- Spain

- /

- Renewable Energy

- /

- BME:SLR

Solaria Energía (BME:SLR) Surges After Net Income Jumps on Higher Revenue—Is Profitability the New Growth Engine?

Reviewed by Sasha Jovanovic

- Solaria Energía y Medio Ambiente has released its earnings results for the nine months ended September 30, 2025, reporting €258.91 million in revenue and €141.67 million in net income, both sharply higher compared to the previous year.

- Despite a slight decline in sales, the company achieved a very large year-on-year increase in net income, highlighting a marked improvement in profitability.

- We'll examine how Solaria's surge in net income, amid higher revenue, affects the company's investment outlook and future growth expectations.

These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Solaria Energía y Medio Ambiente Investment Narrative Recap

Belief in Solaria Energía y Medio Ambiente centers on the company’s capacity to increase earnings as it expands solar generation and branches into new renewable segments, despite exposure to regulatory and financial risks. The sharp rise in net income for the first nine months of 2025 is a positive development, but it does not immediately resolve concerns about the impact of project finance dependence and interest rate sensitivity, which remains a key risk for near-term earnings stability.

Among recent company developments, Solaria’s ongoing construction of over 1.5 GW in new solar capacity is particularly relevant. This effort directly supports the anticipated boost in operational scale, which may underpin sustained revenue growth, but execution risks and the need for ongoing permitting and financing could influence how quickly these catalysts translate into results for shareholders.

However, investors should be aware that if access to financing tightens or project costs rise unexpectedly...

Read the full narrative on Solaria Energía y Medio Ambiente (it's free!)

Solaria Energía y Medio Ambiente is projected to achieve €351.8 million in revenue and €117.7 million in earnings by 2028. This forecasts an annual revenue growth rate of 18.7% and a €29.1 million increase in earnings from the current €88.6 million.

Uncover how Solaria Energía y Medio Ambiente's forecasts yield a €13.62 fair value, a 23% downside to its current price.

Exploring Other Perspectives

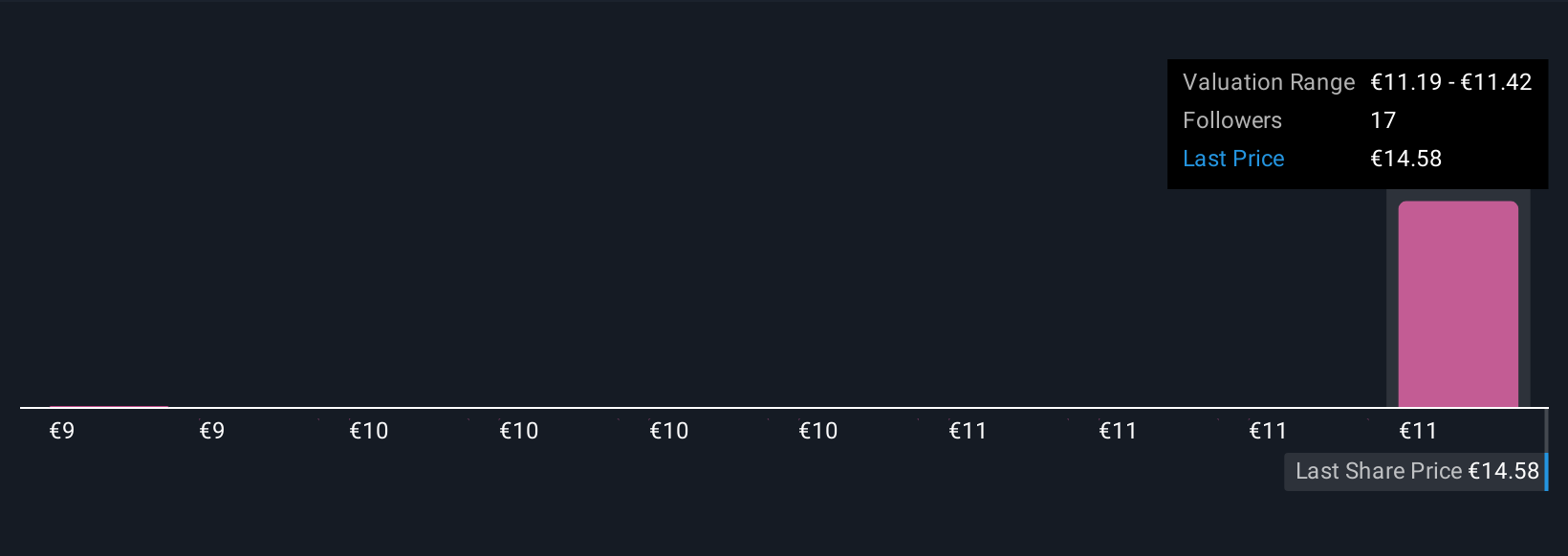

Simply Wall St Community members set fair value estimates for Solaria from €9.16 to €13.63, based on 2 detailed views. While the community sees a range of outcomes, the company’s reliance on project finance highlights how funding conditions could shape future results and investor returns, there is clear value in weighing multiple perspectives.

Explore 2 other fair value estimates on Solaria Energía y Medio Ambiente - why the stock might be worth as much as €13.62!

Build Your Own Solaria Energía y Medio Ambiente Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Solaria Energía y Medio Ambiente research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Solaria Energía y Medio Ambiente research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Solaria Energía y Medio Ambiente's overall financial health at a glance.

Searching For A Fresh Perspective?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:SLR

Solid track record and fair value.

Market Insights

Community Narratives