- Finland

- /

- Electrical

- /

- HLSE:KEMPOWR

After Leaping 30% Kempower Oyj (HEL:KEMPOWR) Shares Are Not Flying Under The Radar

Despite an already strong run, Kempower Oyj (HEL:KEMPOWR) shares have been powering on, with a gain of 30% in the last thirty days. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 40% over that time.

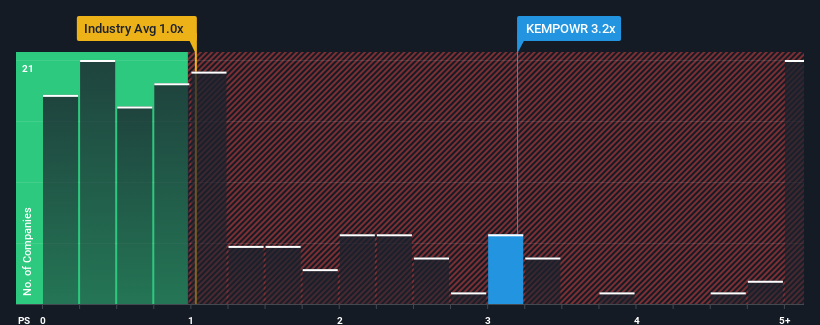

Following the firm bounce in price, you could be forgiven for thinking Kempower Oyj is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 3.2x, considering almost half the companies in Finland's Electrical industry have P/S ratios below 1x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

Check out our latest analysis for Kempower Oyj

What Does Kempower Oyj's P/S Mean For Shareholders?

Kempower Oyj could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It might be that many expect the dour revenue performance to recover substantially, which has kept the P/S from collapsing. If not, then existing shareholders may be extremely nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Kempower Oyj.Is There Enough Revenue Growth Forecasted For Kempower Oyj?

Kempower Oyj's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 21%. In spite of this, the company still managed to deliver immense revenue growth over the last three years. Accordingly, shareholders will be pleased, but also have some serious questions to ponder about the last 12 months.

Looking ahead now, revenue is anticipated to climb by 24% each year during the coming three years according to the six analysts following the company. With the industry only predicted to deliver 8.2% per annum, the company is positioned for a stronger revenue result.

In light of this, it's understandable that Kempower Oyj's P/S sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Bottom Line On Kempower Oyj's P/S

Shares in Kempower Oyj have seen a strong upwards swing lately, which has really helped boost its P/S figure. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our look into Kempower Oyj shows that its P/S ratio remains high on the merit of its strong future revenues. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

Before you take the next step, you should know about the 1 warning sign for Kempower Oyj that we have uncovered.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Kempower Oyj might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About HLSE:KEMPOWR

Kempower Oyj

Manufactures and sells electric vehicle (EV) charging equipment and solutions for cars, buses, trucks, boats, aviation, and machinery in Nordics, rest of Europe, North America, and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives