Valmet (HLSE:VALMT): €100 Million One-Off Loss Tests Profit Quality Narrative

Reviewed by Simply Wall St

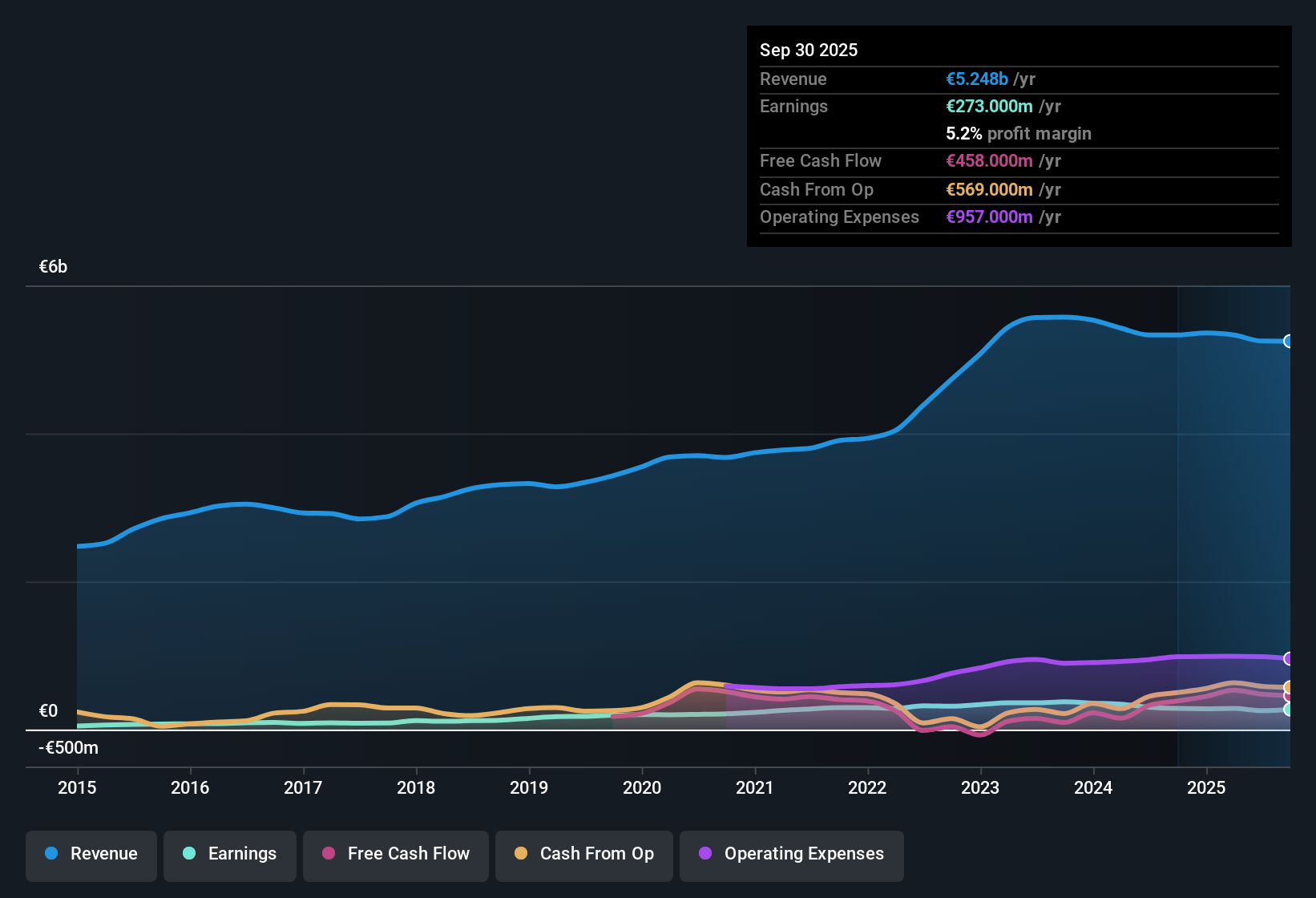

Valmet Oyj (HLSE:VALMT) reported EPS growth averaging 2.6% annually over the past five years, with current net profit margins of 5.2%, just below last year’s 5.3%. The most recent results include a €100 million one-off loss, which weighed on the latest twelve-month earnings. Looking ahead, analysts expect revenue to expand by 4.1% per year, slightly ahead of the Finnish market average. Earnings are projected to grow 18.59% yearly, keeping investor attention on the company’s bounce-back and future earnings power.

See our full analysis for Valmet Oyj.Now, let’s see how Valmet’s latest numbers compare with the narratives that have shaped expectations around this stock and find out where the consensus might shift.

See what the community is saying about Valmet Oyj

Cost Savings Plan Targets €80 Million Annually

- Management is rolling out a new operating model expected to drive €80 million in recurring annual cost savings by early 2026, mostly through a simpler corporate structure and local accountability.

- Analysts’ consensus view holds that these cost reductions, combined with digitalization and automation initiatives, will help raise recurring high-margin service revenues and expand operating margins over time.

- Efficiency improvements are forecast to directly lower selling, general and administrative expenses and cost of goods sold, supporting margin growth.

- Investments in digitalization and automation are positioned as key enablers for more resilient, higher-margin service income going forward.

Consensus narrative points out that structurally lower costs from the new model and digital push are expected to provide lasting margin expansion, especially as Valmet leverages its large installed base for value-added services. See the full consensus take on Valmet’s strategy shake-up and margin outlook: 📊 Read the full Valmet Oyj Consensus Narrative.

Profit Mix Shifts and Margin Challenges

- The Biomaterial Solutions and Services segment currently delivers a 10% EBITA margin, which is well below the company’s 14% target and raises questions about progress toward a stronger profit mix.

- Consensus narrative underscores tension between strong growth in automation and process optimization segments and weaker transactional volumes in mature pulp and paper sectors.

- Rising investment in life cycle services and a push to grow high-margin recurring revenues should help counteract pressure from capital-intensive, lower-margin projects.

- Critics highlight that heavy dependence on large, lumpy orders can introduce unpredictable cash flows and undermine overall earnings stability.

DCF Fair Value Remains Far Above Market Price

- Valmet trades at €27.57 per share, which is significantly below its estimated DCF fair value of €51.86 and also below the peer average P/E of 20.6x, suggesting notable upside compared to peers.

- Analysts’ consensus view supports the idea that ongoing improvements in profitability and recurring revenues justify a higher valuation, but risks around execution, restructuring costs, and eventual margin achievement remain active factors.

- Consensus price target of €29.03 sits just 0.4% below the current share price, signaling that the market currently views Valmet as fairly priced based on visible progress.

- Disagreements between most bullish (€36.0) and bearish (€18.0) analyst targets reflect differing confidence in the company’s ability to deliver on guidance and transform earnings quality.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Valmet Oyj on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Got a unique take on these figures? Share your outlook and craft a personal narrative in just minutes. Do it your way

A great starting point for your Valmet Oyj research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Despite recurring cost reductions, Valmet’s margins and earnings stability remain uncertain because of uneven profit mix, missed profitability targets, and exposure to lumpy project revenues.

If you want more consistent results, use stable growth stocks screener (2119 results) to focus on companies with track records of steady revenue and profit growth no matter the market cycle.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:VALMT

Valmet Oyj

Develops and supplies process technologies, automation, and services for the pulp, paper, and energy industries in North America, South America, China, Europe, the Middle East, Africa, and the Asia Pacific.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives