- Spain

- /

- Renewable Energy

- /

- BME:SLR

Here's Why I Think Solaria Energía y Medio Ambiente (BME:SLR) Might Deserve Your Attention Today

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in Solaria Energía y Medio Ambiente (BME:SLR). While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

Check out our latest analysis for Solaria Energía y Medio Ambiente

Solaria Energía y Medio Ambiente's Earnings Per Share Are Growing.

As one of my mentors once told me, share price follows earnings per share (EPS). Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. Impressively, Solaria Energía y Medio Ambiente has grown EPS by 28% per year, compound, in the last three years. This has no doubt fuelled the optimism that sees the stock trading on a high multiple of earnings.

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. I note that, last year, Solaria Energía y Medio Ambiente's revenue from operations was lower than its revenue, so that could distort my analysis of its margins. The good news is that Solaria Energía y Medio Ambiente is growing revenues, and EBIT margins improved by 16.6 percentage points to 69%, over the last year. Ticking those two boxes is a good sign of growth, in my book.

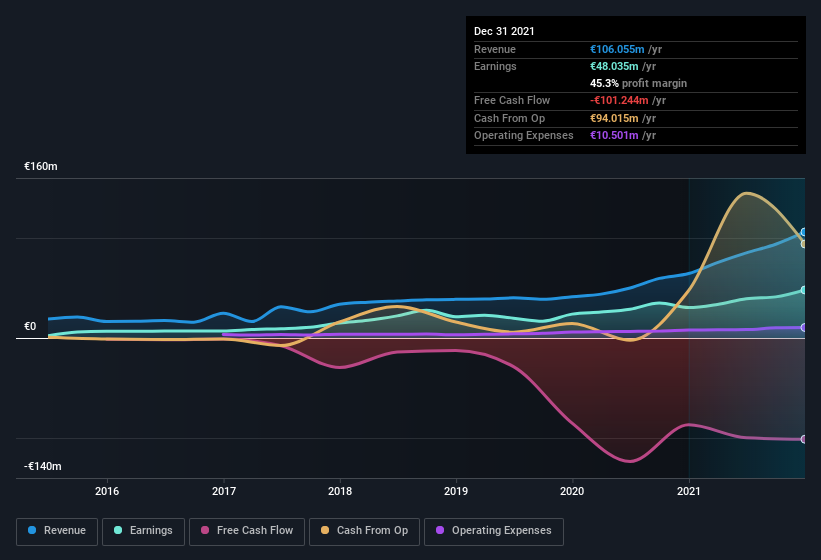

In the chart below, you can see how the company has grown earnings, and revenue, over time. For finer detail, click on the image.

Of course the knack is to find stocks that have their best days in the future, not in the past. You could base your opinion on past performance, of course, but you may also want to check this interactive graph of professional analyst EPS forecasts for Solaria Energía y Medio Ambiente.

Are Solaria Energía y Medio Ambiente Insiders Aligned With All Shareholders?

I like company leaders to have some skin in the game, so to speak, because it increases alignment of incentives between the people running the business, and its true owners. As a result, I'm encouraged by the fact that insiders own Solaria Energía y Medio Ambiente shares worth a considerable sum. To be specific, they have €20m worth of shares. That's a lot of money, and no small incentive to work hard. Despite being just 0.7% of the company, the value of that investment is enough to show insiders have plenty riding on the venture.

Is Solaria Energía y Medio Ambiente Worth Keeping An Eye On?

Given my belief that share price follows earnings per share you can easily imagine how I feel about Solaria Energía y Medio Ambiente's strong EPS growth. Further, the high level of insider ownership impresses me, and suggests that I'm not the only one who appreciates the EPS growth. So this is very likely the kind of business that I like to spend time researching, with a view to discerning its true value. You still need to take note of risks, for example - Solaria Energía y Medio Ambiente has 3 warning signs (and 2 which are concerning) we think you should know about.

Although Solaria Energía y Medio Ambiente certainly looks good to me, I would like it more if insiders were buying up shares. If you like to see insider buying, too, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BME:SLR

Solid track record and fair value.

Market Insights

Community Narratives