- Spain

- /

- Renewable Energy

- /

- BME:SLR

Solaria (BME:SLR): Assessing Valuation as Investor Optimism Lifts Shares Higher

Reviewed by Kshitija Bhandaru

Solaria Energía y Medio Ambiente (BME:SLR) has caught investors’ attention recently, with shares seeing a steady move higher this week. The stock's momentum stands out when looking at recent performance compared to peers in the utilities sector.

See our latest analysis for Solaria Energía y Medio Ambiente.

Solaria’s share price has picked up modestly over recent months, outpacing many competitors in its sector and reflecting renewed optimism from investors. While the one-year total shareholder return sits virtually flat, the upward momentum in the past quarter hints at a shift in sentiment around growth prospects and risk appetite.

If this shift makes you curious about other standout opportunities, now is a great moment to broaden your watchlist and discover fast growing stocks with high insider ownership

With shares rising sharply in recent months, the question for investors is whether Solaria’s current price reflects real undervaluation, or if growing optimism means future gains are already factored in. Is there still an opportunity here?

Most Popular Narrative: 16% Overvalued

At a fair value estimate of €11.42, the most widely followed narrative puts Solaria Energía y Medio Ambiente’s shares about 16% below the last close of €13.22. The latest consensus reflects shifting analyst expectations that could have major implications for current investors.

Solaria's diversification into real estate associated with renewables, Generia, and the data center business is expected to be a significant catalyst for future growth. This is anticipated to support increased revenue and expanding margins over time.

Want to know which bold financial bets are powering this new outlook? The key element of this narrative is aggressive expansion and a strategic shift beyond solar. Intrigued about the core assumptions fueling this valuation, and how revenue and margins play into the story? Dive in now to uncover the surprising growth ambitions that are moving the needle behind this fair value.

Result: Fair Value of €11.42 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, potential tax changes and the company’s reliance on project finance could both quickly shift analyst forecasts and change the outlook for the future.

Find out about the key risks to this Solaria Energía y Medio Ambiente narrative.

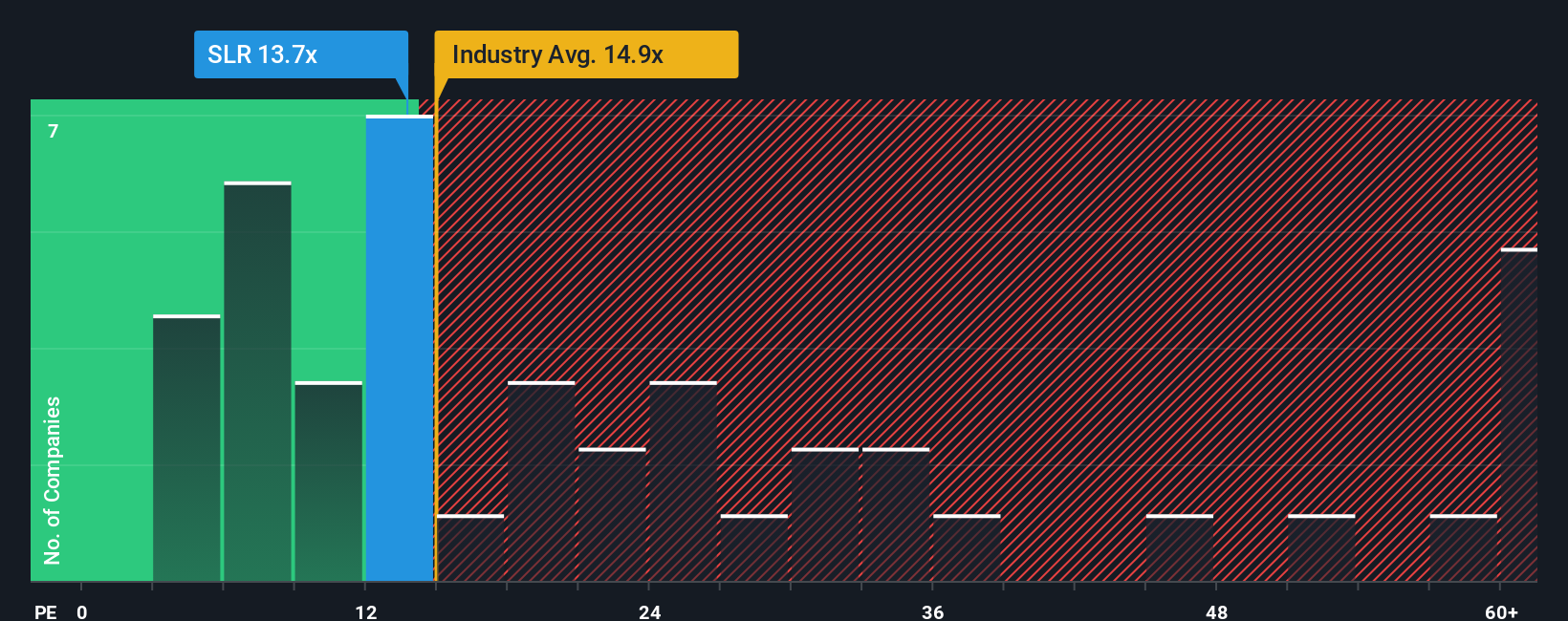

Another View: Look at the Multiples

Switching gears from analyst targets to price-earnings comparisons, Solaria is trading at 12.8x earnings, which is much lower than the European Renewable Energy industry average of 14.4x, its peer group at 24.7x, and even below the market-based fair ratio of 15.6x. This signals potential undervaluation, but are investors overlooking lingering risks or is there hidden value yet to be revealed?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Solaria Energía y Medio Ambiente Narrative

If you see things differently or want to dig into the numbers yourself, it's easy to build your own perspective in just a few minutes. Do it your way

A great starting point for your Solaria Energía y Medio Ambiente research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Shake up your portfolio with fresh opportunities that you’ll want to grab before others spot them. There has never been a smarter time to take control of your investing strategy.

- Catch emerging innovators and seize your chance in the tech revolution by tapping into these 24 AI penny stocks that are driving breakthroughs in automation and machine learning.

- Lock in steady returns with smart picks among these 19 dividend stocks with yields > 3% that offer reliable yields and can help power up your income, even when markets get choppy.

- Jump on the edge of the digital frontier and ride the momentum behind these 78 cryptocurrency and blockchain stocks shaping the future of finance and blockchain technology.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:SLR

Solid track record and fair value.

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success