimate.

- However, elevated loss rates and below-market revenue growth remain major headwinds. This tempers how aggressively investors might treat the DCF as actionable.

Rapid Loss Acceleration Raises Red Flags

- Losses at Suominen have expanded at a compound annual rate of 60.2% over the past five years, showing that the path to profitability could remain challenging even as revenue forecasts turn positive.

- According to the prevailing market view, these deep losses and a shaky financial foundation reinforce caution about short-term upside. This highlights the importance of watching for delivery on turnaround plans before treating SUY1V as a growth story.

- The company’s projected earnings growth of over 100% a year depends on reversing recent negative trends. Ongoing loss expansion adds risk to the forecasted turnaround.

- If profitability improvements do not emerge within the forecast window, further valuation downside is possible despite the apparent discounts.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Suominen Oyj's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite deep share price discounts, Suominen’s rapid loss acceleration and weaker financial footing raise serious questions about stability and near-term recovery.

If you want confidence in a company’s ability to weather tough times, check out solid balance sheet and fundamentals stocks screener (1988 results) which highlights resilient businesses with healthier balance sheets and less risk of unpleasant surprises.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:SUY1V

Suominen Oyj

Manufactures and sells nonwovens as roll goods for wipes and other applications in Finland, the Americas, the rest of Europe, and internationally.

Good value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives