- Finland

- /

- Auto Components

- /

- HLSE:TYRES

Nokian Tyres (HLSE:TYRES): Losses Accelerate 61.2% Annually, Raising Fresh Doubts on Turnaround Hopes

Reviewed by Simply Wall St

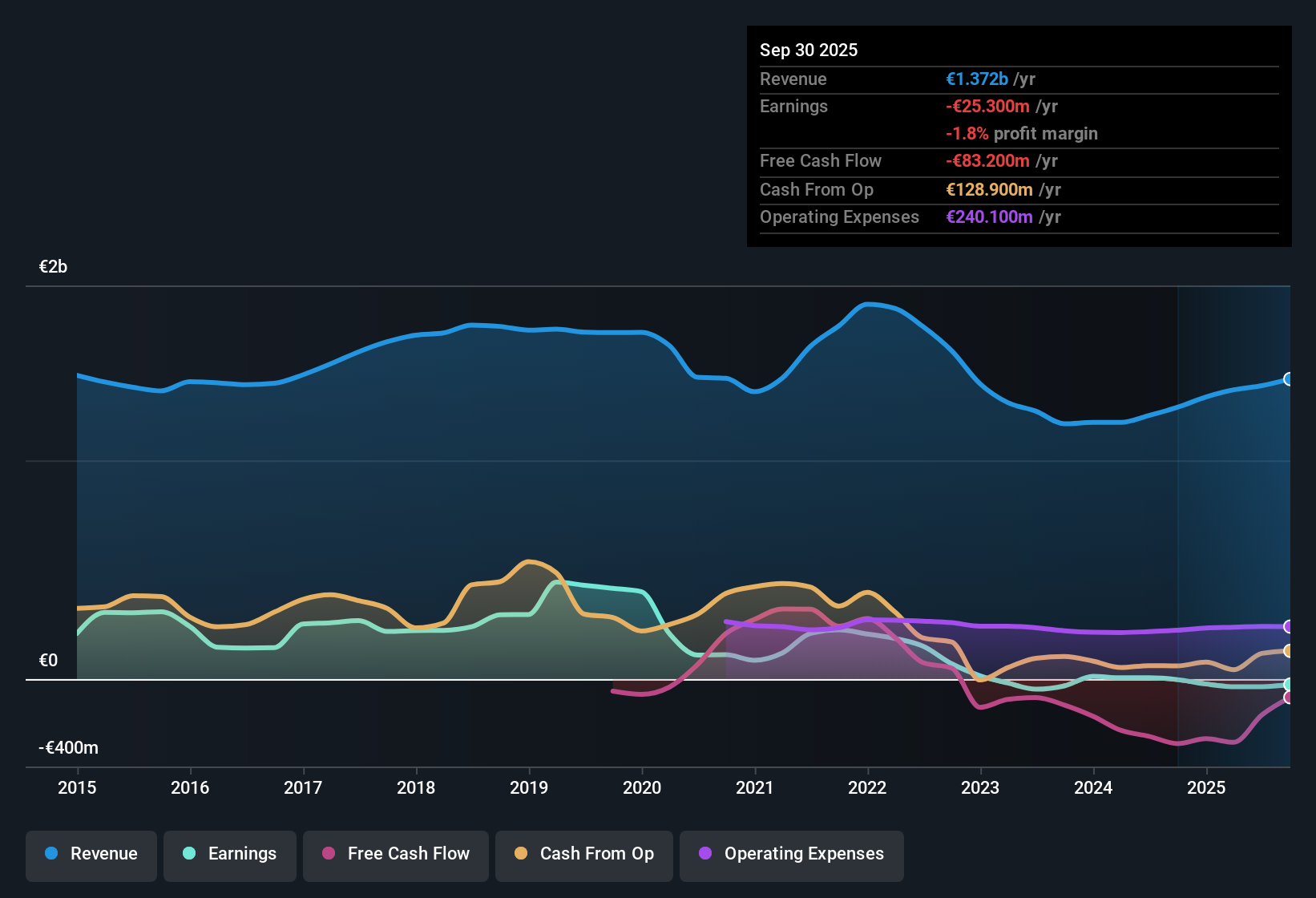

Nokian Renkaat Oyj (HLSE:TYRES) remains unprofitable, with annual losses increasing by 61.2% per year over the past five years. However, analysts forecast a sharp turnaround, with earnings expected to grow 81.4% per year and the company projected to return to profitability within the next three years, outpacing the broader market's growth expectations. The company’s top line is also set for solid improvement, as revenue is forecast to grow at 8.4% per year, more than double the Finnish market average. Shares currently trade at €8.96, well below an estimated fair value of €19.45.

See our full analysis for Nokian Renkaat Oyj.Now, let’s see how these headline results measure up against the most widely held narratives and views around Nokian Renkaat, spotlighting where expectations and reality might collide.

Curious how numbers become stories that shape markets? Explore Community Narratives

Losses Accelerate Despite Recovery Talk

- Annual losses have been rising at a pace of 61.2% per year over the last five years, which signals the company's struggle to control costs against ongoing operational changes.

- Optimism about a turnaround centers on the expectation of earnings growing 81.4% per year and returning to profitability within three years.

- Ambitious margin recovery stories focus on significant forecasted earnings growth compared to the company’s current, deepening loss trajectory.

- Prevailing positive perspectives depend on actual earnings reversing course soon. However, with losses still mounting at such a rapid rate, the optimism is yet to be substantiated by hard numbers.

Balance Sheet and Dividend Risks Underline Doubts

- The EDGAR summary flags the company’s financial position and dividend sustainability as noteworthy risk areas, making its path to stable growth less certain for investors.

- Concerns revolve around whether cash reserves and future cash flow can support present operations and ongoing dividend commitments.

- Market watchers keep a close eye on any signals of tightening liquidity or payout strain, given the flagged risk on dividends and financial health.

- Skeptics point out that without visible improvements in these areas, the recovery narrative faces tough questions about real-world execution.

Premium Price Tags Versus Industry Peers

- Nokian Renkaat’s Price-To-Sales Ratio stands at 0.9x, which tops both its peers (average 0.7x) and the broader European auto components industry (average 0.3x), suggesting a valuation premium that is hard to overlook for bargain-hunting investors.

- Public discussion highlights how this premium could be justified only if the company not only delivers its aggressive recovery but also continues to outpace the sector.

- The stock’s €8.96 share price sits well below its DCF fair value of €19.45, presenting an apparent upside, but the premium to industry valuation metrics keeps some investors on the sidelines awaiting clearer evidence of execution.

- Some point out that unless revenue and margin gains start to materialize soon, the market may keep applying a discount relative to the sector regardless of headline fair value estimates.

For a deeper dive into how investors are interpreting these mixed signals versus industry benchmarks, check the latest consensus narrative for a balanced perspective. 📊 Read the full Nokian Renkaat Oyj Consensus Narrative.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Nokian Renkaat Oyj's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

Explore Alternatives

Nokian Renkaat Oyj faces mounting losses and persistent balance sheet risks, which raises doubts about its ability to sustain operations and future dividends.

If you don’t want to compromise on financial strength, check out solid balance sheet and fundamentals stocks screener (1980 results) to focus on companies with stronger balance sheets and healthier fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nokian Renkaat Oyj might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:TYRES

Nokian Renkaat Oyj

Develops and manufactures tires for passenger cars, trucks, and heavy machineries in Nordics, the rest of Europe, the Americas, and internationally.

Reasonable growth potential and slightly overvalued.

Market Insights

Community Narratives