- Sweden

- /

- Real Estate

- /

- OM:SAGA A

3 European Growth Companies With Significant Insider Ownership

Reviewed by Simply Wall St

As European markets continue to show resilience with notable gains across major indices, investors are increasingly focusing on growth opportunities within the region. In this context, companies with significant insider ownership often attract attention as they can indicate strong confidence in the business's future prospects and alignment of interests between management and shareholders.

Top 10 Growth Companies With High Insider Ownership In Europe

| Name | Insider Ownership | Earnings Growth |

| Pharma Mar (BME:PHM) | 11.9% | 43.9% |

| MilDef Group (OM:MILDEF) | 13.7% | 83% |

| MedinCell (ENXTPA:MEDCL) | 12.5% | 90.4% |

| Magnora (OB:MGN) | 10.4% | 58.9% |

| KebNi (OM:KEBNI B) | 36.3% | 69.2% |

| Egetis Therapeutics (OM:EGTX) | 10.3% | 85% |

| CTT Systems (OM:CTT) | 17.5% | 41.2% |

| Circus (XTRA:CA1) | 24.1% | 67.1% |

| CD Projekt (WSE:CDR) | 29.7% | 49.6% |

| Bonesupport Holding (OM:BONEX) | 10.4% | 51.6% |

Let's explore several standout options from the results in the screener.

CapMan Oyj (HLSE:CAPMAN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: CapMan Oyj is a leading Nordic private assets management and investment firm specializing in various investment strategies, including private equity, venture capital, real estate, and infrastructure, with a market cap of €322.22 million.

Operations: The company's revenue segments include private equity and venture capital, focusing on growth capital investments and middle market buyouts; real estate investments with a value-add and income focus; and infrastructure investments in transportation and telecommunications.

Insider Ownership: 14.4%

Earnings Growth Forecast: 34.2% p.a.

CapMan Oyj, with significant insider ownership, has seen more insider buying than selling recently, indicating confidence in its growth prospects. Despite a recent dip in revenue and net income, CapMan's earnings are expected to grow at 34.2% annually over the next three years—outpacing the Finnish market average of 16.8%. However, its dividend yield of 7.68% is not well covered by earnings or free cash flow, suggesting potential sustainability concerns.

- Dive into the specifics of CapMan Oyj here with our thorough growth forecast report.

- Upon reviewing our latest valuation report, CapMan Oyj's share price might be too optimistic.

Beijer Alma (OM:BEIA B)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Beijer Alma AB (publ) operates in component manufacturing and industrial trading across Sweden, the Nordic Region, Europe, North America, Asia, and internationally with a market cap of SEK16.60 billion.

Operations: Beijer Alma's revenue segments include component manufacturing and industrial trading across Sweden, the Nordic Region, Europe, North America, Asia, and other international markets.

Insider Ownership: 14.2%

Earnings Growth Forecast: 22.6% p.a.

Beijer Alma, with high insider ownership and recent insider buying, is trading below its estimated fair value. Despite a decrease in profit margins and net income for Q3 2025, its earnings are expected to grow significantly at 22.6% annually over the next three years, surpassing the Swedish market average. However, revenue growth is forecasted to be modest at 4.4% annually and the company carries a high level of debt which may impact financial flexibility.

- Click to explore a detailed breakdown of our findings in Beijer Alma's earnings growth report.

- In light of our recent valuation report, it seems possible that Beijer Alma is trading beyond its estimated value.

AB Sagax (OM:SAGA A)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: AB Sagax is a property company that owns and manages a diverse portfolio of properties across several European countries, with a market cap of approximately SEK79.79 billion.

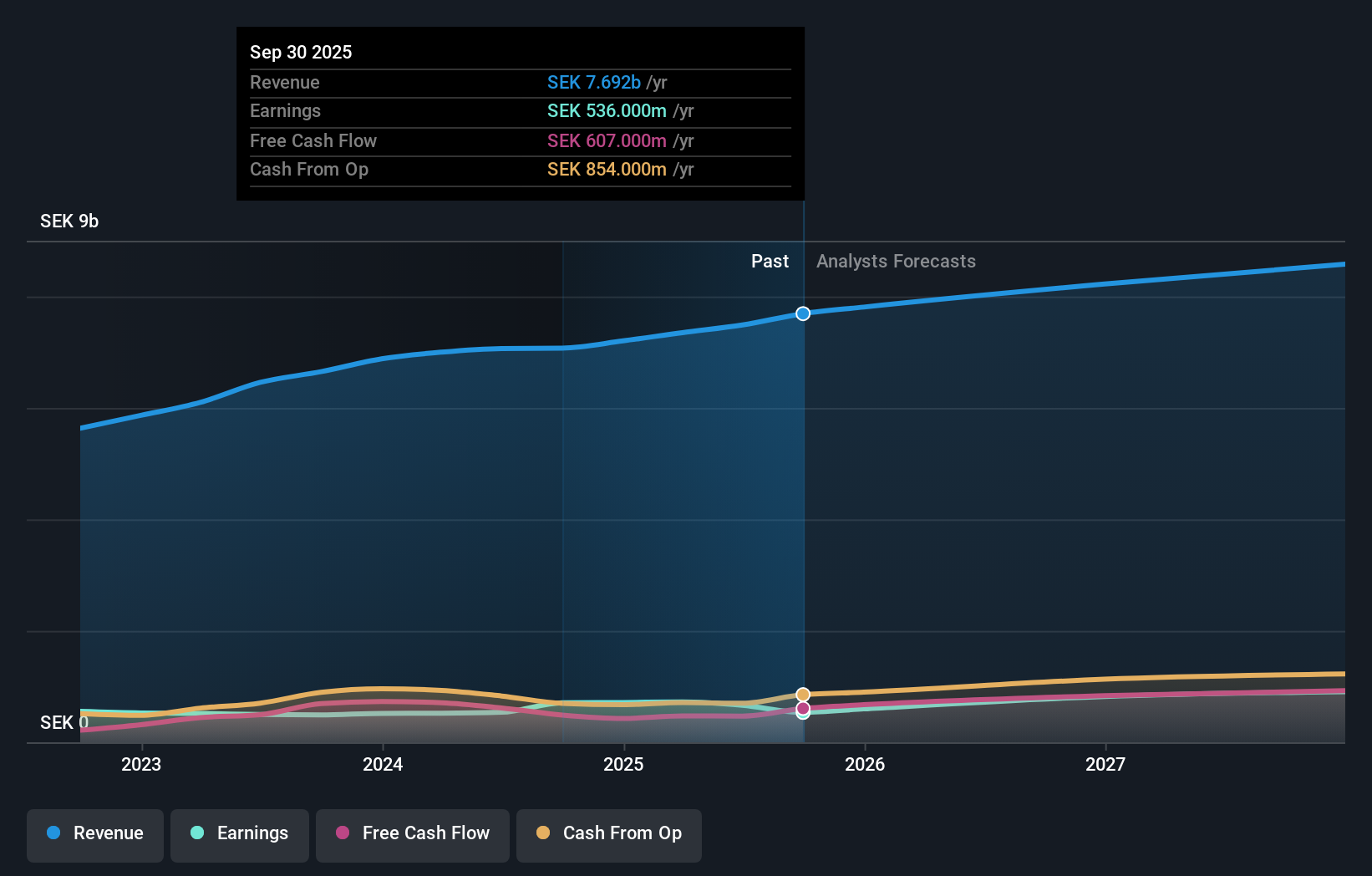

Operations: The company's revenue primarily comes from its real estate rental segment, generating SEK5.30 billion.

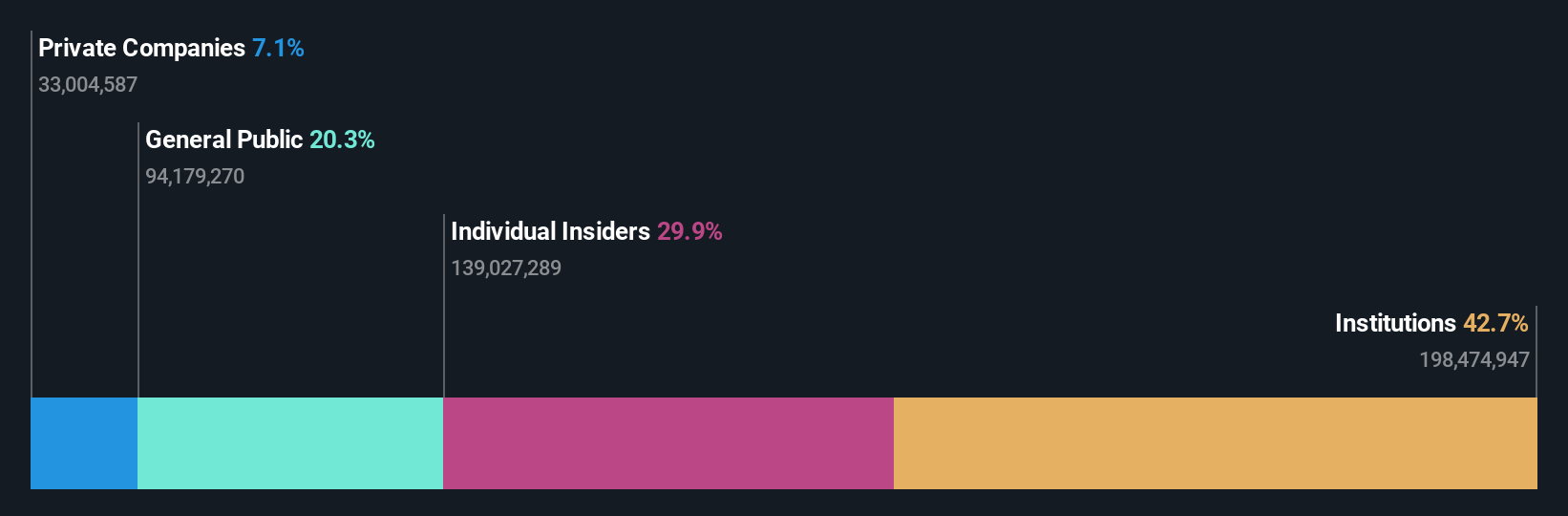

Insider Ownership: 28.7%

Earnings Growth Forecast: 23.6% p.a.

AB Sagax, with significant insider ownership, is poised for substantial earnings growth at 23.6% annually over the next three years, outpacing the Swedish market's average. However, its revenue growth forecast of 8.1% remains below the high-growth threshold but above market expectations. Recent earnings show increased sales to SEK 3.99 billion for nine months in 2025 but a decline in net income due to large one-off items affecting financial results and debt coverage concerns from operating cash flow limitations.

- Take a closer look at AB Sagax's potential here in our earnings growth report.

- The analysis detailed in our AB Sagax valuation report hints at an inflated share price compared to its estimated value.

Seize The Opportunity

- Click here to access our complete index of 190 Fast Growing European Companies With High Insider Ownership.

- Curious About Other Options? Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:SAGA A

AB Sagax

A property company, owns and manages a property portfolio in Sweden, Finland, France, Benelux, Spain, Germany, and other European countries.

Reasonable growth potential average dividend payer.

Similar Companies

Market Insights

Community Narratives