- Spain

- /

- Renewable Energy

- /

- BME:ANE

Corporación Acciona Energías Renovables, S.A.'s (BME:ANE) Low P/E No Reason For Excitement

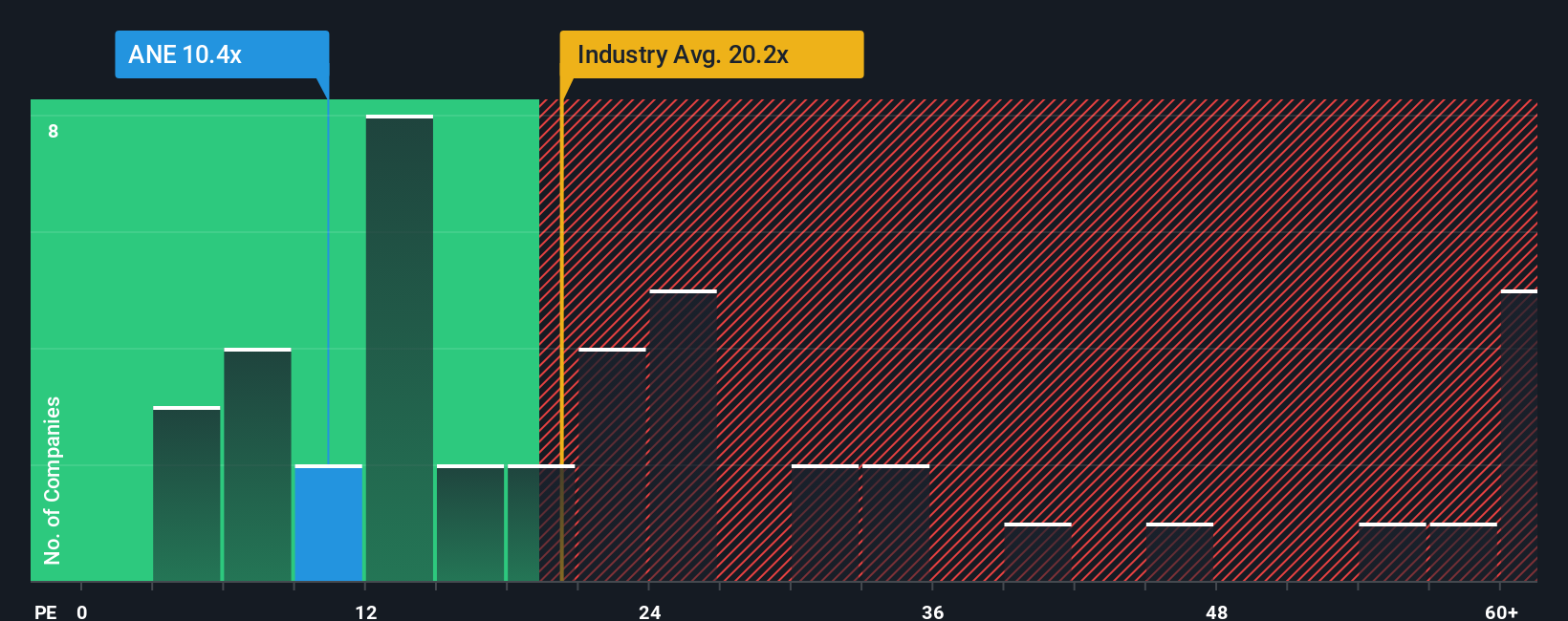

When close to half the companies in Spain have price-to-earnings ratios (or "P/E's") above 17x, you may consider Corporación Acciona Energías Renovables, S.A. (BME:ANE) as an attractive investment with its 10.4x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

Corporación Acciona Energías Renovables certainly has been doing a good job lately as it's been growing earnings more than most other companies. One possibility is that the P/E is low because investors think this strong earnings performance might be less impressive moving forward. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Check out our latest analysis for Corporación Acciona Energías Renovables

Is There Any Growth For Corporación Acciona Energías Renovables?

In order to justify its P/E ratio, Corporación Acciona Energías Renovables would need to produce sluggish growth that's trailing the market.

If we review the last year of earnings growth, the company posted a terrific increase of 296%. As a result, it also grew EPS by 30% in total over the last three years. Accordingly, shareholders would have probably been satisfied with the medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to slump, contracting by 23% per year during the coming three years according to the analysts following the company. That's not great when the rest of the market is expected to grow by 10% per annum.

In light of this, it's understandable that Corporación Acciona Energías Renovables' P/E would sit below the majority of other companies. However, shrinking earnings are unlikely to lead to a stable P/E over the longer term. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Final Word

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Corporación Acciona Energías Renovables maintains its low P/E on the weakness of its forecast for sliding earnings, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

There are also other vital risk factors to consider before investing and we've discovered 2 warning signs for Corporación Acciona Energías Renovables that you should be aware of.

Of course, you might also be able to find a better stock than Corporación Acciona Energías Renovables. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BME:ANE

Corporación Acciona Energías Renovables

Corporación Acciona Energías Renovables, S.A.

Solid track record with mediocre balance sheet.

Market Insights

Community Narratives