Introducing Uponor Oyj (HEL:UPONOR), The Stock That Dropped 25% In The Last Year

While it may not be enough for some shareholders, we think it is good to see the Uponor Oyj (HEL:UPONOR) share price up 18% in a single quarter. But in truth the last year hasn't been good for the share price. After all, the share price is down 25% in the last year, significantly under-performing the market.

See our latest analysis for Uponor Oyj

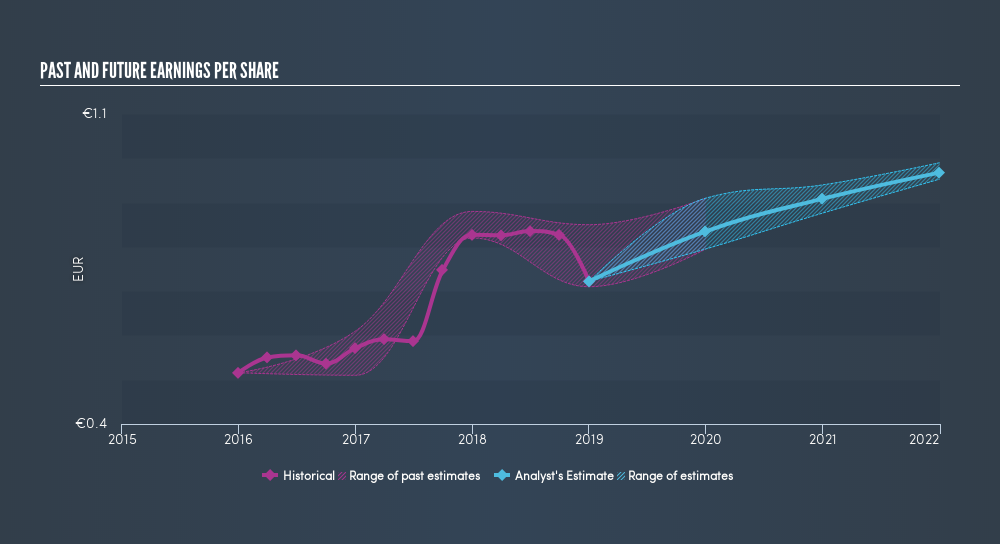

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Unfortunately Uponor Oyj reported an EPS drop of 13% for the last year. This reduction in EPS is not as bad as the 25% share price fall. Unsurprisingly, given the lack of EPS growth, the market seems to be more cautious about the stock.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

This free interactive report on Uponor Oyj's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. In the case of Uponor Oyj, it has a TSR of -22% for the last year. That exceeds its share price return that we previously mentioned. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

Investors in Uponor Oyj had a tough year, with a total loss of 22% (including dividends), against a market gain of about 6.0%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 2.8% over the last half decade. We realise that Buffett has said investors should 'buy when there is blood on the streets', but we caution that investors should first be sure they are buying a high quality businesses. Keeping this in mind, a solid next step might be to take a look at Uponor Oyj's dividend track record. This freeinteractive graph is a great place to start.

But note: Uponor Oyj may not be the best stock to buy. So take a peek at this freelist of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on FI exchanges.We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About HLSE:UPONOR

Uponor Oyj

Uponor Oyj engages in the provision of plumbing, indoor climate, and infrastructure solutions in Europe and North America.

Flawless balance sheet with questionable track record.

Similar Companies

Market Insights

Community Narratives