A Fresh Look at Nordea Bank (HLSE:NDA FI) Valuation Following Steady Share Price Performance

Reviewed by Simply Wall St

Nordea Bank Abp (HLSE:NDA FI) shares have held relatively steady in recent sessions, closing at €14.45. While the stock has not experienced a dramatic shift due to a major event, investors may find interest in its recent performance trends.

See our latest analysis for Nordea Bank Abp.

Nordea Bank Abp’s share price has rallied significantly since the start of the year, now up 35.2% year-to-date. With a one-year total shareholder return of 45.4% and a three-year return approaching 87%, momentum has clearly been building. This may indicate renewed investor confidence in the bank’s growth prospects.

If steady gains like these are catching your attention, it could be the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

With shares climbing and recent returns outpacing the market, the key question now is whether Nordea Bank Abp remains undervalued or if the market has already factored in all future growth. This may leave little room for upside.

Most Popular Narrative: 5.8% Undervalued

Nordea Bank Abp’s most closely-followed narrative puts fair value at €15.34, slightly above the last close price of €14.45, suggesting room for upside according to these projections.

Nordea's disciplined focus on efficiency and capital optimization, with cost-to-income ratio maintained around 46% and continued active capital return via buybacks, creates strong potential for sustained EPS and ROE outperformance, especially as secular shifts toward digital and sustainable banking accelerate revenue opportunities.

The forecast powering this narrative is not built on wishful thinking. Imagine efficient capital return, rising margins, and a premium profit multiple. Yet the true pace of buyback-fueled growth and margin gains is hidden just out of view. Want to find out what’s really baked into analysts’ bold target?

Result: Fair Value of €15.34 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent margin compression or region-specific economic slowdowns could quickly disrupt the optimistic outlook currently reflected in Nordea’s shares.

Find out about the key risks to this Nordea Bank Abp narrative.

Another View: What Do Market Valuation Ratios Say?

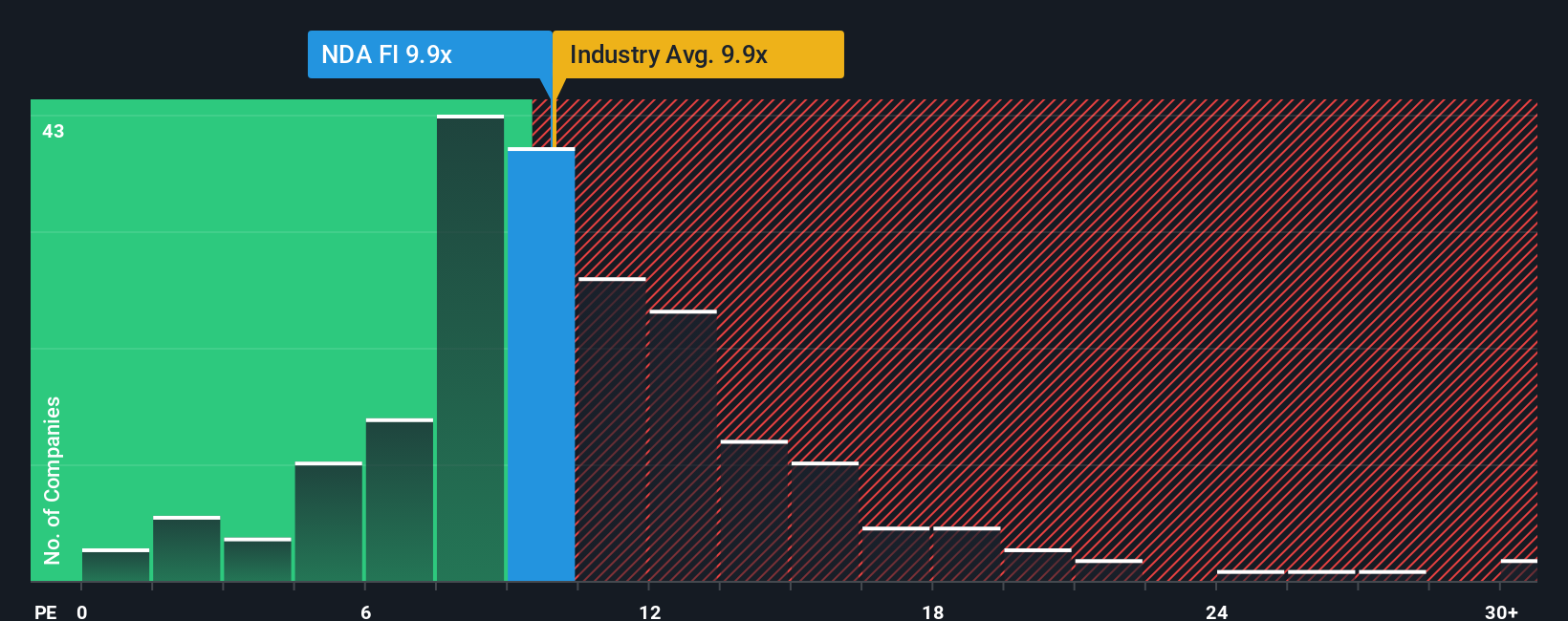

Looking at Nordea Bank Abp’s valuation through the lens of price-to-earnings, the shares trade at 10.4x, making them pricier than both the European Banks industry average of 9.9x and peer average of 9x. The company's fair ratio, which indicates where the market could head, is 9.6x. This suggests the stock is less of a bargain on this metric and invites caution, as markets can adjust quickly.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Nordea Bank Abp Narrative

If you see things differently or want to dive deeper into the numbers, you can quickly craft your own perspective on Nordea Bank Abp’s story in just a few minutes. Do it your way

A great starting point for your Nordea Bank Abp research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let great opportunities slip through your fingers when fresh investment ideas are right at your fingertips. The next outperformer could be just a few clicks away.

- Capture higher yields by checking out these 18 dividend stocks with yields > 3%, offering consistent payouts over 3% and a record of reliable performance.

- Jump on the fast-moving wave of innovation with these 27 AI penny stocks, driving growth through artificial intelligence, automation, and smart technologies.

- Spot overlooked value by scanning these 904 undervalued stocks based on cash flows, trading below intrinsic worth and positioned for future upside.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nordea Bank Abp might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:NDA FI

Nordea Bank Abp

Offers banking products and services for individuals, families, and businesses in Sweden, Finland, Norway, Denmark, and internationally.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives