Oma Säästöpankki (HLSE:OMASP) Margin Decline Challenges “Steady Value” Narrative Despite Low P/E

Reviewed by Simply Wall St

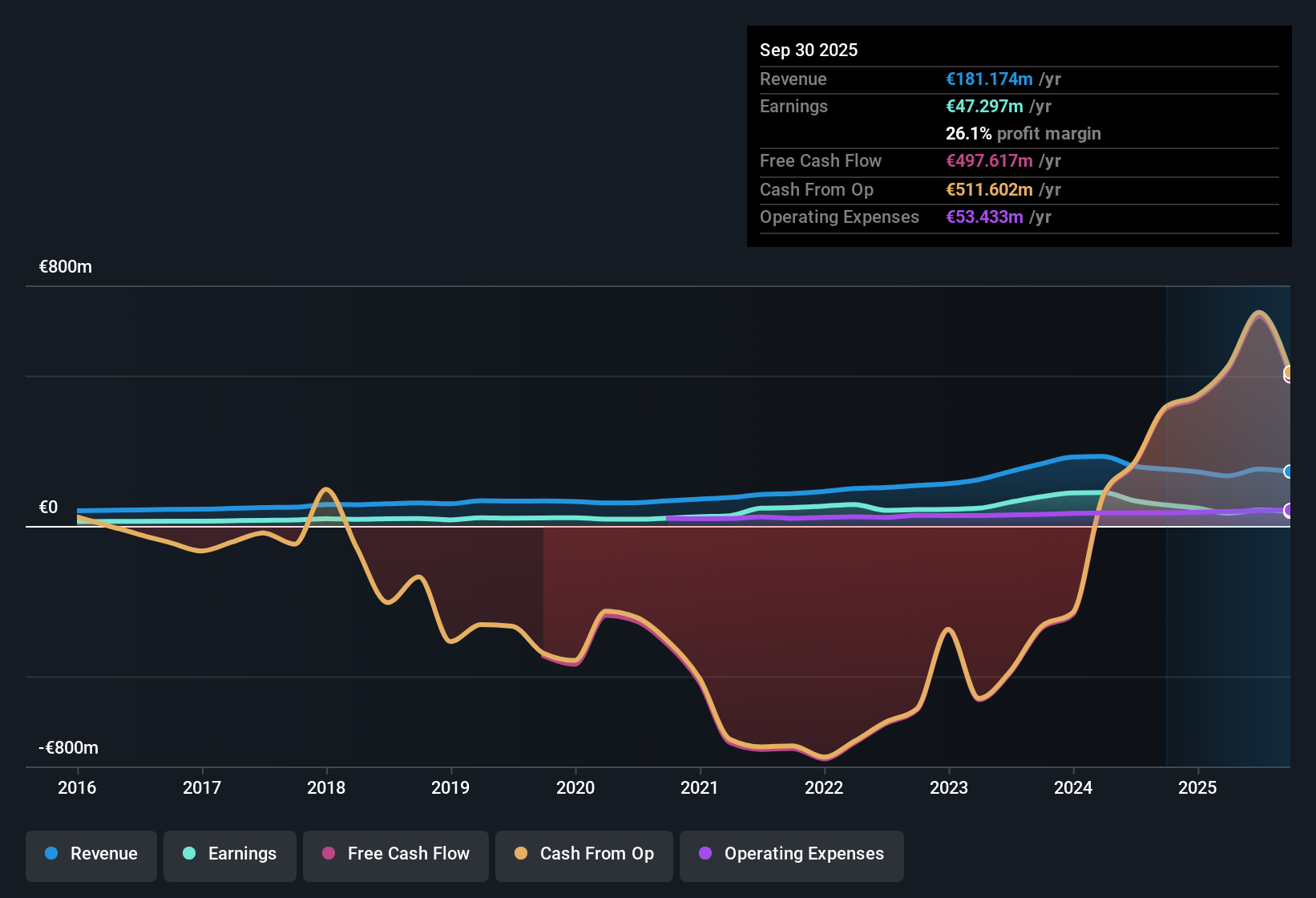

Oma Säästöpankki Oyj (HLSE:OMASP) posted annual earnings growth of 8.7% over the past five years. However, the latest data highlights a turn to negative growth and a notable margin squeeze, with net profit margins down to 26.1% from last year’s 36.9%. The stock currently trades at €10.56, well below the estimated fair value of €30.44, and the company’s Price-To-Earnings Ratio of 7.4x is considerably under the sector average. With forecasts pointing to more modest revenue and earnings growth compared to the Finnish market, the focus now shifts to OMASP’s disciplined valuation, continued profitability, and how investors view these results in light of slowing momentum.

See our full analysis for Oma Säästöpankki Oyj.Next, we’re diving into how these numbers stack up against Simply Wall St’s most widely followed narratives for OMASP. Some will be validated, while others might face some sharp questions.

Curious how numbers become stories that shape markets? Explore Community Narratives

Margin Compression Hits Despite High Earnings Quality

- Net profit margins slid to 26.1% from 36.9% a year ago, reflecting significant pressure on profitability even as earnings quality is still described as high in the filings.

- Stable operational resilience continues to define OMASP. Analysis highlights how a disciplined and drama-free approach helps win cautious investors.

- Investors seeking defensive exposure to Finnish banking find the company’s steadiness appealing, especially in light of broader sector volatility.

- However, the sharp margin contraction stands out against the narrative of quiet strength. This means cautious optimism is warranted for those focusing on sustainability of earnings.

P/E Remains a Major Value Hook

- OMASP’s Price-To-Earnings Ratio sits at 7.4x, which is noticeably below both the European banking industry average (10x) and its peer group (13.8x). This underscores a pronounced discount to comparable companies.

- Prevailing analysis highlights that this steep value gap could attract more retail and value-oriented investors.

- A steep discount aligns with the narrative of OMASP as an under-the-radar quality pick in a sector that prizes stability, particularly since recent news coverage centers on operational steadiness rather than negative developments.

- However, lagging forecasted revenue and earnings growth, especially at 1.4% and 4.2% per year versus the Finnish market’s 4.2% and 17.3%, may keep excitement tempered for growth-focused buyers.

Dividends Flag Long-Term Income Risk

- Sustainability of future dividends is listed as a key risk, putting income visibility into question despite the company’s positive absolute and relative value metrics.

- Recent analysis stresses the importance of monitoring income stability.

- The company’s balance of good value and ongoing profit forecasts is attractive, but income-focused investors are urged to pay close attention to the flagged risk around dividend consistency.

- This tension means the story is not just about cheapness; it is about whether value can hold up if near-term earnings developments impact payouts.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Oma Säästöpankki Oyj's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

While OMASP trades at a discount and boasts steady operations, sharp margin compression and questions about dividend sustainability introduce uncertainty for income-focused investors.

If you want more reliable income streams, check out these 1970 dividend stocks with yields > 3% to discover companies offering greater dividend consistency and higher yield potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:OMASP

Oma Säästöpankki Oyj

Provides banking products and services to private customers, small and medium-sized enterprises, and agriculture and forestry entrepreneurs in Finland.

Undervalued with mediocre balance sheet.

Market Insights

Community Narratives