- Japan

- /

- Real Estate

- /

- TSE:8841

3 Intriguing Stocks Estimated To Be Priced Below Fair Value By Up To 46.9%

Reviewed by Simply Wall St

Amidst a backdrop of global market fluctuations, investors are navigating uncertainties stemming from policy shifts under the new Trump administration and mixed economic signals across key regions. As sectors react differently to these changes, identifying stocks that may be undervalued presents a compelling opportunity for those looking to capitalize on potential mispricings in the market.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Shandong Bailong Chuangyuan Bio-Tech (SHSE:605016) | CN¥16.63 | CN¥33.16 | 49.9% |

| KMC (Kuei Meng) International (TWSE:5306) | NT$126.50 | NT$251.32 | 49.7% |

| Lindab International (OM:LIAB) | SEK226.60 | SEK450.18 | 49.7% |

| SeSa (BIT:SES) | €76.00 | €150.71 | 49.6% |

| Accent Group (ASX:AX1) | A$2.51 | A$4.99 | 49.7% |

| S-Pool (TSE:2471) | ¥344.00 | ¥681.84 | 49.5% |

| GemPharmatech (SHSE:688046) | CN¥12.90 | CN¥25.74 | 49.9% |

| AirBoss of America (TSX:BOS) | CA$4.25 | CA$8.45 | 49.7% |

| SBI Sumishin Net Bank (TSE:7163) | ¥2901.00 | ¥5793.23 | 49.9% |

| Audinate Group (ASX:AD8) | A$8.82 | A$17.59 | 49.9% |

Let's uncover some gems from our specialized screener.

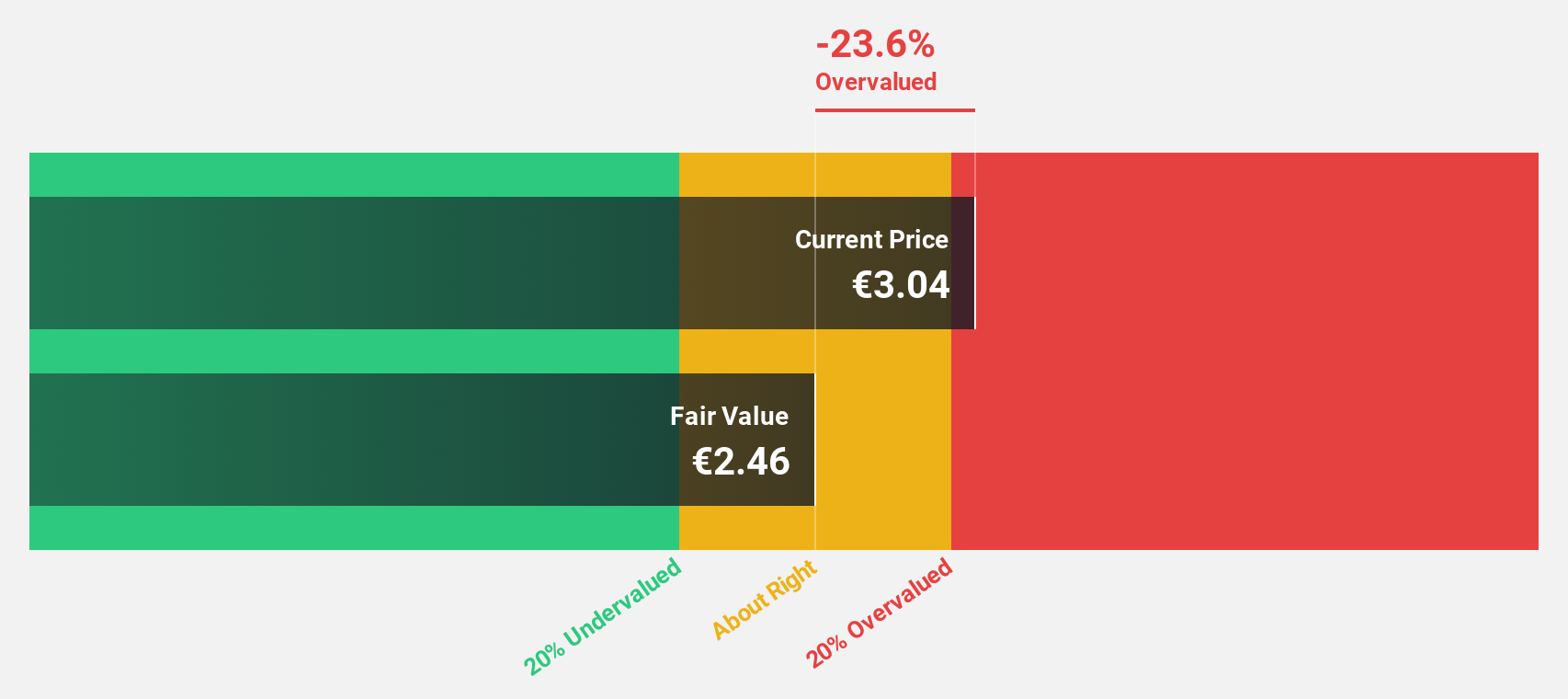

Ercros (BME:ECR)

Overview: Ercros, S.A. is a Spanish company that manufactures and sells basic chemicals, intermediate chemicals, and pharmaceuticals with a market cap of €325.51 million.

Operations: The company's revenue segments include €63.57 million from pharmaceuticals, €375.76 million from chlorine derivatives, and €193.57 million from intermediate chemicals.

Estimated Discount To Fair Value: 12.8%

Ercros is trading at €3.56, slightly below its estimated fair value of €4.08, making it undervalued based on discounted cash flow analysis. Despite a recent net loss of €7.8 million for the nine months ending September 2024, earnings are forecast to grow significantly at 48.5% per year over the next three years, outpacing the Spanish market's growth rate. However, revenue growth remains moderate and dividends have an unstable track record.

- Our growth report here indicates Ercros may be poised for an improving outlook.

- Dive into the specifics of Ercros here with our thorough financial health report.

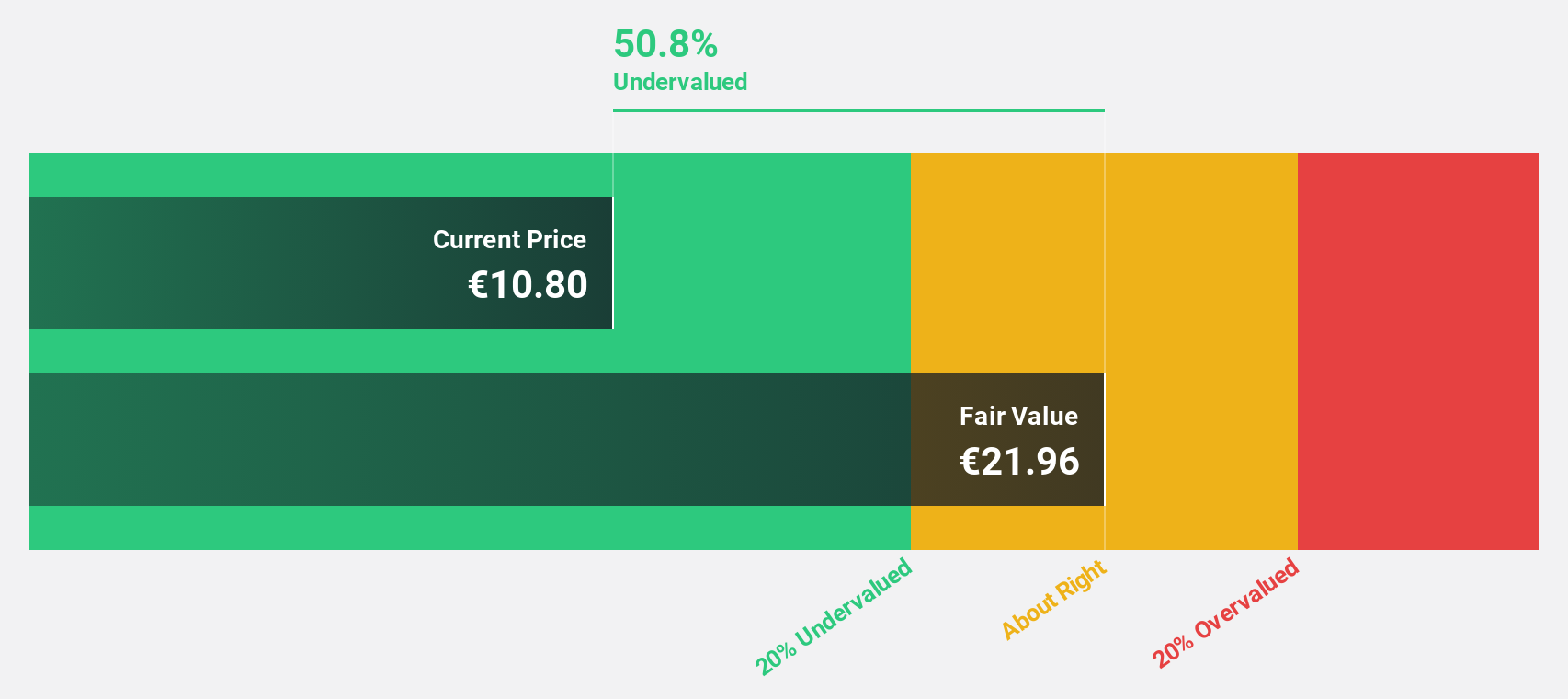

Etteplan Oyj (HLSE:ETTE)

Overview: Etteplan Oyj offers software and embedded solutions, industrial equipment and plant engineering, and technical communication services across Finland, Scandinavia, China, and Central Europe with a market cap of €265.12 million.

Operations: The company's revenue is derived from three primary segments: Engineering Solutions (€198.51 million), Software and Embedded Solutions (€95.48 million), and Technical Communication Solutions (€70.47 million).

Estimated Discount To Fair Value: 44.6%

Etteplan Oyj is trading at €10.5, significantly below its estimated fair value of €18.94, suggesting undervaluation based on discounted cash flow analysis. Despite high debt levels and revised guidance due to weak demand in Europe, earnings are forecast to grow substantially at 24.8% per year, surpassing the Finnish market's growth rate. Recent investments in testing facilities may enhance future service offerings and revenue potential despite current challenges impacting profitability and order backlogs.

- Insights from our recent growth report point to a promising forecast for Etteplan Oyj's business outlook.

- Click here and access our complete balance sheet health report to understand the dynamics of Etteplan Oyj.

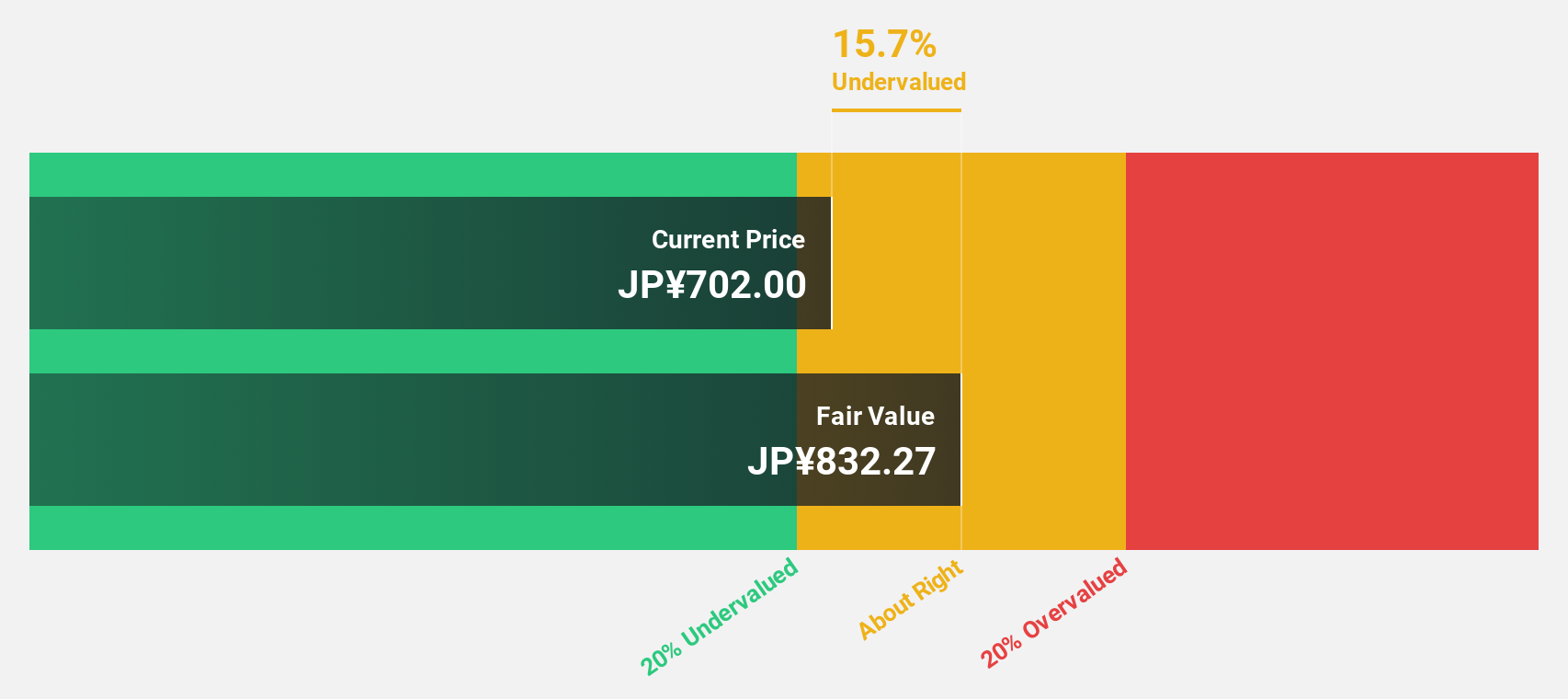

TOC (TSE:8841)

Overview: TOC Co., Ltd. operates in the real estate sector in Japan and has a market cap of ¥56.81 billion.

Operations: The company generates revenue through its real estate operations in Japan.

Estimated Discount To Fair Value: 46.9%

TOC Co., Ltd. is trading at ¥601, considerably below its estimated fair value of ¥1131.01, indicating potential undervaluation based on discounted cash flow analysis. Earnings are projected to grow significantly at 59.5% annually, outpacing the JP market's growth rate of 8%. However, profit margins have declined from last year's 49.3% to 3.6%, partly due to large one-off items affecting financial results, and return on equity remains low at a forecasted 3.1%.

- The analysis detailed in our TOC growth report hints at robust future financial performance.

- Get an in-depth perspective on TOC's balance sheet by reading our health report here.

Make It Happen

- Take a closer look at our Undervalued Stocks Based On Cash Flows list of 933 companies by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TOC might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8841

Excellent balance sheet with reasonable growth potential.