- Norway

- /

- Oil and Gas

- /

- OB:BWLPG

Exploring Three Undiscovered Gem Stocks in Europe

Reviewed by Simply Wall St

As the pan-European STOXX Europe 600 Index continues its upward trajectory, rising for a fourth consecutive week amid easing trade tensions between China and the U.S., investors are increasingly looking towards small- and mid-cap stocks that have shown resilience in this dynamic market environment. With key indices like Germany's DAX gaining momentum, identifying promising stocks within Europe's diverse landscape requires a keen understanding of market conditions and an eye for companies with strong fundamentals and growth potential.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Intellego Technologies | 11.59% | 68.05% | 72.76% | ★★★★★★ |

| Linc | NA | 101.28% | 29.81% | ★★★★★★ |

| Decora | 20.76% | 12.61% | 12.54% | ★★★★★☆ |

| Flügger group | 20.98% | 3.24% | -29.82% | ★★★★★☆ |

| Alantra Partners | 3.79% | -3.99% | -23.83% | ★★★★★☆ |

| Viohalco | 91.31% | 12.25% | 17.37% | ★★★★☆☆ |

| Procimmo Group | 157.49% | 0.65% | 4.94% | ★★★★☆☆ |

| Practic | 5.21% | 4.49% | 7.23% | ★★★★☆☆ |

| Inversiones Doalca SOCIMI | 15.57% | 6.53% | 7.16% | ★★★★☆☆ |

| Castellana Properties Socimi | 53.49% | 6.64% | 21.96% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Koninklijke Heijmans (ENXTAM:HEIJM)

Simply Wall St Value Rating: ★★★★★★

Overview: Koninklijke Heijmans N.V. is involved in property development, construction, and infrastructure sectors both within the Netherlands and internationally, with a market capitalization of approximately €1.34 billion.

Operations: Heijmans generates revenue through its Living (€994.30 million), Connect (€996.60 million), and Work (€634.60 million) segments. The company focuses on property development, construction, and infrastructure projects within the Netherlands and internationally.

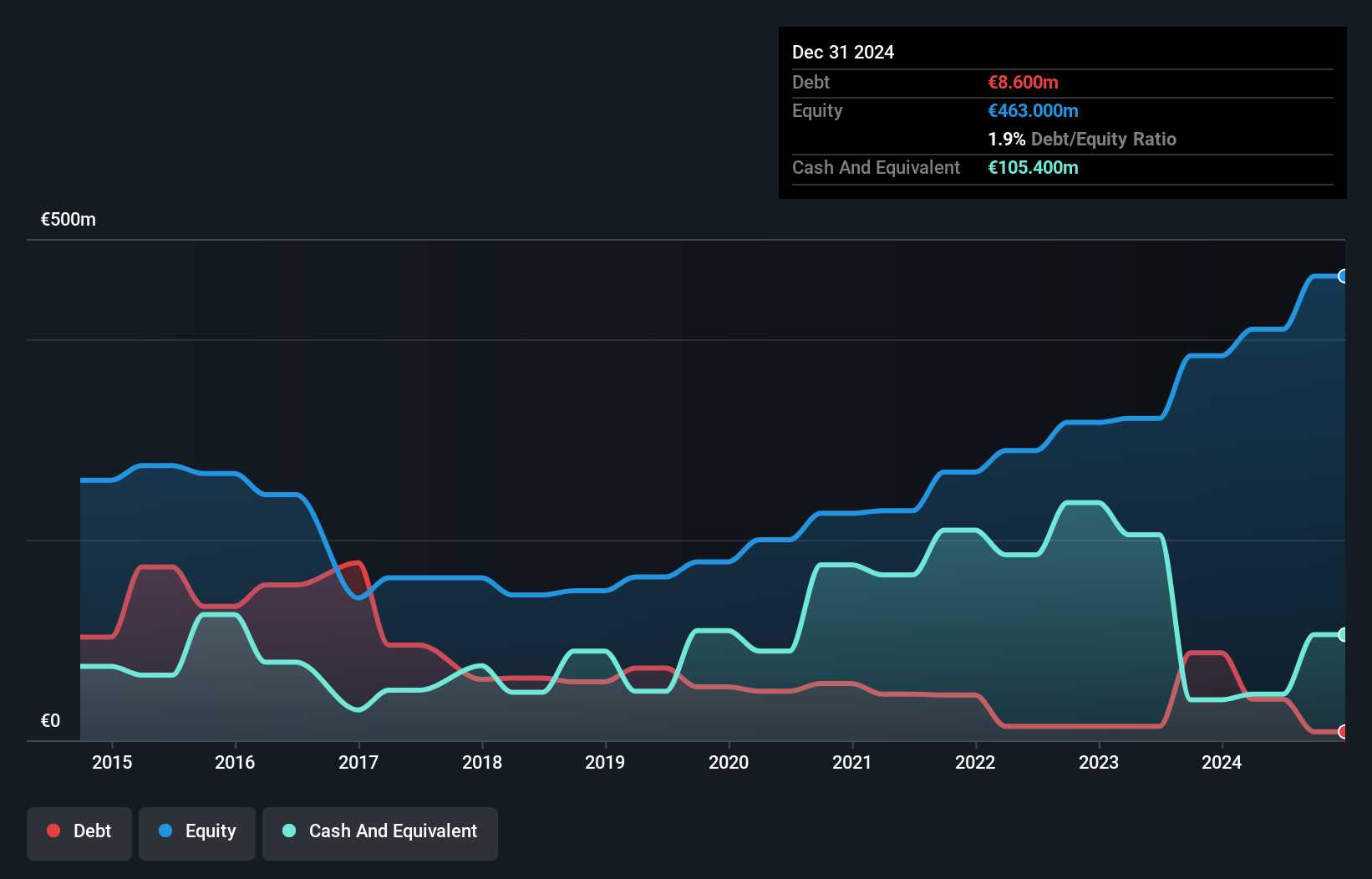

Heijmans, a construction player with high-quality earnings, is trading 57.9% below its fair value estimate. Over the past year, its earnings surged by 50.8%, significantly outpacing the industry's 9.3% growth rate. With interest payments well-covered at 17.8 times EBIT and a reduced debt-to-equity ratio from 29.9% to just 1.9% over five years, Heijmans shows financial resilience despite recent share volatility and removal from the Netherlands ASCX index in March 2025 likely affecting sentiment temporarily while strategic shifts towards energy projects could stabilize future earnings amidst regulatory challenges.

GRK Infra Oyj (HLSE:GRK)

Simply Wall St Value Rating: ★★★★★★

Overview: GRK Infra Oyj is a company that offers infrastructure construction services across Finland, Sweden, and Estonia with a market capitalization of €470.33 million.

Operations: GRK Infra Oyj generates revenue primarily from its heavy construction segment, amounting to €794.78 million. The company's financial performance is characterized by a net profit margin trend that provides insights into its profitability within the infrastructure construction sector across Finland, Sweden, and Estonia.

GRK Infra Oyj, a noteworthy player in the European construction sector, has seen its debt to equity ratio improve from 31.5% to 21.4% over five years. Recent earnings growth of 71.4% outpaced the industry's 9.3%, showcasing robust performance despite highly illiquid shares trading at a significant discount of 80.8%. The company remains financially sound with more cash than total debt and positive free cash flow, reinforcing its stability amidst forecasts suggesting an average earnings decline of 3.4% annually over the next three years. A recent €12 million contract for road infrastructure further bolsters GRK's order book and future prospects.

- Navigate through the intricacies of GRK Infra Oyj with our comprehensive health report here.

Assess GRK Infra Oyj's past performance with our detailed historical performance reports.

BWG (OB:BWLPG)

Simply Wall St Value Rating: ★★★★★☆

Overview: BW LPG Limited is an investment holding company involved in ship owning and chartering activities on a global scale, with a market capitalization of NOK17.30 billion.

Operations: BW LPG Limited generates revenue primarily from its shipping and product services segments, with $1.04 billion and $2.65 billion respectively. The company's revenue model is significantly driven by these two segments, while inter-segment eliminations account for a reduction of $128.19 million in the total revenue calculation.

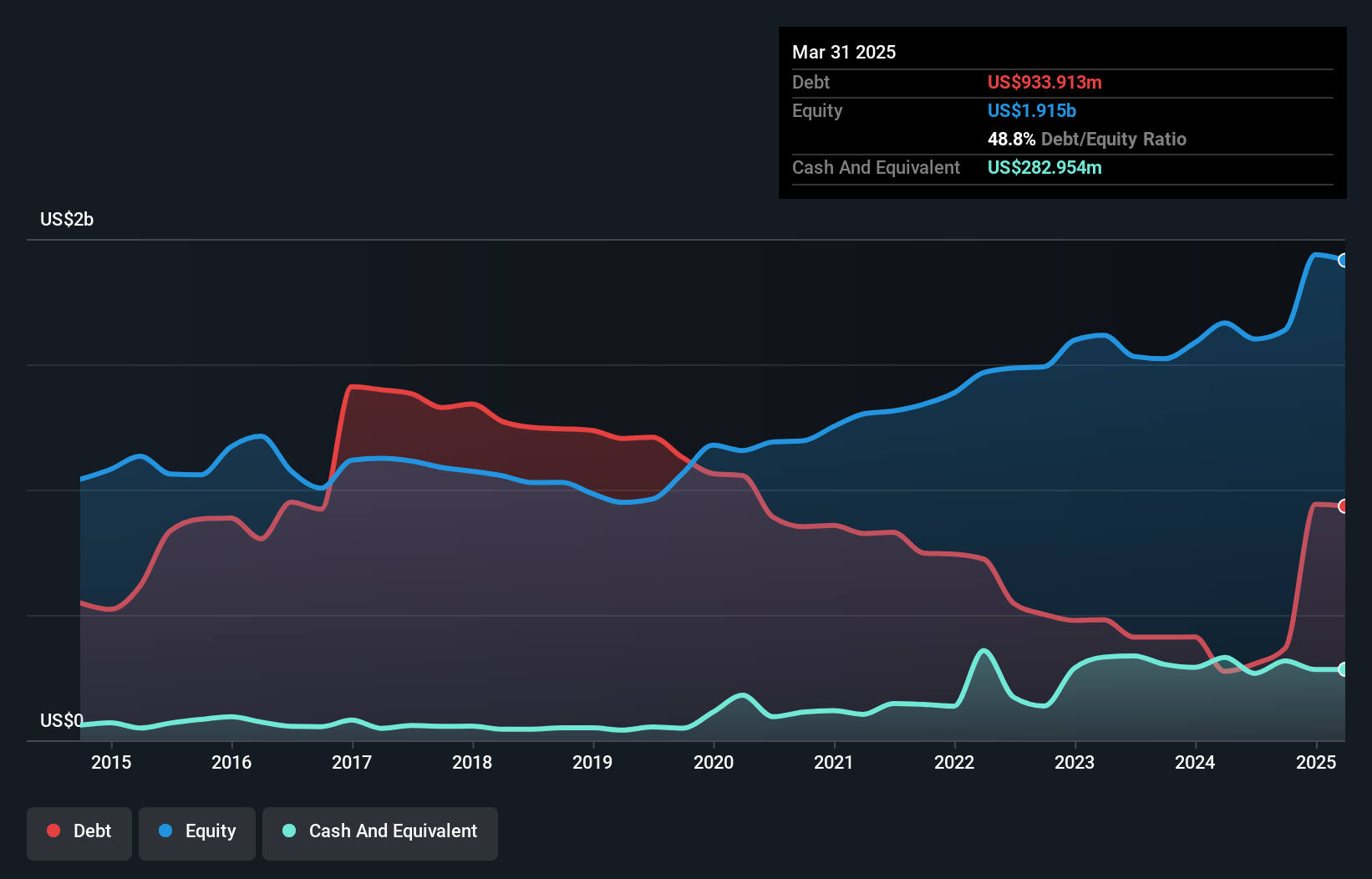

BWG navigates the volatile waters of the oil and gas sector with a strategic focus on fleet upgrades and operational efficiencies. Recent acquisitions, including Avance Gas vessels, are poised to strengthen its market position, potentially reducing costs through enhanced fleet synergies. The introduction of LPG dual fuel technology is expected to boost efficiency amid rising Asian demand. Despite these positives, BWG contends with geopolitical risks and increased leverage from expansion borrowings. Trading at 84.9% below estimated fair value suggests potential upside, although net profit margins have tightened to 9.9% from last year's 15.9%. In April 2025, BWG repurchased shares worth $2.73 million under its buyback program.

Where To Now?

- Click here to access our complete index of 325 European Undiscovered Gems With Strong Fundamentals.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BWG might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:BWLPG

BWG

An investment holding company, engages in ship owning and chartering activities worldwide.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives