- Spain

- /

- Gas Utilities

- /

- BME:ENG

Enagás, S.A. (BME:ENG) Third-Quarter Results Just Came Out: Here's What Analysts Are Forecasting For Next Year

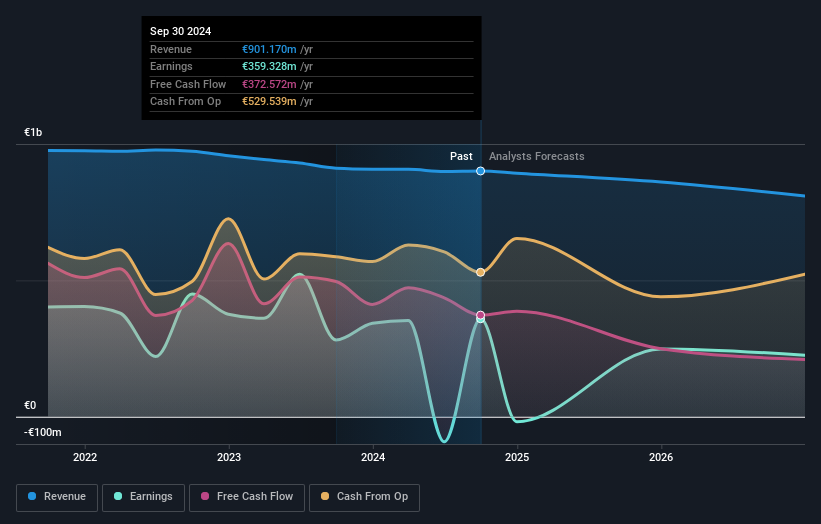

The third-quarter results for Enagás, S.A. (BME:ENG) were released last week, making it a good time to revisit its performance. Revenues fell badly short of expectations, with revenue of €223m, missing analyst estimates by 37%. Earnings are an important time for investors, as they can track a company's performance, look at what the analysts are forecasting for next year, and see if there's been a change in sentiment towards the company. So we collected the latest post-earnings statutory consensus estimates to see what could be in store for next year.

View our latest analysis for Enagás

After the latest results, the consensus from Enagás' 14 analysts is for revenues of €860.5m in 2025, which would reflect a small 4.5% decline in revenue compared to the last year of performance. Statutory earnings per share are expected to dive 31% to €0.95 in the same period. Yet prior to the latest earnings, the analysts had been anticipated revenues of €860.4m and earnings per share (EPS) of €0.95 in 2025. So it's pretty clear that, although the analysts have updated their estimates, there's been no major change in expectations for the business following the latest results.

It will come as no surprise then, to learn that the consensus price target is largely unchanged at €15.62. The consensus price target is just an average of individual analyst targets, so - it could be handy to see how wide the range of underlying estimates is. The most optimistic Enagás analyst has a price target of €19.50 per share, while the most pessimistic values it at €13.00. These price targets show that analysts do have some differing views on the business, but the estimates do not vary enough to suggest to us that some are betting on wild success or utter failure.

These estimates are interesting, but it can be useful to paint some more broad strokes when seeing how forecasts compare, both to the Enagás' past performance and to peers in the same industry. We would also point out that the forecast 3.6% annualised revenue decline to the end of 2025 is better than the historical trend, which saw revenues shrink 6.1% annually over the past five years Compare this against analyst estimates for companies in the broader industry, which suggest that revenues (in aggregate) are expected to grow 3.9% annually. So it's pretty clear that, while it does have declining revenues, the analysts also expect Enagás to suffer worse than the wider industry.

The Bottom Line

The most obvious conclusion is that there's been no major change in the business' prospects in recent times, with the analysts holding their earnings forecasts steady, in line with previous estimates. Fortunately, the analysts also reconfirmed their revenue estimates, suggesting that it's tracking in line with expectations. Although our data does suggest that Enagás' revenue is expected to perform worse than the wider industry. The consensus price target held steady at €15.62, with the latest estimates not enough to have an impact on their price targets.

With that in mind, we wouldn't be too quick to come to a conclusion on Enagás. Long-term earnings power is much more important than next year's profits. We have forecasts for Enagás going out to 2026, and you can see them free on our platform here.

You should always think about risks though. Case in point, we've spotted 3 warning signs for Enagás you should be aware of, and 2 of them make us uncomfortable.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Enagás might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BME:ENG

Enagás

Engages in the transmission, storage, and regasification of natural gas.

Moderate growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion