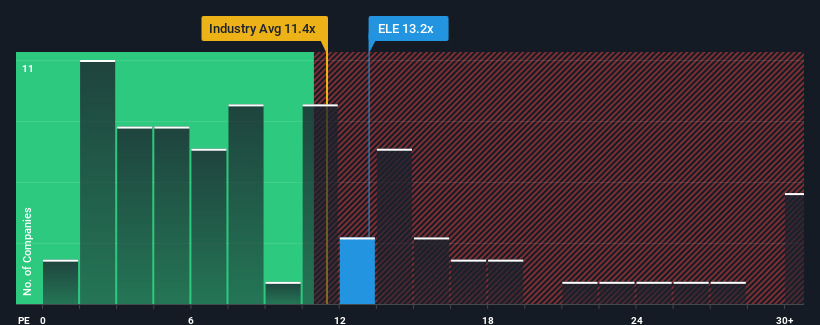

When close to half the companies in Spain have price-to-earnings ratios (or "P/E's") above 19x, you may consider Endesa, S.A. (BME:ELE) as an attractive investment with its 13.2x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

With earnings growth that's superior to most other companies of late, Endesa has been doing relatively well. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Check out our latest analysis for Endesa

Does Growth Match The Low P/E?

The only time you'd be truly comfortable seeing a P/E as low as Endesa's is when the company's growth is on track to lag the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 154% last year. Pleasingly, EPS has also lifted 32% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing earnings over that time.

Shifting to the future, estimates from the analysts covering the company suggest earnings should grow by 2.6% each year over the next three years. That's shaping up to be materially lower than the 9.2% each year growth forecast for the broader market.

With this information, we can see why Endesa is trading at a P/E lower than the market. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Final Word

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Endesa's analyst forecasts revealed that its inferior earnings outlook is contributing to its low P/E. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

It is also worth noting that we have found 2 warning signs for Endesa that you need to take into consideration.

You might be able to find a better investment than Endesa. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Endesa might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BME:ELE

Endesa

Engages in the generation, distribution, and sale of electricity in Spain, Portugal, France, Germany, the United Kingdom, Switzerland, Luxembourg, the Netherlands, Singapore, Italy, Morocco, and internationally.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives