Major Port Equipment and Service Deals Could Be a Game Changer for Kalmar Oyj (HLSE:KALMAR)

Reviewed by Sasha Jovanovic

- In recent announcements, Kalmar Oyj reported two key contract wins: an agreement to supply 16 hybrid straddle carriers to Transnet Port Terminals in South Africa, and the extension of its long-term Kalmar Care maintenance contract with Belfast Container Terminal, part of Irish Continental Group.

- These developments highlight Kalmar's continued momentum in securing both equipment and service contracts, supporting its position as a trusted partner for port operators seeking operational reliability and sustainable solutions.

- We'll explore how the latest South African equipment order could influence Kalmar's growth outlook and future earnings expectations.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Kalmar Oyj Investment Narrative Recap

Owning shares in Kalmar Oyj requires confidence in the company's ability to drive growth through automation, service expansion, and sustainable equipment, while navigating global uncertainties in trade policy and price competition. The recent contract wins in South Africa and Belfast reinforce the company’s strong client relationships, although these developments do not materially change the most immediate catalysts or the primary risk, namely, potential market softness and hesitancy among customers in the Americas impacting short-term order intake.

The recent agreement to supply 16 hybrid straddle carriers to Transnet Port Terminals in South Africa is especially aligned with Kalmar’s focus on expanding its eco portfolio and securing large equipment contracts, key catalysts supporting its expected order-driven revenue growth and margin improvement goals.

However, it's important to remember that, despite these wins, the risk of prolonged order delays from US distribution sector customers could still weigh on the growth outlook, should ...

Read the full narrative on Kalmar Oyj (it's free!)

Kalmar Oyj's outlook projects €2.0 billion in revenue and €211.3 million in earnings by 2028. This requires a 5.4% annual revenue growth and a €74.8 million increase in earnings from the current €136.5 million.

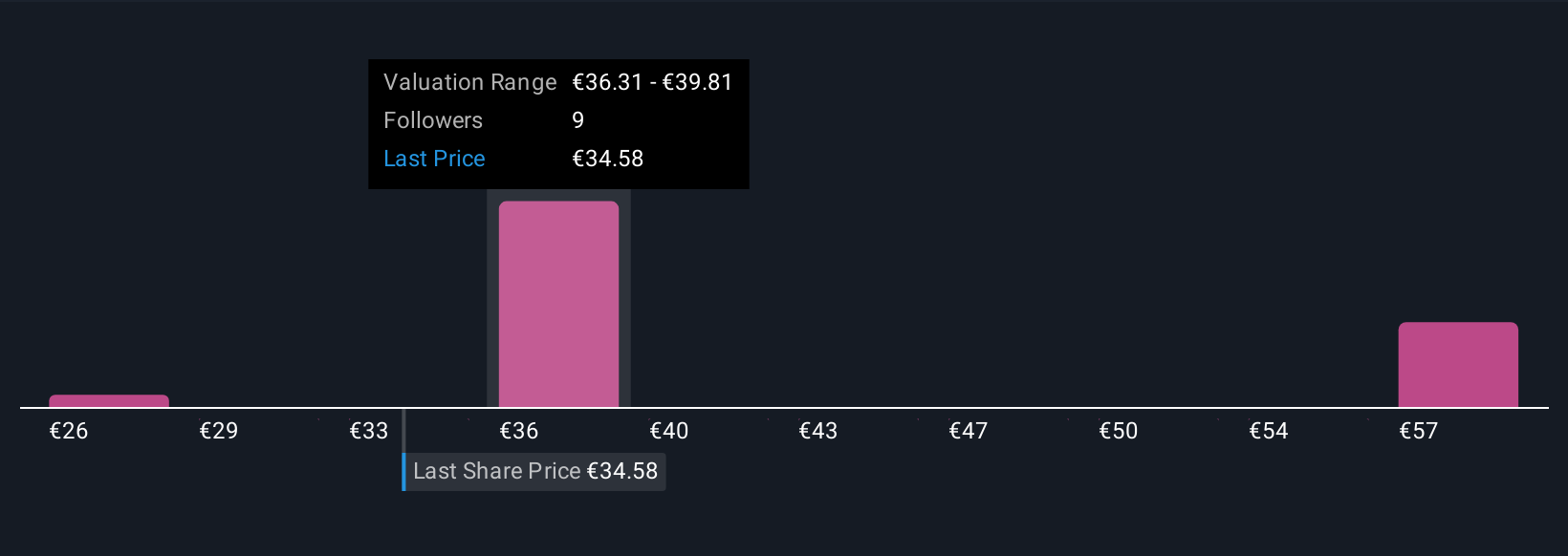

Uncover how Kalmar Oyj's forecasts yield a €39.20 fair value, a 6% upside to its current price.

Exploring Other Perspectives

Fair value estimates from the Simply Wall St Community span from €39.20 to €55.43, with two unique viewpoints represented. While many see opportunity in Kalmar’s eco portfolio growth, the risk of delayed customer orders in key markets suggests a closer look at these varying perspectives is worthwhile.

Explore 2 other fair value estimates on Kalmar Oyj - why the stock might be worth just €39.20!

Build Your Own Kalmar Oyj Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Kalmar Oyj research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Kalmar Oyj research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Kalmar Oyj's overall financial health at a glance.

Searching For A Fresh Perspective?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 37 companies in the world exploring or producing it. Find the list for free.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kalmar Oyj might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:KALMAR

Kalmar Oyj

Provides heavy material handling equipment and services for ports, terminals, distribution centres, manufacturing, and heavy logistics industries in the Americas, Europe, Asia, the Middle East, and Africa.

Undervalued with excellent balance sheet.

Market Insights

Community Narratives