- Finland

- /

- Healthcare Services

- /

- HLSE:ORIOLA

Oriola (HLSE:ORIOLA) Losses Deepen, Dividend Sustainability in Doubt Despite Turnaround Hopes

Reviewed by Simply Wall St

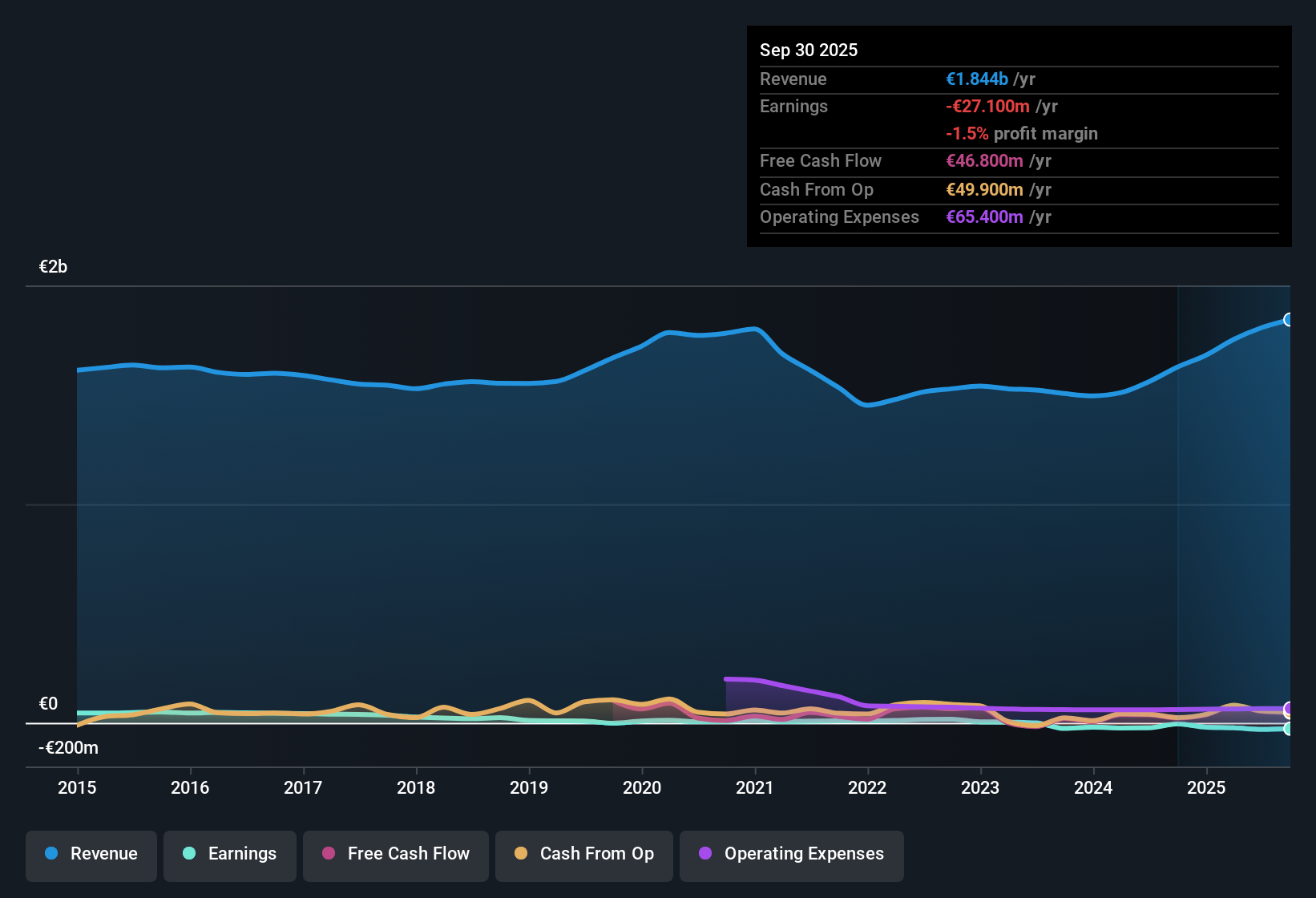

Oriola Oyj (HLSE:ORIOLA) remains unprofitable, with losses having accelerated at a 65.5% annual rate over the past five years. However, earnings are now forecast to surge by 76.67% per year and the company is projected to return to profitability within three years. Revenue is expected to grow at 4.7% per year, outpacing the wider Finnish market average of 4%. Shares trade at €1.19, which represents a steep discount to the estimated fair value of €4.84 and is well below sector multiples. Investors are weighing strong turnaround prospects and a compelling valuation against the company’s loss history and questions around dividend sustainability.

See our full analysis for Oriola Oyj.The next section matches these headline numbers with the current market narratives, highlighting where they converge and where investor expectations may need a reset.

Curious how numbers become stories that shape markets? Explore Community Narratives

Price-to-Sales Ratio Sits at 0.1x, Well Below Sector Averages

- With a price-to-sales (P/S) ratio of just 0.1x, Oriola trades far beneath the European healthcare sector average of 0.6x and its peer group’s 9.6x. This highlights a pronounced market discount despite the company’s ongoing losses.

- Prevailing market view highlights a striking valuation gap that supports the case for long-term upside if operations improve.

- At €1.19 per share, the stock stands at a steep discount to both its DCF fair value of €4.84 and the sector’s typical multiples.

- Yet the narrative cautions that this “value trap” profile can linger without clear progress toward sustained profitability.

Losses Have Accelerated, but Profitability Is Forecast Within Three Years

- Oriola’s losses have widened by 65.5% per year over the last five years. However, earnings are now forecast to grow at a notable 76.67% per year, with a return to profitability anticipated within three years.

- The prevailing market view focuses on a “wait-and-see” posture, emphasizing that while management expects a turnaround,

- The rapid historical loss rate counters optimism about near-term profit.

- Investors are watching whether execution on digital efficiency and sector modernization can reverse this trend.

Dividend Sustainability Remains an Open Question

- Despite the attention on value and growth, Oriola’s EDGAR summary notes concerns that its dividend may not be sustainable if recent losses persist and earnings do not recover as planned.

- The prevailing market view flags dividend risk as a central tension.

- The company’s deepening losses directly challenge its ability to maintain cash returns to shareholders.

- As a result, potential dividend cuts could undermine the “defensive play” thesis often cited by value-focused investors.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Oriola Oyj's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

Explore Alternatives

Oriola’s widening losses and questions about its ability to sustain dividends make it a riskier choice for income-focused investors.

Seeking reliable cash returns? Discover these 2003 dividend stocks with yields > 3% to find companies offering stronger yields and more sustainable dividend profiles right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:ORIOLA

Oriola Oyj

Engages in the wholesale of pharmaceuticals and health products in Sweden, Finland, and internationally.

Undervalued with excellent balance sheet.

Market Insights

Community Narratives