Kreate Group Oyj (HEL:KREATE) has announced that it will pay a dividend of €0.25 per share on the 2nd of October. This will take the dividend yield to an attractive 6.4%, providing a nice boost to shareholder returns.

Kreate Group Oyj's Future Dividend Projections Appear Well Covered By Earnings

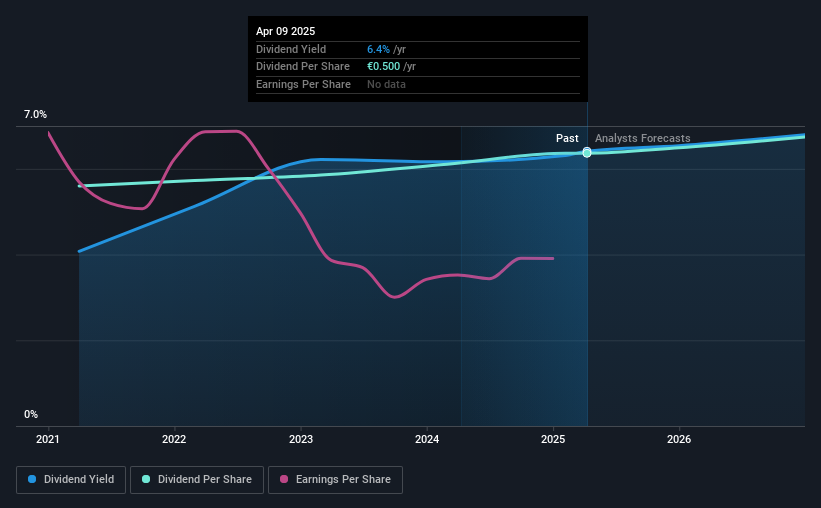

While it is great to have a strong dividend yield, we should also consider whether the payment is sustainable. Prior to this announcement, the dividend made up 99% of earnings, and the company was generating negative free cash flows. Paying out such a large dividend compared to earnings while also not generating free cash flows is a major warning sign for the sustainability of the dividend as these levels are certainly a bit high.

The next year is set to see EPS grow by 67.1%. If the dividend continues along recent trends, we estimate the payout ratio will be 62%, which would make us comfortable with the sustainability of the dividend, despite the levels currently being quite high.

View our latest analysis for Kreate Group Oyj

Kreate Group Oyj Doesn't Have A Long Payment History

The company has maintained a consistent dividend for a few years now, but we would like to see a longer track record before relying on it. The annual payment during the last 4 years was €0.44 in 2021, and the most recent fiscal year payment was €0.50. This implies that the company grew its distributions at a yearly rate of about 3.2% over that duration. We like that the dividend hasn't been shrinking. However we're conscious that the company hasn't got an overly long track record of dividend payments yet, which makes us wary of relying on its dividend income.

Dividend Growth Potential Is Shaky

Investors could be attracted to the stock based on the quality of its payment history. However, initial appearances might be deceiving. Kreate Group Oyj's EPS has fallen by approximately 11% per year during the past five years. Such rapid declines definitely have the potential to constrain dividend payments if the trend continues into the future. On the bright side, earnings are predicted to gain some ground over the next year, but until this turns into a pattern we wouldn't be feeling too comfortable.

We're Not Big Fans Of Kreate Group Oyj's Dividend

In conclusion, we have some concerns about this dividend, even though it being raised is good. The company's earnings aren't high enough to be making such big distributions, and it isn't backed up by strong growth or consistency either. The dividend doesn't inspire confidence that it will provide solid income in the future.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. To that end, Kreate Group Oyj has 4 warning signs (and 3 which are concerning) we think you should know about. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

Valuation is complex, but we're here to simplify it.

Discover if Kreate Group Oyj might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About HLSE:KREATE

Kreate Group Oyj

Engages in the construction of infrastructure projects for private and public sector customers in Finland.

Excellent balance sheet with reasonable growth potential.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026