- Spain

- /

- Gas Utilities

- /

- BME:NTGY

Naturgy Energy Group, S.A. (BME:NTGY) Just Released Its Third-Quarter Earnings: Here's What Analysts Think

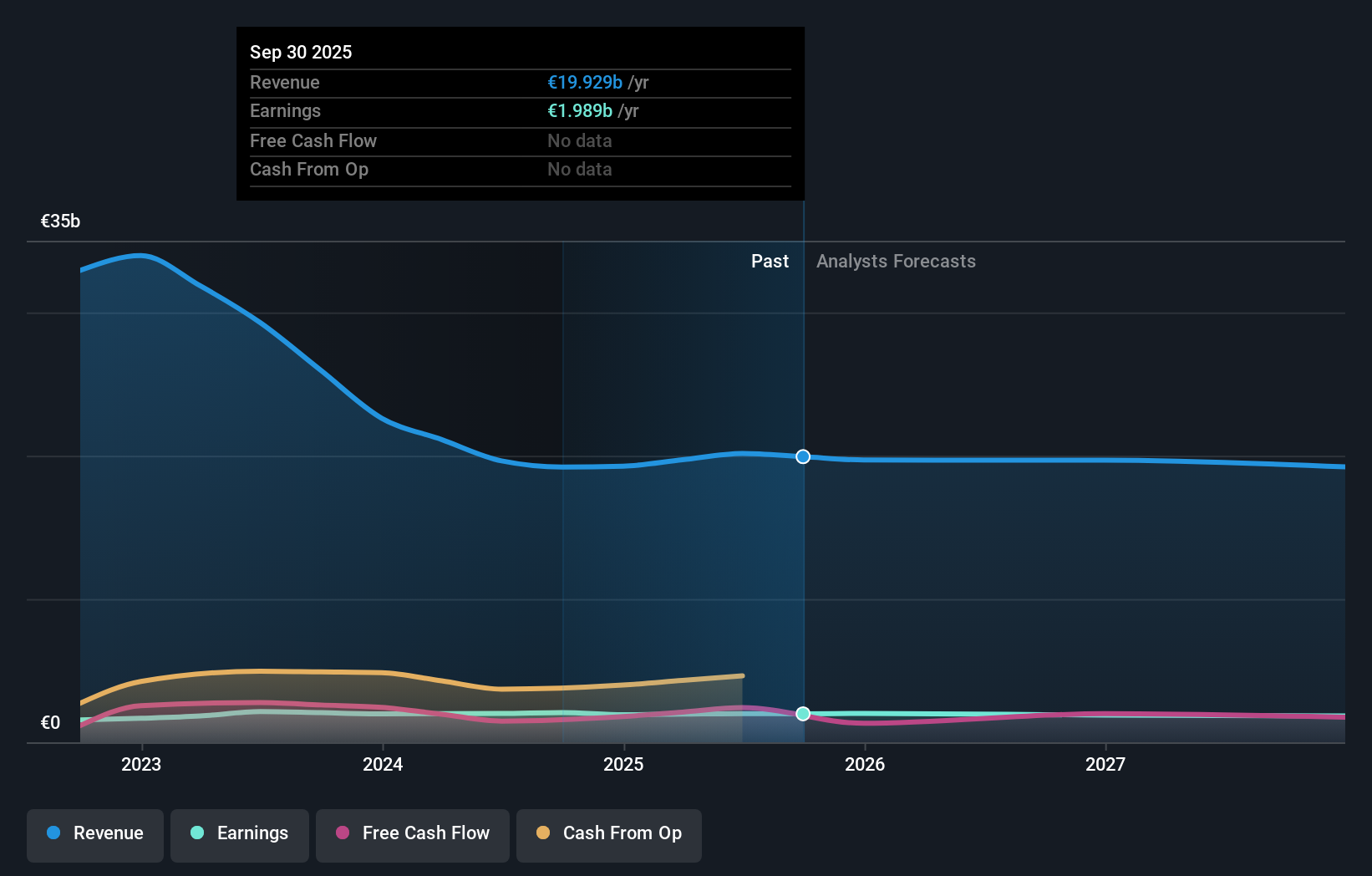

The quarterly results for Naturgy Energy Group, S.A. (BME:NTGY) were released last week, making it a good time to revisit its performance. It was a pretty good result, with revenues of €10.0b, and Naturgy Energy Group came in a solid 10% ahead of expectations. Earnings are an important time for investors, as they can track a company's performance, look at what the analysts are forecasting for next year, and see if there's been a change in sentiment towards the company. Readers will be glad to know we've aggregated the latest statutory forecasts to see whether the analysts have changed their mind on Naturgy Energy Group after the latest results.

Following last week's earnings report, Naturgy Energy Group's twelve analysts are forecasting 2026 revenues to be €19.7b, approximately in line with the last 12 months. Statutory earnings per share are forecast to shrink 6.7% to €1.93 in the same period. Yet prior to the latest earnings, the analysts had been anticipated revenues of €19.8b and earnings per share (EPS) of €1.93 in 2026. So it's pretty clear that, although the analysts have updated their estimates, there's been no major change in expectations for the business following the latest results.

See our latest analysis for Naturgy Energy Group

It will come as no surprise then, to learn that the consensus price target is largely unchanged at €26.48. It could also be instructive to look at the range of analyst estimates, to evaluate how different the outlier opinions are from the mean. There are some variant perceptions on Naturgy Energy Group, with the most bullish analyst valuing it at €31.25 and the most bearish at €22.50 per share. Analysts definitely have varying views on the business, but the spread of estimates is not wide enough in our view to suggest that extreme outcomes could await Naturgy Energy Group shareholders.

These estimates are interesting, but it can be useful to paint some more broad strokes when seeing how forecasts compare, both to the Naturgy Energy Group's past performance and to peers in the same industry. We would highlight that revenue is expected to reverse, with a forecast 1.0% annualised decline to the end of 2026. That is a notable change from historical growth of 1.7% over the last five years. Compare this with our data, which suggests that other companies in the same industry are, in aggregate, expected to see their revenue grow 3.2% per year. It's pretty clear that Naturgy Energy Group's revenues are expected to perform substantially worse than the wider industry.

The Bottom Line

The most important thing to take away is that there's been no major change in sentiment, with the analysts reconfirming that the business is performing in line with their previous earnings per share estimates. On the plus side, there were no major changes to revenue estimates; although forecasts imply they will perform worse than the wider industry. The consensus price target held steady at €26.48, with the latest estimates not enough to have an impact on their price targets.

Keeping that in mind, we still think that the longer term trajectory of the business is much more important for investors to consider. We have estimates - from multiple Naturgy Energy Group analysts - going out to 2027, and you can see them free on our platform here.

We don't want to rain on the parade too much, but we did also find 3 warning signs for Naturgy Energy Group (1 is concerning!) that you need to be mindful of.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Naturgy Energy Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BME:NTGY

Naturgy Energy Group

Engages in the supply, liquefaction, regasification, transport, storage, distribution, and sale of gas.

Established dividend payer and good value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Automotive Electronics Manufacturer Consistent and Stable

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion