- Finland

- /

- Food and Staples Retail

- /

- HLSE:KESKOB

Kesko (HLSE:KESKOB): Assessing Valuation Following Strong Sales Growth and Market Outperformance

Reviewed by Kshitija Bhandaru

Kesko Oyj (HLSE:KESKOB) just reported higher group sales figures across the month, past quarter, and nine-month periods ending in September 2025. This has caught the eye of investors during an otherwise subdued session for Finland’s stock market.

See our latest analysis for Kesko Oyj.

While most of the Finnish market struggled this week, Kesko Oyj stood out as a rare bright spot after its strong sales update. The share price climbed to €19.19 and delivered a 6% gain over the last week alone. The positive momentum follows other recent sessions as one of the best performers, and with a 9.2% total shareholder return over the past year, the stock’s longer-term performance remains solid even as short-term momentum picks up.

If you’re curious about other stocks showing fresh momentum, now’s an ideal time to broaden your investing radar and discover fast growing stocks with high insider ownership

With robust sales growth and the stock still trading below analyst targets, is Kesko Oyj offering investors a real buying opportunity, or has the market already factored in all the upside from its strong momentum?

Price-to-Earnings of 20.1x: Is it justified?

Kesko Oyj trades at a price-to-earnings (P/E) ratio of 20.1x, which positions its shares notably above the regional peer group. With a last close at €19.19, investors are paying a premium compared to both the sector and its closest rivals.

The price-to-earnings ratio reflects what the market is willing to pay today for a company’s current and future earnings. For consumer retailing groups like Kesko Oyj, it serves as a quick barometer of market optimism about profit growth and underlying stability, relative to similar European businesses.

While enthusiasm for Kesko’s sales surge appears to have lifted its valuation, the P/E of 20.1x is meaningfully higher than the European Consumer Retailing industry average of 18.1x and above the peer group average of 16.5x. This suggests investors are pricing in either a faster earnings rebound or a premium for Kesko’s resilience. However, the current multiple leaves little room for disappointment.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 20.1x (OVERVALUED)

However, if revenue growth slows or net income trends weaker than expected, investor optimism could quickly cool and the current momentum could be challenged.

Find out about the key risks to this Kesko Oyj narrative.

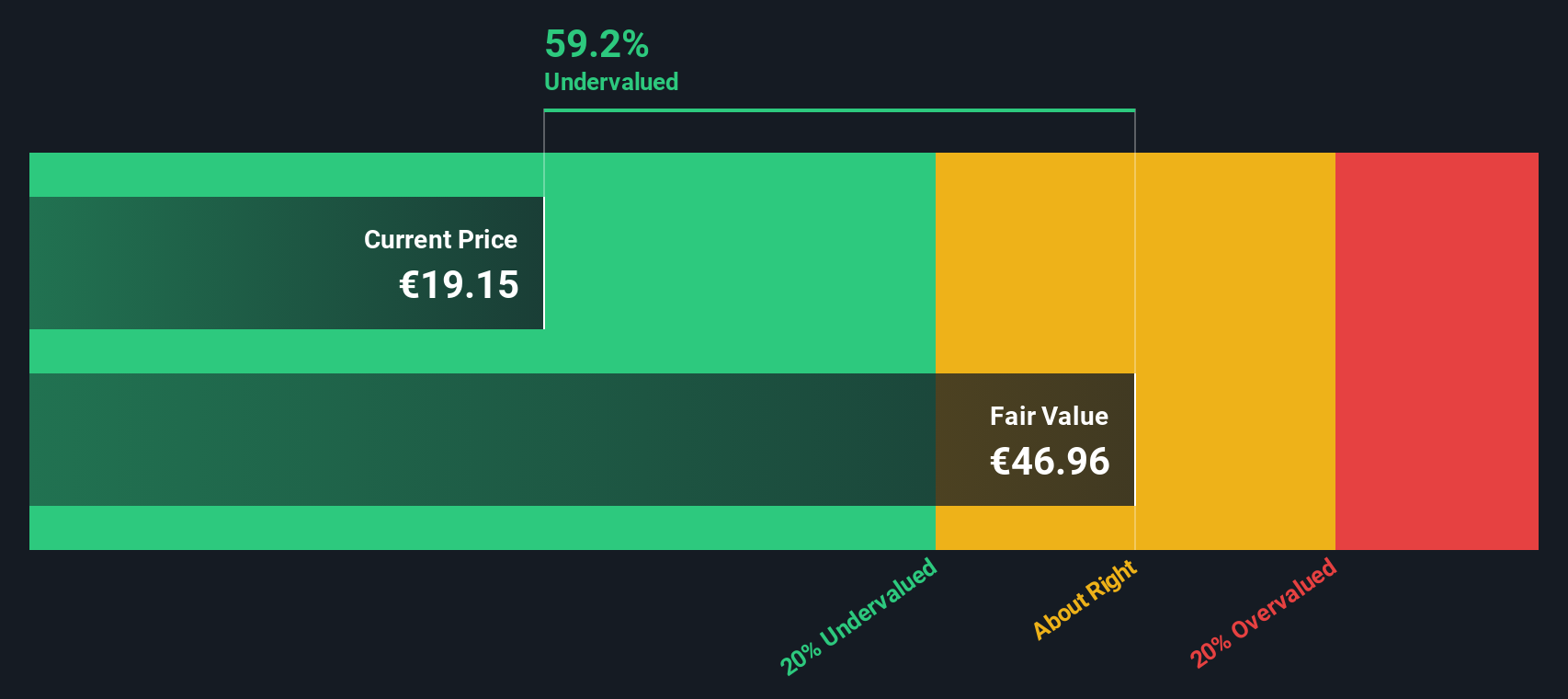

Another View: Discounted Cash Flow Analysis Shows Undervaluation

Looking beyond earnings multiples, our DCF model suggests a different narrative for Kesko Oyj. According to this approach, the current share price of €19.19 is trading well below our calculated fair value of €47.07. This indicates that the stock may be significantly undervalued based on future cash flows. Could the market be overlooking potential long-term value here?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Kesko Oyj for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Kesko Oyj Narrative

If you see things differently or want to dig deeper for yourself, you can craft your perspective and analysis in just a few minutes. Go ahead and Do it your way.

A great starting point for your Kesko Oyj research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Act now to stay ahead of market trends and unlock smarter opportunities. These unique stock ideas are gaining traction, so consider exploring them before they attract more attention.

- Capitalize on strong income potential with high-yield picks using these 18 dividend stocks with yields > 3%.

- Catch the wave of tomorrow’s breakthroughs by tracking these 24 AI penny stocks that are advancing artificial intelligence.

- Spot hidden value that others might overlook with these 871 undervalued stocks based on cash flows based on solid cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kesko Oyj might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:KESKOB

Kesko Oyj

Engages in the chain operations in Finland, Sweden, Norway, Estonia, Latvia, Lithuania, Denmark, and Poland.

Second-rate dividend payer and slightly overvalued.

Similar Companies

Market Insights

Community Narratives