Assessing Nordea Bank Valuation After Strategic Digital Push and 41.7% Share Price Surge

Reviewed by Bailey Pemberton

- Wondering if Nordea Bank Abp is undervalued, or if the recent excitement is justified? You are not alone, especially as investors search for opportunities in a strong performing sector.

- The stock has delivered an impressive 41.7% return over the past year and is up 33.6% year to date, even with a recent dip of 3.6% in the last week. This puts future prospects top of mind.

- Recent headlines have highlighted Nordea Bank Abp's active role in shaping the Nordic banking landscape, including strategic branch consolidations and a focus on digital initiatives. Both of these factors have kept it in the spotlight and may have played a part in the latest share price swings.

- As for value, Nordea Bank Abp scores just 2 out of 6 on our undervaluation checklist. However, numbers only tell part of the story, so let us break down the standard valuation approaches and hint at a more insightful angle later in the article.

Nordea Bank Abp scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Nordea Bank Abp Excess Returns Analysis

The Excess Returns valuation model looks at how much return a company generates above the cost of equity for each euro invested by shareholders. In other words, it measures whether Nordea Bank Abp is producing meaningful value from its capital after accounting for the cost of funding that capital.

According to this approach, key metrics for Nordea Bank Abp are as follows:

- Book Value: €9.16 per share

- Stable EPS: €1.45 per share (Source: Weighted future Return on Equity estimates from 14 analysts.)

- Cost of Equity: €0.66 per share

- Excess Return: €0.78 per share

- Average Return on Equity: 14.72%

- Stable Book Value: €9.82 per share (Source: Weighted future Book Value estimates from 2 analysts.)

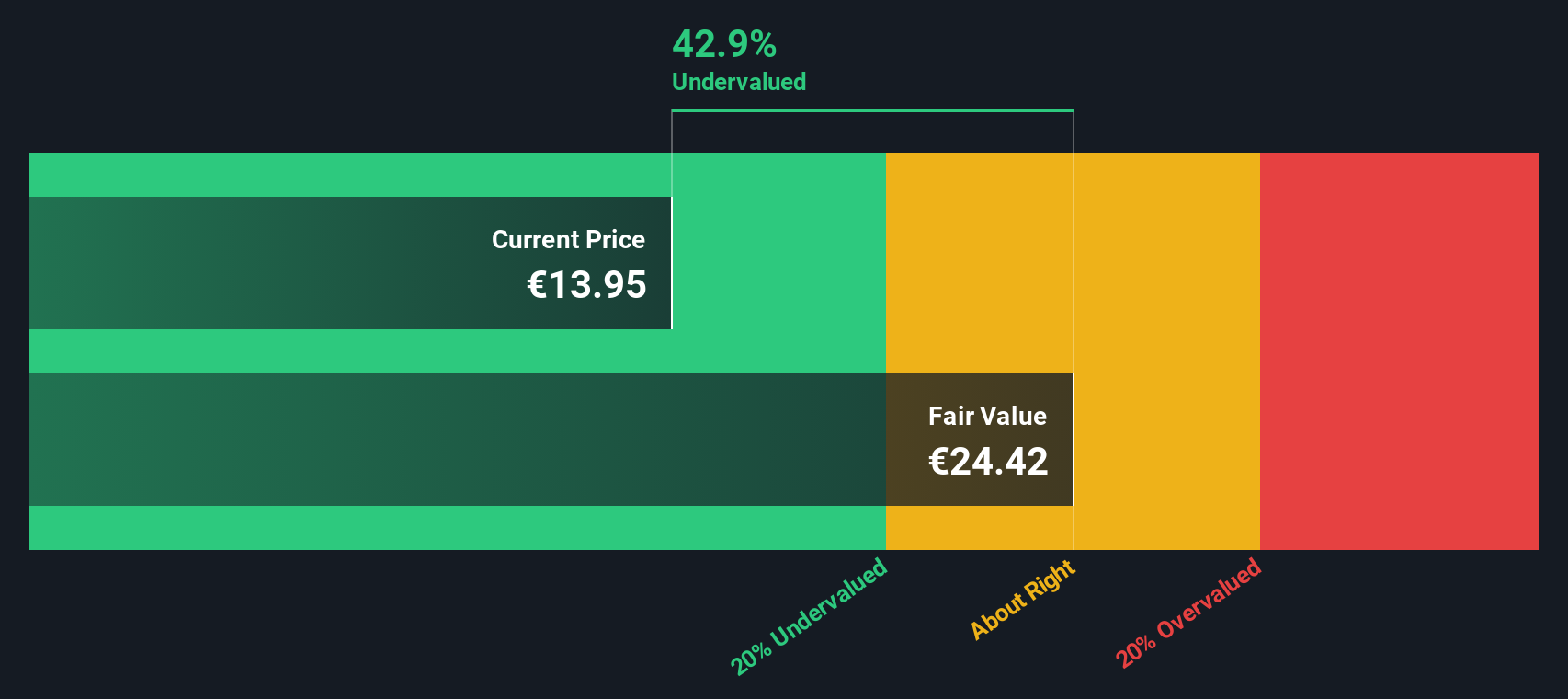

This model finds the stock’s intrinsic value by projecting future earnings and comparing them to the cost of equity. When the company’s returns consistently exceed the cost of equity, it signals strong value creation potential for shareholders. Nordea Bank Abp’s intrinsic value is estimated at €25.62 per share. This suggests the current market price is 44.3% below its true worth.

Based on this analysis, Nordea Bank Abp appears significantly undervalued according to the excess returns approach.

Result: UNDERVALUED

Our Excess Returns analysis suggests Nordea Bank Abp is undervalued by 44.3%. Track this in your watchlist or portfolio, or discover 840 more undervalued stocks based on cash flows.

Approach 2: Nordea Bank Abp Price vs Earnings

The price-to-earnings (PE) ratio is a time-tested valuation tool for profitable companies like Nordea Bank Abp. It tells investors how much they are paying for each euro of current earnings, making it a useful metric when consistent profitability is present. PE ratios also reflect market expectations. Higher ratios can signal greater anticipated growth, while lower ratios may indicate market caution or higher perceived risk.

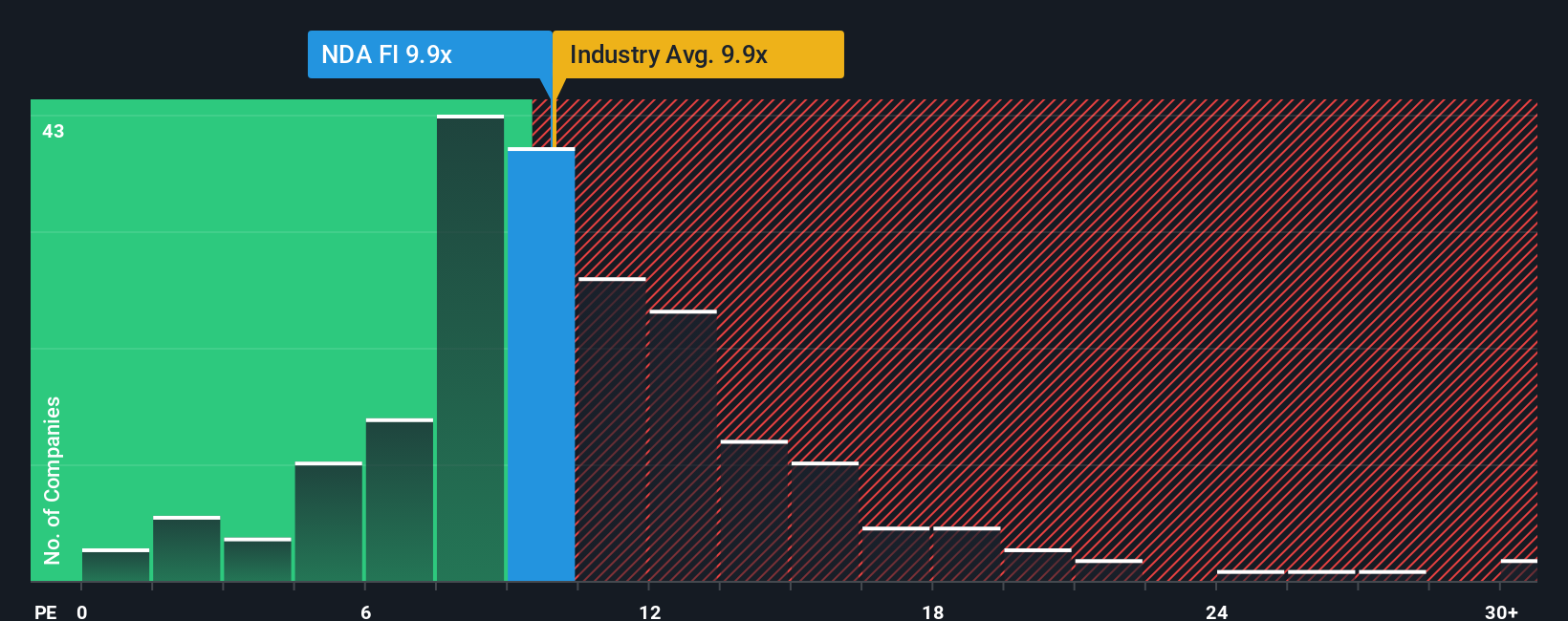

As of now, Nordea Bank Abp trades at a PE ratio of 10.2x. For comparison, the average PE ratio among its banking sector peers sits at 10.0x, while the broader industry average stands slightly higher at 10.2x. These figures suggest Nordea is valued in line with its industry and fellow banks.

Simply Wall St's “Fair Ratio” digs deeper than standard comparisons. This proprietary figure weighs multiple factors specific to Nordea, such as its earnings growth outlook, profit margins, industry norms, company size, and risk profile, to estimate what a truly justified multiple would be. In Nordea’s case, the Fair Ratio is 9.6x, which is just a hair below its current PE. Since the gap is less than 0.10x, this indicates the market price already reflects the company’s fundamentals, growth, and risk profile quite accurately.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1411 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Nordea Bank Abp Narrative

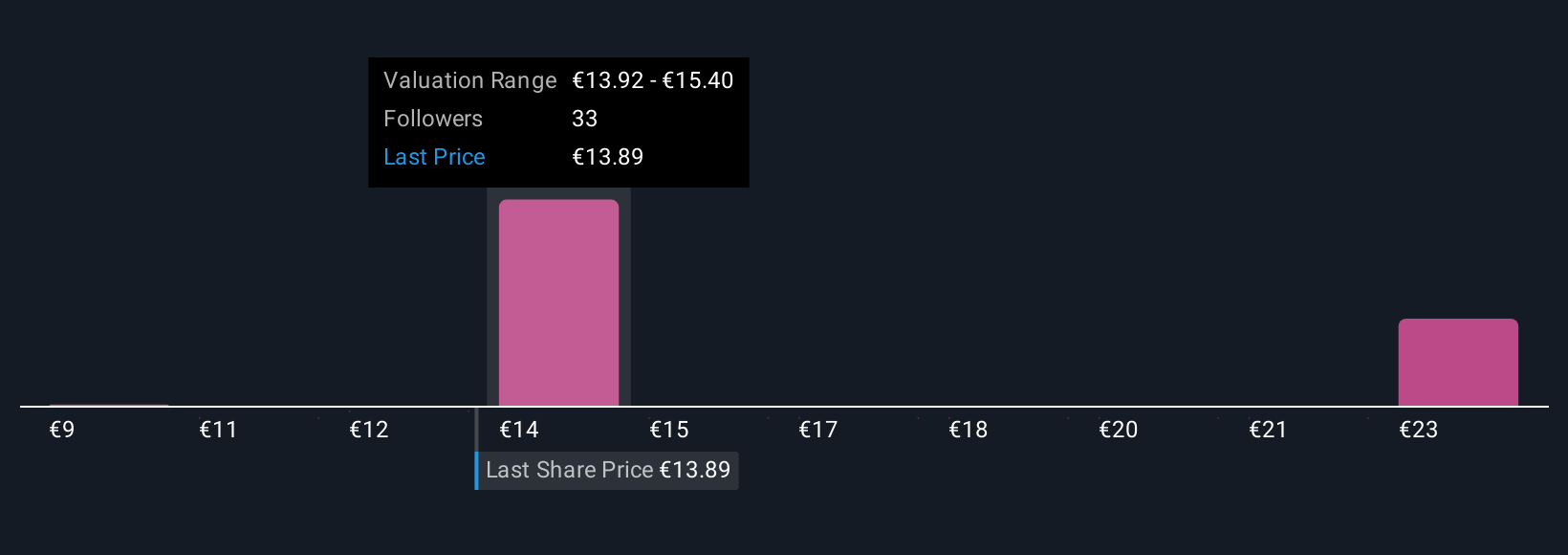

Earlier we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives. A Narrative takes the story you have about Nordea Bank Abp, connects it to your beliefs about its future revenue, earnings, and margins, and translates these assumptions into a personalized fair value. This all comes together in one easy and accessible tool available on Simply Wall St’s Community page, trusted by millions of investors worldwide.

Unlike conventional valuation models, Narratives bring together your perspective and the numbers, helping you track how your own view compares to the current share price so you can make more informed calls about when it might be time to buy or sell. They are dynamic as well: as new information such as earnings releases or news headlines arrive, your Narrative updates automatically, ensuring your analysis always stays relevant.

For example, some investors may craft a bullish Narrative for Nordea Bank Abp, assuming strong long-term digitalization and robust wealth management trends, leading to a fair value estimate as high as €16.20 per share. Others may factor in regional risks or margin pressures and set their fair value as low as €11.80. Narratives empower you to test your own assumptions and see, in real time, how your valuation stands alongside those of others in the market.

Do you think there's more to the story for Nordea Bank Abp? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nordea Bank Abp might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:NDA FI

Nordea Bank Abp

Offers banking products and services for individuals, families, and businesses in Sweden, Finland, Norway, Denmark, and internationally.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives