- Finland

- /

- Construction

- /

- HLSE:GRK

Discovering Three Hidden European Stock Gems For Your Portfolio

Reviewed by Simply Wall St

As the European market navigates a mixed landscape, with the pan-European STOXX Europe 600 Index inching higher on dovish signals from the U.S. Federal Reserve and easing trade tensions, investors are increasingly seeking opportunities in lesser-known stocks that may offer unique value propositions. In this context, identifying hidden gems involves looking for companies that demonstrate resilience and potential for growth amid economic fluctuations, making them intriguing additions to a diversified portfolio.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Dekpol | 64.28% | 9.75% | 13.77% | ★★★★★☆ |

| Sparta | NA | nan | nan | ★★★★★☆ |

| Freetrailer Group | 0.01% | 22.96% | 31.56% | ★★★★★☆ |

| Inmocemento | 28.68% | 4.15% | 33.84% | ★★★★★☆ |

| va-Q-tec | 43.54% | 8.03% | -34.33% | ★★★★★☆ |

| Deutsche Balaton | 4.58% | -18.46% | -16.14% | ★★★★★☆ |

| Procimmo Group | 141.47% | 6.84% | 6.01% | ★★★★☆☆ |

| Dn Agrar Group | 63.27% | 15.46% | 33.00% | ★★★★☆☆ |

| Practic | NA | 4.86% | 6.64% | ★★★★☆☆ |

| Alantra Partners | 11.48% | -5.76% | -30.16% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

CNTEE Transelectrica (BVB:TEL)

Simply Wall St Value Rating: ★★★★★★

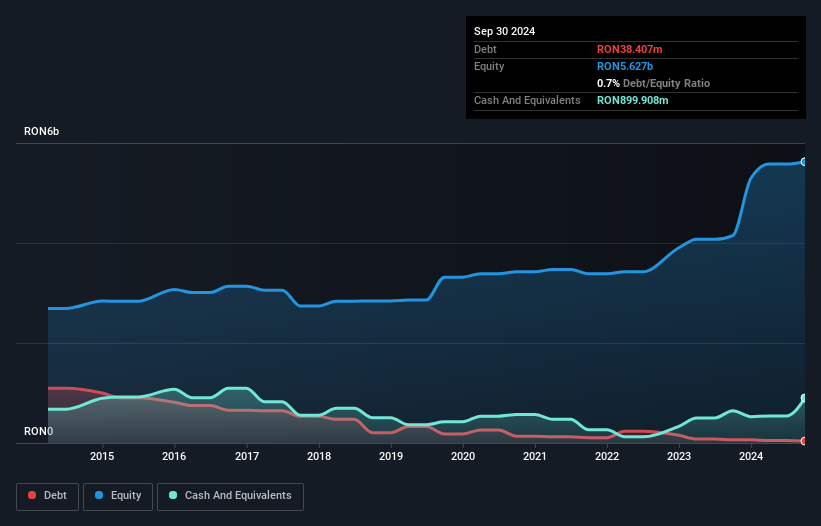

Overview: CNTEE Transelectrica SA is a company that operates as the transmission and system operator for Romania's national power system, with a market capitalization of RON4.75 billion.

Operations: Transelectrica's primary revenue stream comes from its transmission and dispatch services, generating RON6.14 billion. The company has a market capitalization of RON4.75 billion.

Transelectrica, a noteworthy player in the European utility sector, showcases impressive financial health with earnings surging by 77% last year, outpacing the industry average of -2%. The company trades at a value 12.8% below its estimated fair value and has reduced its debt-to-equity ratio from 7.7 to 0.7 over five years, reflecting prudent financial management. Despite a dip in half-year sales to RON 2.89 billion from RON 4.53 billion the previous year, net income remained robust at RON 257 million compared to RON 267 million previously, highlighting resilience amidst fluctuating revenues.

- Navigate through the intricacies of CNTEE Transelectrica with our comprehensive health report here.

Gain insights into CNTEE Transelectrica's past trends and performance with our Past report.

GRK Infra Oyj (HLSE:GRK)

Simply Wall St Value Rating: ★★★★★★

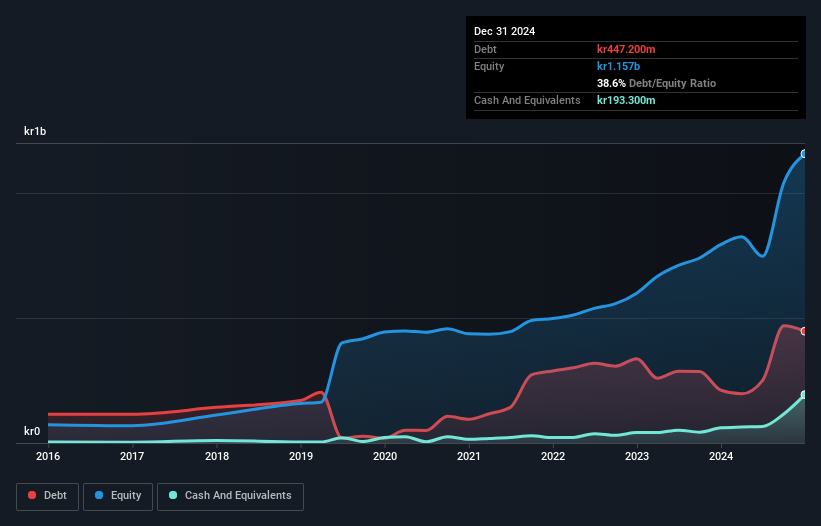

Overview: GRK Infra Oyj is a company that offers infrastructure construction services across Finland, Sweden, and Estonia, with a market capitalization of €571.44 million.

Operations: GRK Infra Oyj generates revenue primarily from its heavy construction segment, which amounted to €844.38 million.

GRK Infra Oyj, a nimble player in the construction sector, has shown remarkable financial resilience. Its debt to equity ratio has decreased from 30.2% to 16.2% over five years, and it holds more cash than total debt, suggesting strong financial health. The company is trading at about 31.6% below fair value estimates and boasts high-quality earnings with an impressive growth of 80.1% over the past year—outpacing the industry average of 6%. Recent strategic projects like renovating national road 21 and winning the Oxberg bridge contract highlight GRK's expanding footprint in critical infrastructure development across Europe.

- Click to explore a detailed breakdown of our findings in GRK Infra Oyj's health report.

Examine GRK Infra Oyj's past performance report to understand how it has performed in the past.

Norbit (OB:NORBT)

Simply Wall St Value Rating: ★★★★★☆

Overview: Norbit ASA offers technology solutions across various industries and has a market capitalization of NOK 12.60 billion.

Operations: Norbit ASA's revenue streams are primarily derived from its Oceans, Connectivity, and Product Innovation and Realization (PIR) segments, generating NOK 899.10 million, NOK 579.40 million, and NOK 717.10 million respectively. The company's net profit margin is a key financial metric to consider when evaluating its profitability.

Norbit, a nimble player in the tech sector, has shown remarkable earnings growth of 116%, outpacing its industry. Its net debt to equity ratio is satisfactory at 22.9%, ensuring financial stability while EBIT covers interest payments comfortably at 13.7x. Recent contracts worth NOK 220 million from the defense sector underscore its expanding footprint and promising revenue trajectory. With sales hitting NOK 684 million for Q2, up from NOK 419 million last year, Norbit's profitability is evident in net income rising to NOK 131 million versus NOK 72 million previously. This financial health supports strategic investments and market expansion efforts effectively.

Turning Ideas Into Actions

- Click through to start exploring the rest of the 327 European Undiscovered Gems With Strong Fundamentals now.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:GRK

GRK Infra Oyj

Provides infrastructure construction services in Finland, Sweden, and Estonia.

Outstanding track record with flawless balance sheet.

Market Insights

Community Narratives