- Finland

- /

- Capital Markets

- /

- HLSE:EQV1V

3 Undiscovered Gems With Strong Growth Potential

Reviewed by Simply Wall St

As global markets navigate a period of mixed economic signals, with U.S. consumer confidence dipping and major indices experiencing moderate gains, investors are increasingly attentive to the undercurrents affecting small-cap stocks. In such an environment, identifying stocks with robust fundamentals and potential for growth can be particularly rewarding, as these undiscovered gems may offer resilience and opportunity amidst broader market fluctuations.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Canal Shipping Agencies | NA | 8.92% | 22.01% | ★★★★★★ |

| Suez Canal Company for Technology Settling (S.A.E) | NA | 22.31% | 13.60% | ★★★★★★ |

| Philippine Savings Bank | NA | 5.49% | 20.73% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Formula Systems (1985) | 37.70% | 9.99% | 13.08% | ★★★★★★ |

| Aesler Grup Internasional | NA | -17.61% | -40.21% | ★★★★★★ |

| Likhami Consulting | NA | 1.68% | -12.74% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Y.D. More Investments | 69.32% | 30.27% | 27.89% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

eQ Oyj (HLSE:EQV1V)

Simply Wall St Value Rating: ★★★★★☆

Overview: eQ Oyj is a publicly owned investment manager with a market capitalization of €536.22 million.

Operations: The primary revenue streams for eQ Oyj come from Asset Management, generating €62.85 million, and Corporate Finance, contributing €7.02 million. The company experienced a negative impact on its investments segment with a figure of -€0.37 million.

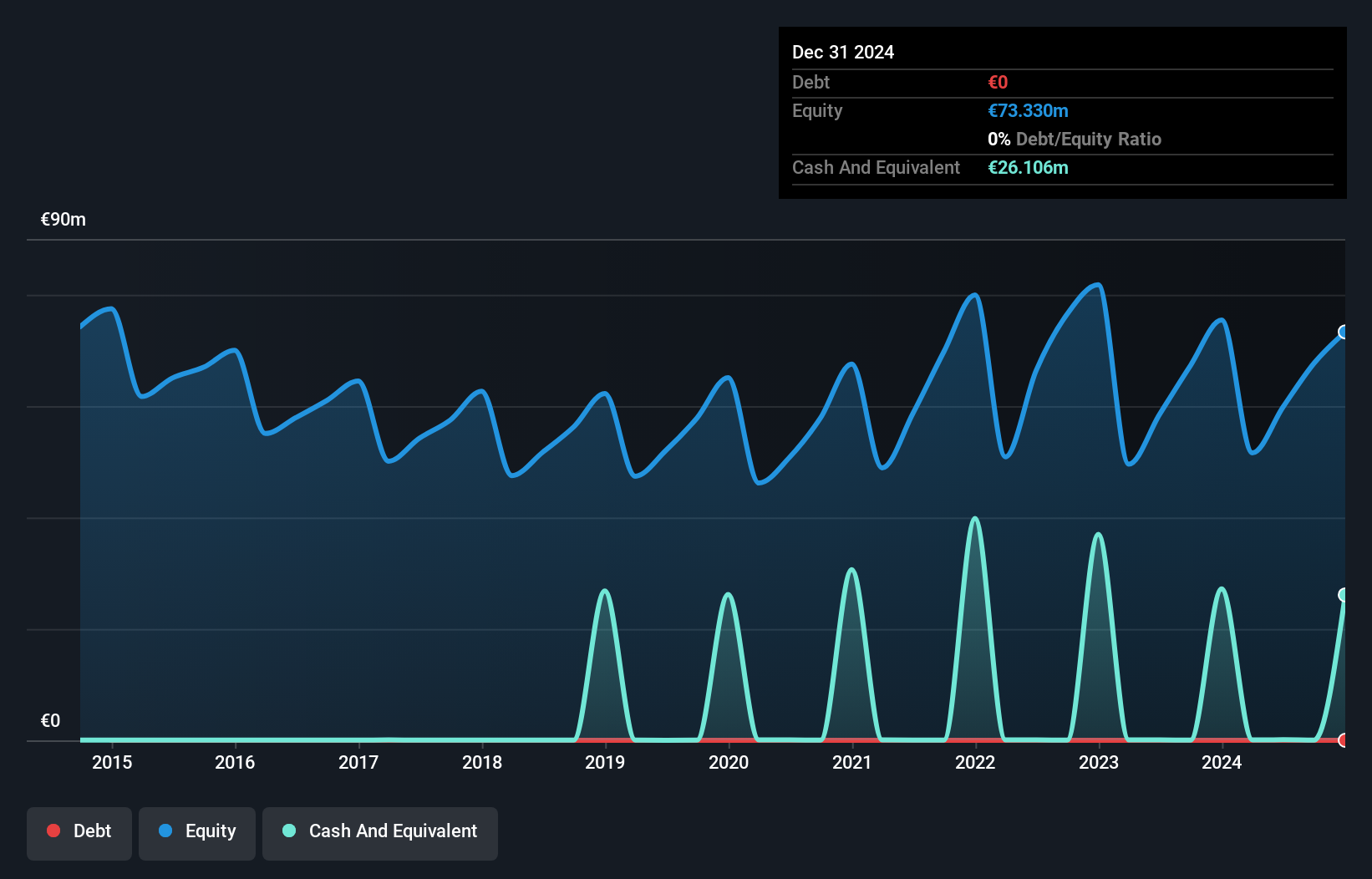

eQ Oyj, a financial entity with no debt for the past five years, showcases high-quality earnings and a robust cash runway. Despite recent executive changes due to CEO Mikko Koskimies stepping down, the company remains stable under Janne Larma as Acting CEO. Over the past five years, earnings have grown at 7.4% annually but lagged behind the industry average of 47.8%. Trading at 25.4% below its estimated fair value suggests potential upside for investors. Recent results show Q3 revenue of €16.9 million and net income of €7.57 million, indicating slight fluctuations compared to last year’s figures.

- Dive into the specifics of eQ Oyj here with our thorough health report.

Assess eQ Oyj's past performance with our detailed historical performance reports.

Wataniya Insurance (SASE:8300)

Simply Wall St Value Rating: ★★★★★★

Overview: Wataniya Insurance Company offers a variety of insurance products and services in the Kingdom of Saudi Arabia, with a market capitalization of SAR 952 million.

Operations: The company generates revenue primarily from Motor-Comp insurance, which contributes SAR 865.53 million, followed by Properties and Accidents & Liability segments at SAR 221.76 million and SAR 161.60 million, respectively. Net gains on investments measured at FVTPL add SAR 16.61 million to its financial performance, while commission income from financial assets not measured at FVTPL contributes another SAR 51.59 million.

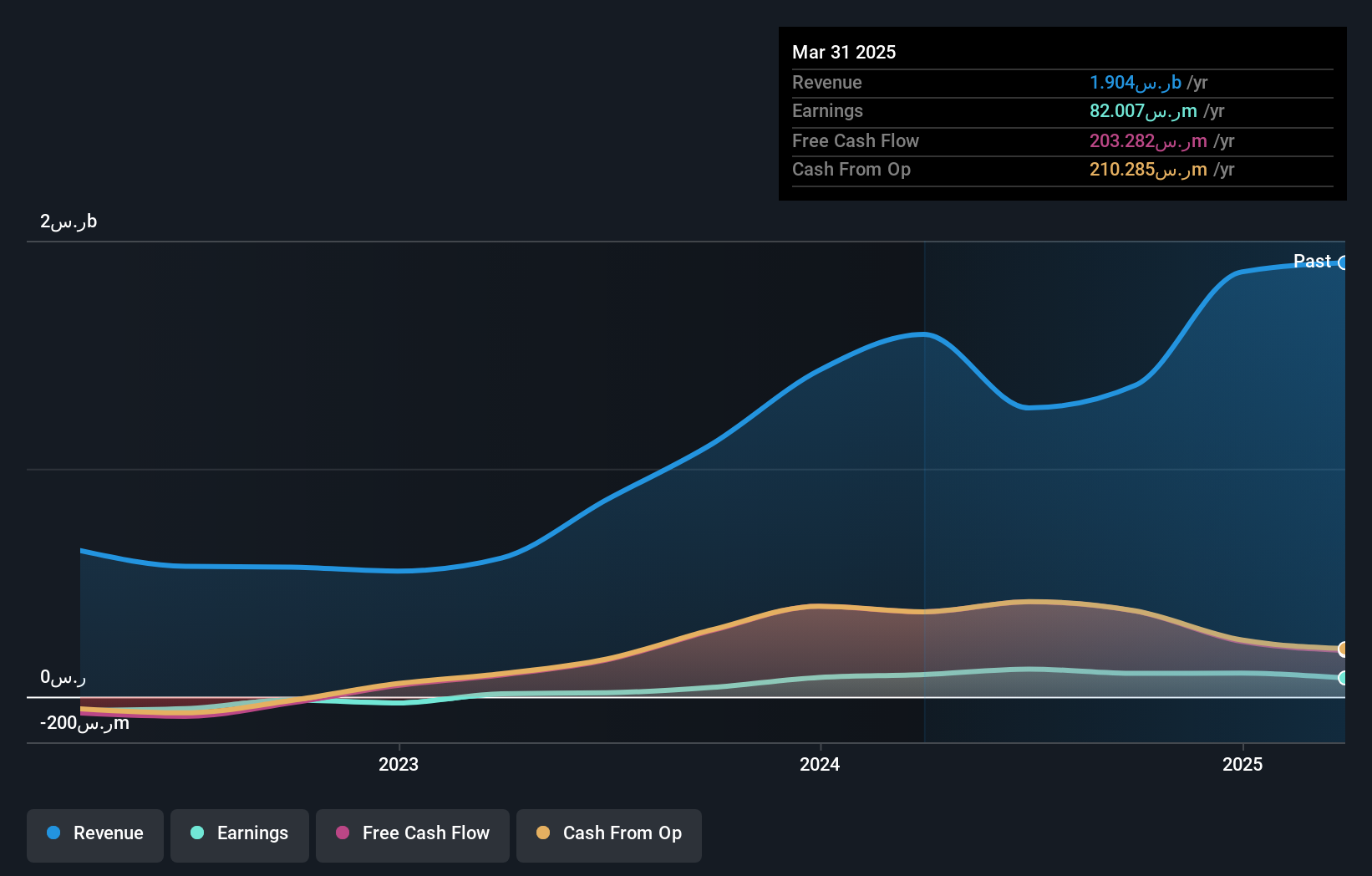

Wataniya Insurance, a smaller player in the insurance sector, seems to be making waves with its impressive earnings growth of 150% over the past year, outpacing the industry average. Its net income for nine months reached SAR 70.56 million, up from SAR 53.08 million previously. Despite a dip in third-quarter net income to SAR 14.88 million from SAR 33.99 million last year, Wataniya's basic earnings per share rose to SAR 1.76 for nine months compared to SAR 1.33 before. With no debt and a favorable price-to-earnings ratio of 9x against the market's average of 23x, it appears undervalued relative to peers.

INKON Life Technology (SZSE:300143)

Simply Wall St Value Rating: ★★★★★☆

Overview: INKON Life Technology Co., Ltd. is engaged in developing an ecological platform for pre-diagnosis, treatment, and health services specifically targeting tumors both in China and internationally, with a market cap of CN¥6.98 billion.

Operations: INKON Life Technology's revenue streams are primarily derived from its ecological platform focused on pre-diagnosis, treatment, and health services for tumors. The company's financial performance is influenced by its operational costs and the effectiveness of its service offerings.

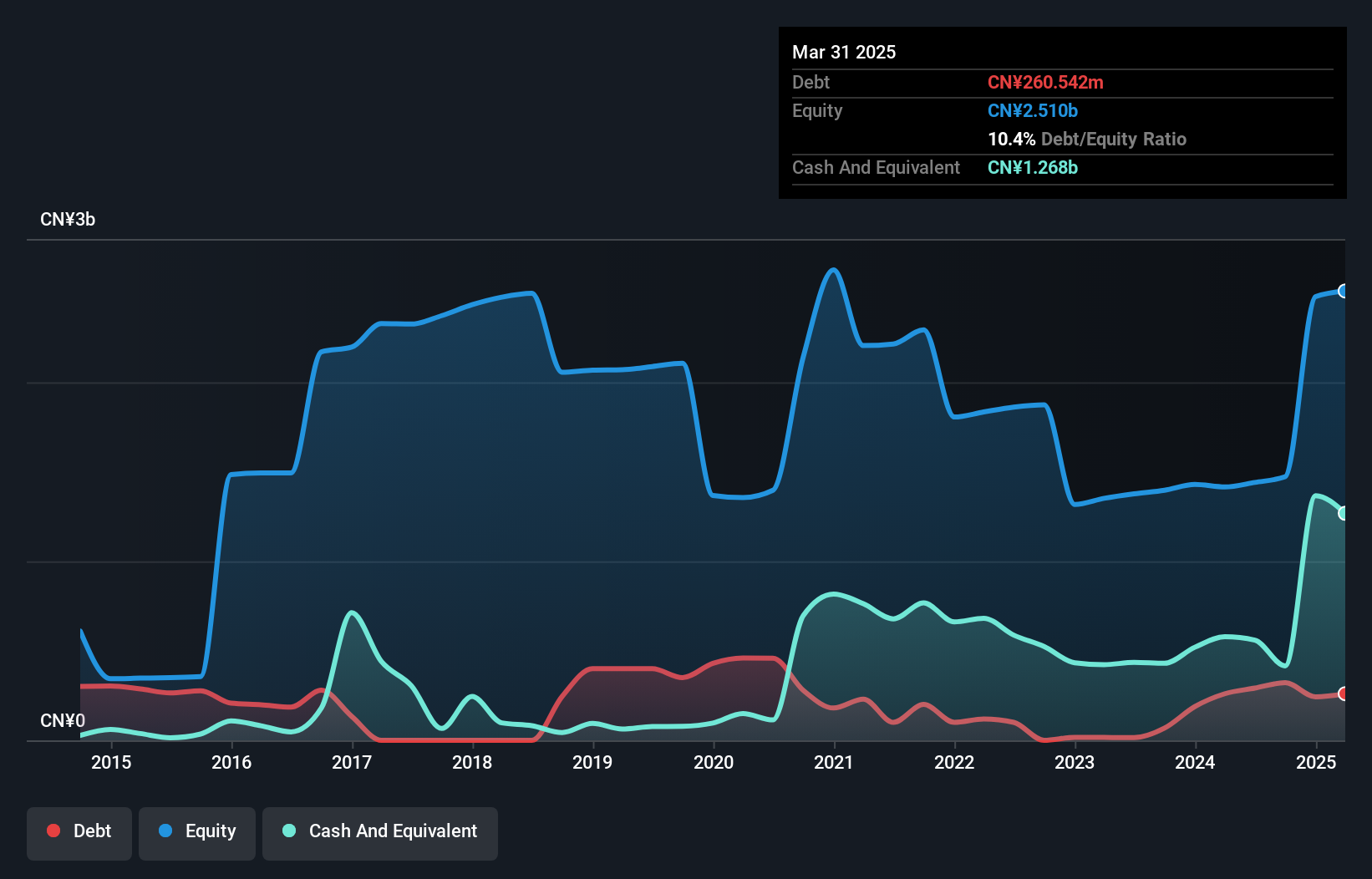

INKON Life Technology, a nimble player in the healthcare sector, has shown resilience despite recent challenges. Over the past five years, its debt to equity ratio rose from 16.6% to 21.9%, indicating a cautious approach towards leveraging growth opportunities. With high-quality earnings and positive free cash flow, INKON seems well-positioned financially. However, shareholders experienced dilution recently due to private placements totaling over 107 million A shares issued for funding purposes. Despite this, the company remains profitable with interest payments comfortably covered by profits and net income at CNY 82.54 million for the first nine months of 2024 compared to CNY 94.05 million last year.

Key Takeaways

- Delve into our full catalog of 4628 Undiscovered Gems With Strong Fundamentals here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:EQV1V

Excellent balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)