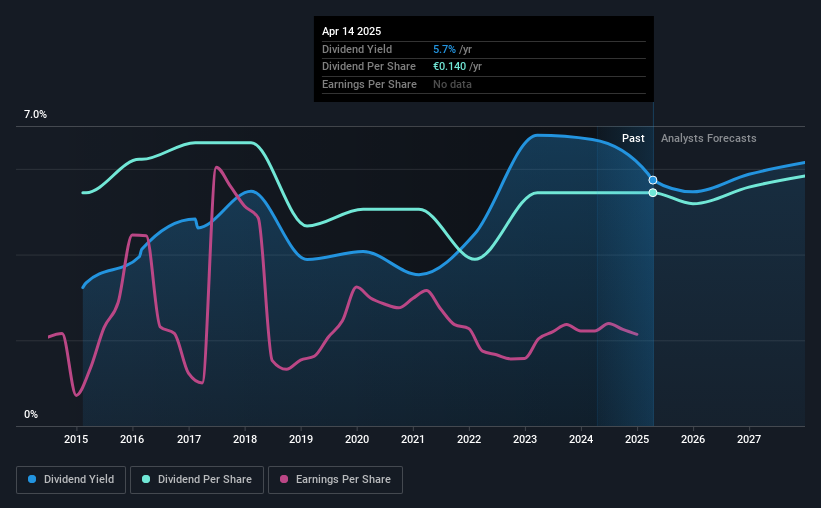

The board of Raisio plc (HEL:RAIVV) has announced that it will pay a dividend of €0.14 per share on the 29th of April. The dividend yield will be 5.7% based on this payment which is still above the industry average.

Raisio's Payment Could Potentially Have Solid Earnings Coverage

While it is great to have a strong dividend yield, we should also consider whether the payment is sustainable. Based on the last payment, Raisio's profits didn't cover the dividend, but the company was generating enough cash instead. Generally, we think cash is more important than accounting measures of profit, so with the cash flows easily covering the dividend, we don't think there is much reason to worry.

Over the next year, EPS is forecast to expand by 54.2%. Assuming the dividend continues along recent trends, our estimates say the payout ratio could reach 81% - on the higher side, but we wouldn't necessarily say this is unsustainable.

View our latest analysis for Raisio

Dividend Volatility

While the company has been paying a dividend for a long time, it has cut the dividend at least once in the last 10 years. The most recent annual payment of €0.14 is about the same as the annual payment 10 years ago. We're glad to see the dividend has risen, but with a limited rate of growth and fluctuations in the payments the total shareholder return may be limited.

Dividend Growth Is Doubtful

Given that the dividend has been cut in the past, we need to check if earnings are growing and if that might lead to stronger dividends in the future. Raisio has seen earnings per share falling at 8.0% per year over the last five years. If earnings continue declining, the company may have to make the difficult choice of reducing the dividend or even stopping it completely - the opposite of dividend growth. Earnings are predicted to grow over the next year, but we would remain cautious until a track record of earnings growth is established.

Raisio's Dividend Doesn't Look Sustainable

Overall, it's nice to see a consistent dividend payment, but we think that longer term, the current level of payment might be unsustainable. The payments haven't been particularly stable and we don't see huge growth potential, but with the dividend well covered by cash flows it could prove to be reliable over the short term. We don't think Raisio is a great stock to add to your portfolio if income is your focus.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. For instance, we've picked out 1 warning sign for Raisio that investors should take into consideration. Is Raisio not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About HLSE:RAIVV

Raisio

Produces and sells food and food ingredients in Finland, the United Kingdom, Ireland, Belgium, and the Netherlands.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives