- Finland

- /

- Auto Components

- /

- HLSE:TYRES

Nokian Renkaat Oyj's (HEL:TYRES) Has Been On A Rise But Financial Prospects Look Weak: Is The Stock Overpriced?

Most readers would already be aware that Nokian Renkaat Oyj's (HEL:TYRES) stock increased significantly by 9.9% over the past month. However, we decided to pay close attention to its weak financials as we are doubtful that the current momentum will keep up, given the scenario. Particularly, we will be paying attention to Nokian Renkaat Oyj's ROE today.

Return on equity or ROE is an important factor to be considered by a shareholder because it tells them how effectively their capital is being reinvested. In simpler terms, it measures the profitability of a company in relation to shareholder's equity.

See our latest analysis for Nokian Renkaat Oyj

How Is ROE Calculated?

The formula for ROE is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Nokian Renkaat Oyj is:

0.9% = €13m ÷ €1.3b (Based on the trailing twelve months to December 2023).

The 'return' is the profit over the last twelve months. Another way to think of that is that for every €1 worth of equity, the company was able to earn €0.01 in profit.

What Is The Relationship Between ROE And Earnings Growth?

So far, we've learned that ROE is a measure of a company's profitability. Depending on how much of these profits the company reinvests or "retains", and how effectively it does so, we are then able to assess a company’s earnings growth potential. Assuming all else is equal, companies that have both a higher return on equity and higher profit retention are usually the ones that have a higher growth rate when compared to companies that don't have the same features.

A Side By Side comparison of Nokian Renkaat Oyj's Earnings Growth And 0.9% ROE

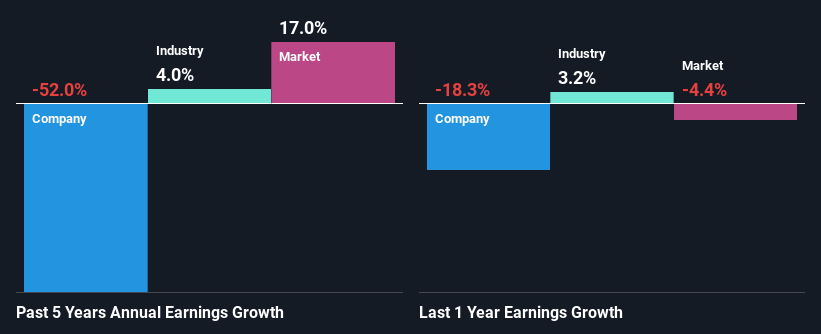

It is quite clear that Nokian Renkaat Oyj's ROE is rather low. Not just that, even compared to the industry average of 8.5%, the company's ROE is entirely unremarkable. Given the circumstances, the significant decline in net income by 52% seen by Nokian Renkaat Oyj over the last five years is not surprising. We reckon that there could also be other factors at play here. Such as - low earnings retention or poor allocation of capital.

However, when we compared Nokian Renkaat Oyj's growth with the industry we found that while the company's earnings have been shrinking, the industry has seen an earnings growth of 4.0% in the same period. This is quite worrisome.

Earnings growth is an important metric to consider when valuing a stock. The investor should try to establish if the expected growth or decline in earnings, whichever the case may be, is priced in. By doing so, they will have an idea if the stock is headed into clear blue waters or if swampy waters await. Is TYRES fairly valued? This infographic on the company's intrinsic value has everything you need to know.

Is Nokian Renkaat Oyj Efficiently Re-investing Its Profits?

Nokian Renkaat Oyj's declining earnings is not surprising given how the company is spending most of its profits in paying dividends, judging by its three-year median payout ratio of 74% (or a retention ratio of 26%). The business is only left with a small pool of capital to reinvest - A vicious cycle that doesn't benefit the company in the long-run.

Additionally, Nokian Renkaat Oyj has paid dividends over a period of at least ten years, which means that the company's management is determined to pay dividends even if it means little to no earnings growth. Upon studying the latest analysts' consensus data, we found that the company's future payout ratio is expected to drop to 58% over the next three years. The fact that the company's ROE is expected to rise to 7.6% over the same period is explained by the drop in the payout ratio.

Conclusion

Overall, we would be extremely cautious before making any decision on Nokian Renkaat Oyj. The company has seen a lack of earnings growth as a result of retaining very little profits and whatever little it does retain, is being reinvested at a very low rate of return. Having said that, looking at current analyst estimates, we found that the company's earnings growth rate is expected to see a huge improvement. To know more about the company's future earnings growth forecasts take a look at this free report on analyst forecasts for the company to find out more.

Valuation is complex, but we're here to simplify it.

Discover if Nokian Renkaat Oyj might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About HLSE:TYRES

Nokian Renkaat Oyj

Develops and manufactures tires for passenger cars, trucks, and heavy machineries in Nordics, the rest of Europe, the Americas, and internationally.

Reasonable growth potential and slightly overvalued.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026