Is Valmet's Latest Layoff Plan Shifting the Investment Case for Valmet Oyj (HLSE:VALMT)?

Reviewed by Sasha Jovanovic

- Valmet announced in November 2025 that it began change negotiations in Finland for potential temporary layoffs impacting more than 950 employees across its Packaging and Paper business area and Global Supply unit, targeting sites in Jyväskylä, Tikkurila in Vantaa, and Raisio.

- This move highlights continued weak demand in key markets and ongoing efforts to enhance cost efficiency after similar workforce measures were conducted earlier in 2025 and 2024.

- We'll explore how the latest round of planned layoffs, aimed at cost control, may influence Valmet's investment narrative and future outlook.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Valmet Oyj Investment Narrative Recap

To own Valmet, an investor needs confidence in the company’s ability to adapt through cyclical downturns in pulp, paper, and packaging demand, leveraging an expanding services business for margin stability. The recent announcement of temporary layoffs in Finland highlights efforts to match capacity with demand and maintain cost discipline. While this move addresses current market softness, it does not materially change the most important short-term catalyst: achieving targeted cost savings through operational streamlining, nor does it offset the largest risk, continued weak order volumes in core segments, particularly Services and Process Technologies. A recent event that stands out in this context is Valmet’s Q3 2025 results, which showed flat sales and only a slight year-over-year increase in net income, reflecting ongoing pressure in end markets despite earlier cost measures. This underscores just how closely cost-control initiatives and operational realignment are intertwined with the company’s near-term earnings outlook, especially while margins in key segments remain below target. By contrast, one potential risk investors should be mindful of is whether ongoing restructuring costs and execution risks may delay the expected improvement in net profit and margins...

Read the full narrative on Valmet Oyj (it's free!)

Valmet Oyj is expected to reach €5.9 billion in revenue and €557.7 million in earnings by 2028. Achieving this would require 4.1% annual revenue growth and an increase in earnings of €302.7 million from the current €255.0 million.

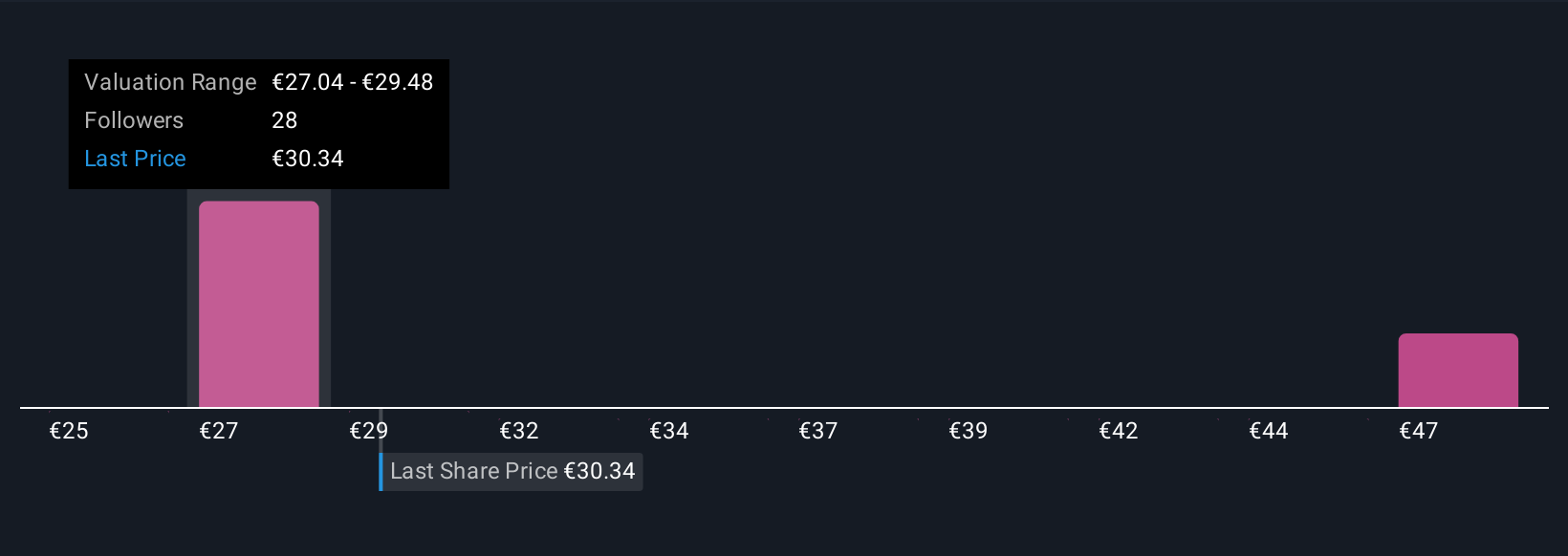

Uncover how Valmet Oyj's forecasts yield a €28.46 fair value, in line with its current price.

Exploring Other Perspectives

Simply Wall St Community members see fair value ranging from €24.60 to €51.55 across 4 different estimates. While several anticipate upside, current cost-cutting actions highlight how exposed Valmet still is to softer demand and earnings variability.

Explore 4 other fair value estimates on Valmet Oyj - why the stock might be worth as much as 81% more than the current price!

Build Your Own Valmet Oyj Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Valmet Oyj research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Valmet Oyj research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Valmet Oyj's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:VALMT

Valmet Oyj

Develops and supplies process technologies, automation, and services for the pulp, paper, and energy industries in North America, South America, China, Europe, the Middle East, Africa, and the Asia Pacific.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives