- Spain

- /

- Electric Utilities

- /

- BME:ANA

Acciona (BME:ANA): Exploring the Valuation After Recent Share Price Rally

Reviewed by Kshitija Bhandaru

See our latest analysis for Acciona.

Over the past year, Acciona has delivered a strong 55.98% total shareholder return, with momentum picking up in recent months as investors react to both sector shifts and company performance. The sharp 63.33% year-to-date share price return suggests optimism is building around Acciona's growth prospects, even while the utilities sector undergoes rapid change.

If Acciona's surge has you looking for what else is gathering steam, it is a great moment to broaden your search and discover fast growing stocks with high insider ownership

With Acciona’s impressive rally, the key question remains whether this momentum signals an undervalued opportunity for investors, or if the current price now fully reflects future growth potential. Is there real upside left?

Most Popular Narrative: 19% Overvalued

The narrative suggests Acciona’s last close price of €182.6 is well above what consensus expects, with fair value estimates implying the market could be too optimistic at current levels. The following quote offers a key insight into the drivers shaping this valuation outlook.

ACCIONA’s infrastructure backlog reached an all-time high of €54 billion, providing a strong foundation for future revenue growth through large-scale projects and concession awards. This is expected to drive an increase in revenue and operating margins as projects come to fruition.

Want to know what projections led analysts to call a top? The narrative’s punch comes from bold assumptions about future profits and shrinking margins. Intrigued by which expectations justify that high valuation? Uncover the details that frame this dominant market view and see if you agree.

Result: Fair Value of €154.12 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent low energy prices or further volatility in key markets could challenge analyst assumptions and shift sentiment on Acciona’s growth outlook.

Find out about the key risks to this Acciona narrative.

Another View: What Does the SWS DCF Model Say?

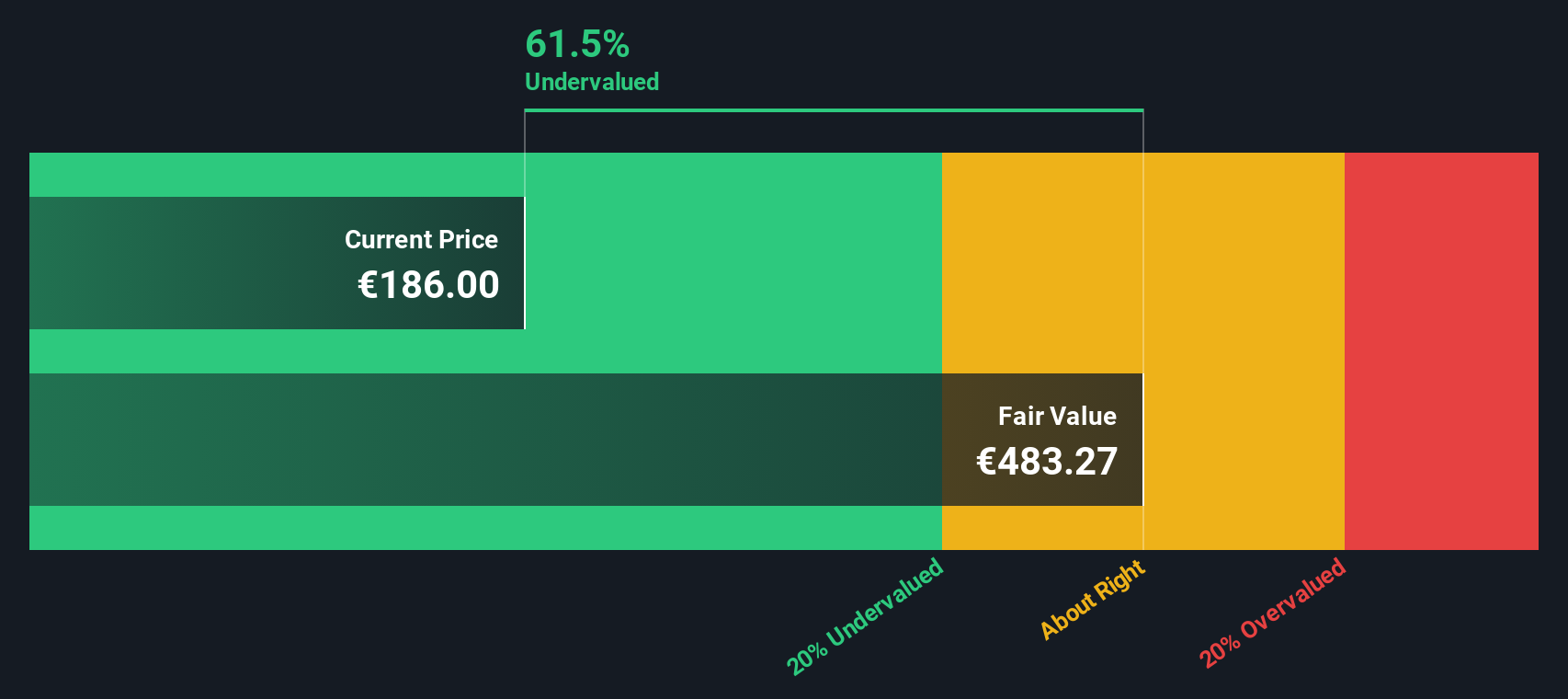

While analysts' price targets suggest Acciona is overvalued at today’s market price, the SWS DCF model presents a much different perspective. According to our DCF valuation, Acciona shares could be trading at a substantial 62% discount to fair value, which suggests significant upside potential. Does this deep undervaluation indicate a rare opportunity, or is the market overlooking something important?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Acciona Narrative

Prefer to analyze the numbers on your own or challenge the prevailing view? Craft a personalized Acciona story in just a few minutes: Do it your way

A great starting point for your Acciona research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors never settle for just one opportunity. Take control of your financial future and get ahead of the next wave by considering these compelling alternatives:

- Unlock potential gains when you spot undervalued gems using these 892 undervalued stocks based on cash flows that reveal companies trading below their true worth.

- Boost your passive income by tapping into these 19 dividend stocks with yields > 3%, which features stocks that consistently reward shareholders with generous yields.

- Capitalize on the future of healthcare by uncovering innovative companies revolutionizing medicine with powerful technology through these 33 healthcare AI stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:ANA

Acciona

Engages in the energy, infrastructure, and other businesses in Spain and internationally.

Solid track record and good value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success