Konecranes (HLSE:KCR): Assessing Valuation Following Share Price Momentum and Growing Automation Demand

Reviewed by Simply Wall St

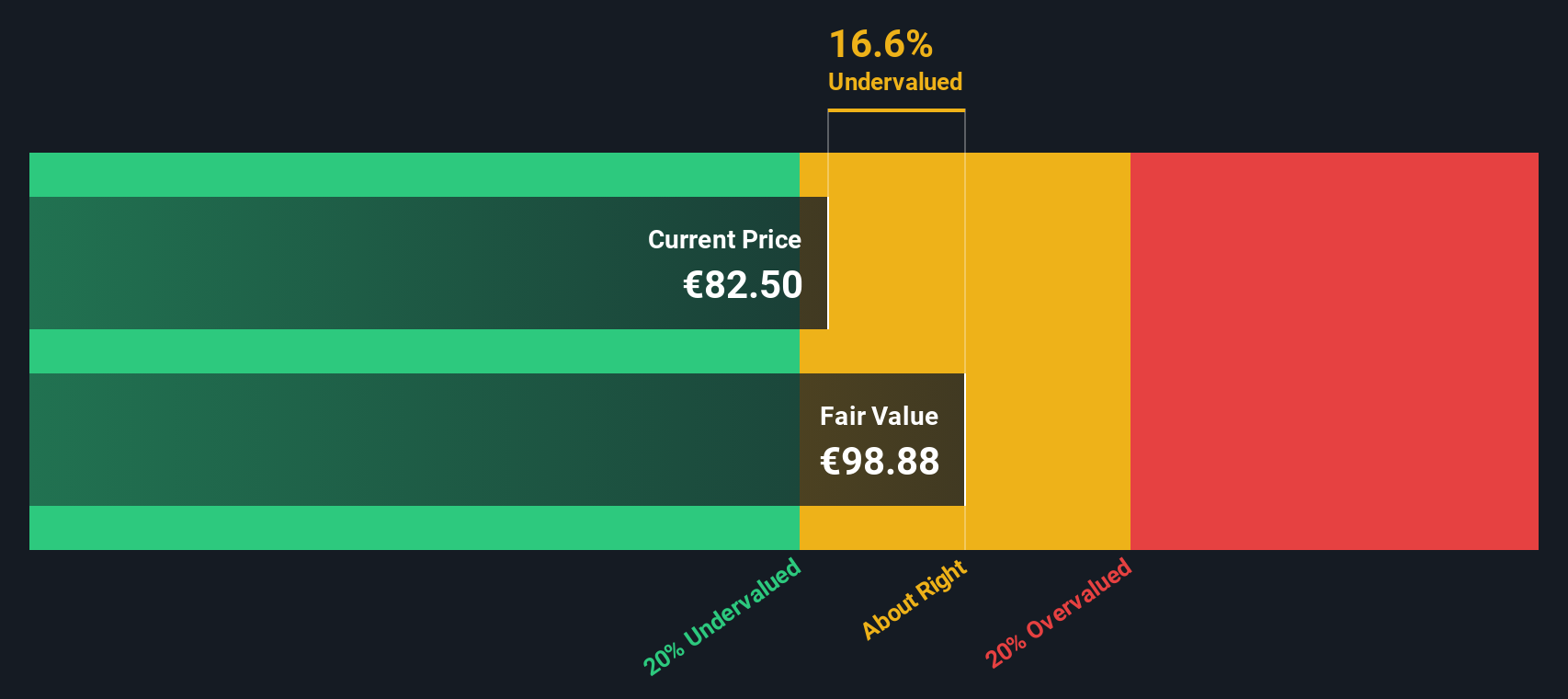

Most Popular Narrative: 7.4% Undervalued

The current prevailing narrative suggests Konecranes shares are undervalued by around 7% based on analyst expectations for earnings and future growth drivers.

The intensifying shift toward automation and smart manufacturing is driving strong demand for advanced port and industrial solutions (like electrified, automation-ready cranes). This is reflected in Port Solutions' record order intake and margins, and is likely to accelerate top-line revenue growth as global investment in Industry 4.0 and port modernization continues.

Wondering what is fueling that bullish analyst target? Behind this valuation, there are bold projections for growth in revenue, profits and margins that most companies only dream about. Want to know if the expectations for Konecranes to outperform the crowd are truly justified? Dive deeper into the details to see the specific forecasts moving this fair value calculation.

Result: Fair Value of €81.0 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, several factors could disrupt Konecranes' outlook. These include weakening service demand in key regions and persistent supply chain delays, both of which threaten future growth.

Find out about the key risks to this Konecranes narrative.Another View: The SWS DCF Model Weighs In

Taking a step back from analyst projections, our DCF model also suggests Konecranes is trading well below its estimated intrinsic value. But can a cash flow-focused outlook spot risks that might be missed when looking only at multiples?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Konecranes for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Konecranes Narrative

If you see things differently or want to dig into the numbers on your own terms, you can easily craft your own perspective in just a few minutes. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Konecranes.

Looking for More Smart Investment Ideas?

If you are truly serious about making your money work harder, do not limit yourself to just one stock. Expand your strategy with revolutionary investment opportunities curated by Simply Wall Street’s best screeners.

- Supercharge your search for tomorrow’s big winners by targeting companies delivering strong financial results. Start with penny stocks with strong financials.

- Unlock the future of healthcare by following market innovators focused on artificial intelligence breakthroughs with healthcare AI stocks.

- Jump ahead of the curve with hand-picked opportunities among undervalued gems, all highlighted in undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Konecranes might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About HLSE:KCR

Konecranes

Manufactures, sells, and services material handling products in Europe, the Middle East, Africa, the Americas, the Asia-Pacific, and internationally.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives