Can Stable Sales and Profit Resilience Redefine Konecranes (HLSE:KCR) Strategic Trajectory?

Reviewed by Sasha Jovanovic

- Konecranes reported its third quarter 2025 results, with sales of €988.7 million and net income of €103.8 million, and issued guidance that expects net sales in 2025 to remain approximately at 2024 levels.

- Despite a decrease in quarterly sales, the company’s net income and earnings per share increased slightly, highlighting resilience in profitability during a period of revenue stabilization.

- We'll explore how the company’s stable 2025 sales outlook and resilient Q3 profitability affect the broader investment narrative for Konecranes.

This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

Konecranes Investment Narrative Recap

To be confident holding Konecranes shares, an investor needs to believe in the durability of its profitability amid cyclical swings in industrial demand, and that the current plateau in sales does not signal deeper structural issues. The Q3 2025 results did not materially change the key short-term catalyst, demand for automation and electrification in ports, or the principal risk, which is continued customer hesitancy and revenue volatility affecting order intake.

Of the recent headlines, the launch of Konecranes' hydrogen fuel cell straddle carrier and other low- to zero-emission products stands out. This supports the narrative that tightening environmental standards and customer demand for sustainable solutions could underpin growth, even as traditional order cycles fluctuate.

Yet, investors should also be mindful that, despite resilience, the real test lies in how the company manages exposure to unpredictable, cyclical port and industrial market demand...

Read the full narrative on Konecranes (it's free!)

Konecranes' narrative projects €4.6 billion revenue and €468.9 million earnings by 2028. This requires 1.9% yearly revenue growth and an €85.6 million earnings increase from €383.3 million.

Uncover how Konecranes' forecasts yield a €90.50 fair value, a 6% upside to its current price.

Exploring Other Perspectives

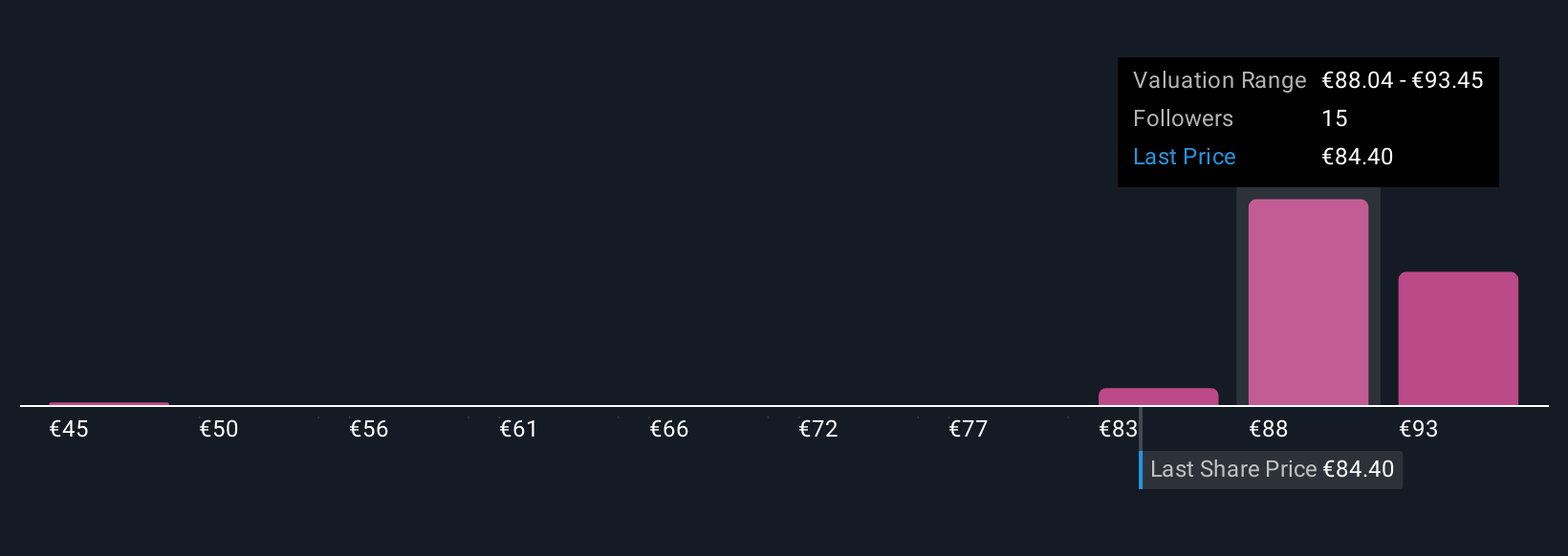

Six private investors in the Simply Wall St Community value Konecranes between €44.79 and €106.25 per share. With sales forecast to remain steady in 2025, the diversity of views shows how much opinions differ on the impact of order cycle risk and future earnings stability.

Explore 6 other fair value estimates on Konecranes - why the stock might be worth as much as 24% more than the current price!

Build Your Own Konecranes Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Konecranes research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Konecranes research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Konecranes' overall financial health at a glance.

Interested In Other Possibilities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Find companies with promising cash flow potential yet trading below their fair value.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 36 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Konecranes might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:KCR

Konecranes

Manufactures, sells, and services material handling products in Europe, the Middle East, Africa, the Americas, the Asia-Pacific, and internationally.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives